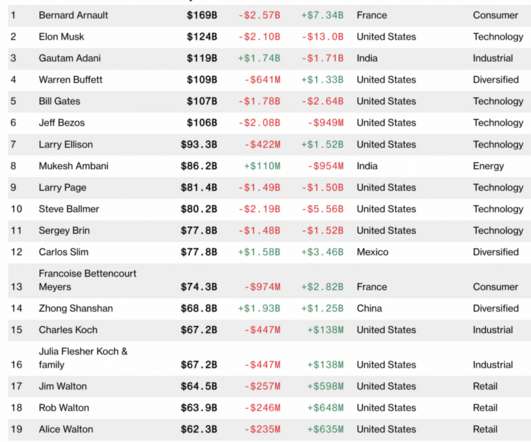

Billionaires Index

The Big Picture

JANUARY 6, 2023

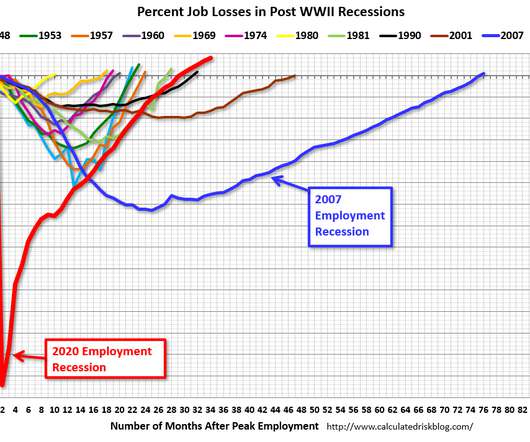

Source : Bloomberg Billionaires Index. I was in the midst of my analysis of how the Fed would react to softening wage gains in the NFP data, when the markets exploded 2.5% higher. The Fed is very concerned that the perennially underpaid median worker has been seeing wage increases. The past few years follows 3 decades of lagging income. It kinda killed my motivation to write yet another pierce discussing Fed actions.

Let's personalize your content