10 Tuesday AM Reads

The Big Picture

MARCH 21, 2023

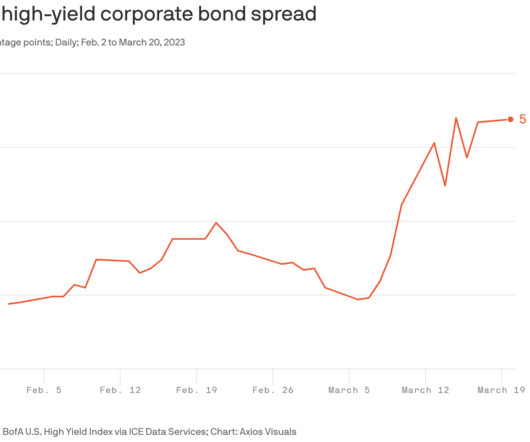

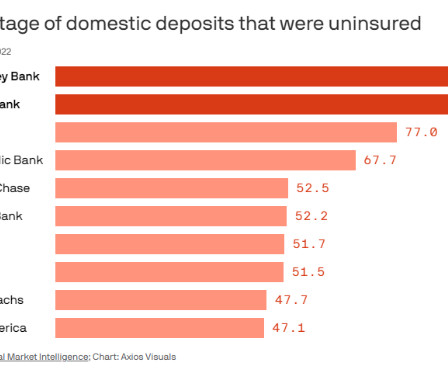

Note: We are off to California and Arizona for a few events later this week; publishing will be spotty… Welcome to Spring! Start the new season with our Two-for-Tuesday morning train reads: • Are Banks OK? Where the sector stands after a turbulent week. ( Slate ) see also Déjà Vu? Why 2023 is Not 2008 : But that is incomparable to the 2008-09 era, where every financial institution had consumed CDOs, where toxic sub-prime loans were securitized into ticking time bombs.

Let's personalize your content