10 Wednesday AM Reads

The Big Picture

JANUARY 11, 2023

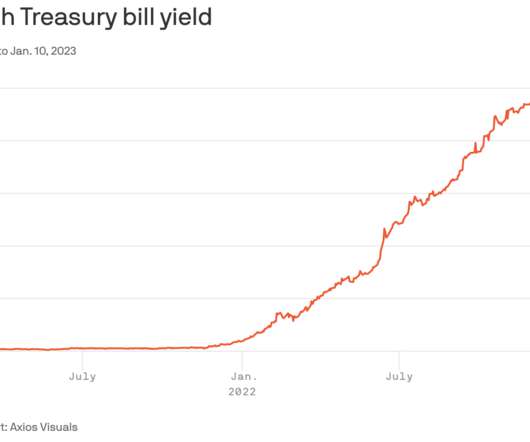

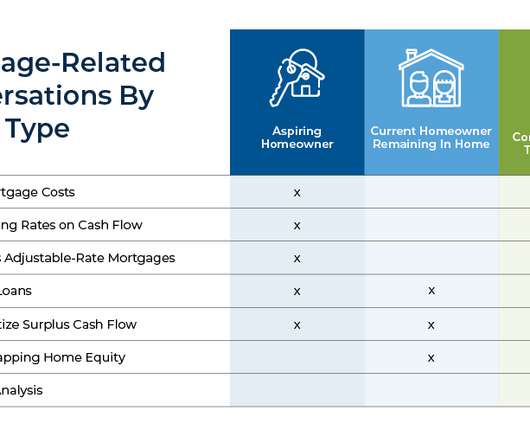

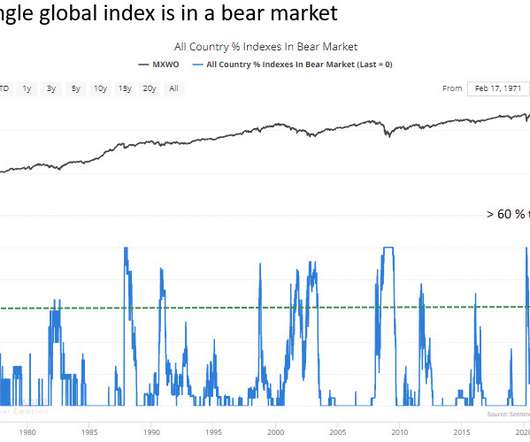

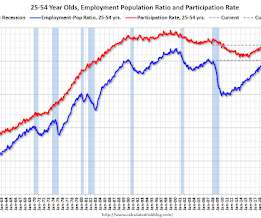

My mid-week morning train WFH reads: • The Fed May Finally Be Winning the War on Inflation. But at What Cost? There’s a good chance that the Fed could push the economy into recession. The pain will not be shared equally. ( New York Times ). • Something big is happening in the U.S. housing market—here’s where 27 leading research firms think it’ll take home prices in 2023.

Let's personalize your content