10 Monday AM Reads

The Big Picture

OCTOBER 31, 2022

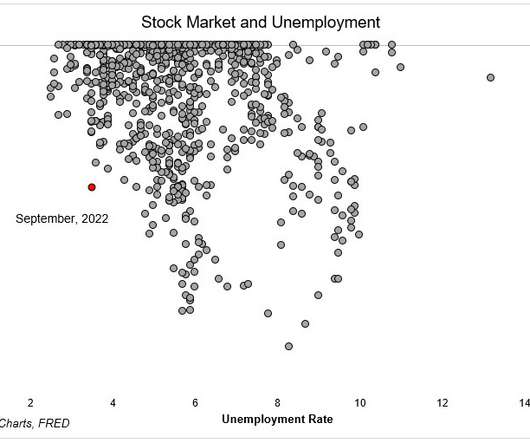

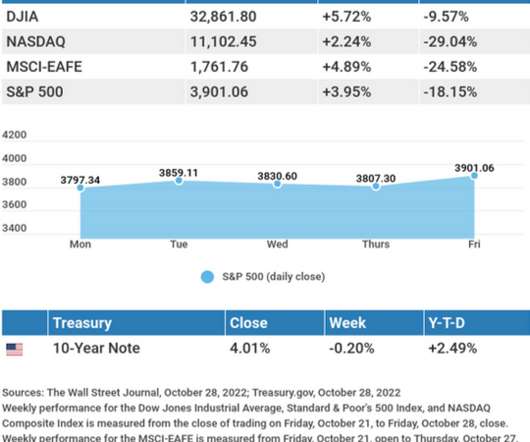

My back-to-work morning train WFH reads: • Is the Stock Market Gaslighting Us? A downturn in the market doesn’t always precede a downturn in the economy. Yes, the stock market is forward-looking, but sometimes it sees things that aren’t there. At its low, the S&P 500 was 25% below its high. It’s hard to completely dismiss this as a leading indicator and I’m not here to do that, but while most drawdowns of this magnitude have led to economic contractions, they haven’t always. ( Irrelevant Inv

Let's personalize your content