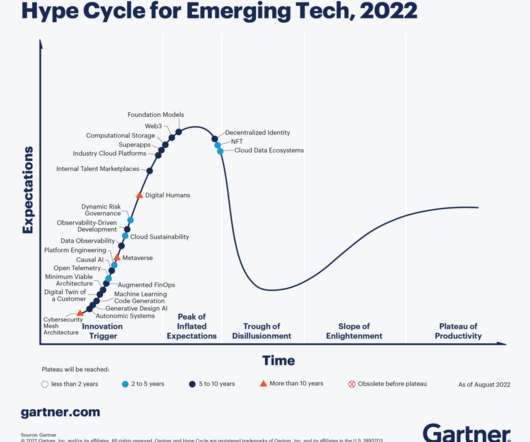

The Hype Cycle, Expertise & Dunning Kruger

The Big Picture

FEBRUARY 9, 2023

I am always fascinated when seemingly random sources converge on the same concept. The current convergence involved some research I was doing centered on Dunning Kruger, Vanguard’s Tim Buckley, my partner Josh’s AI/ChatGPT post, and the general state of the market. It’s like a real-time version of “ The Blind Men and the Elephant ,” by John Godfrey Saxe.

Let's personalize your content