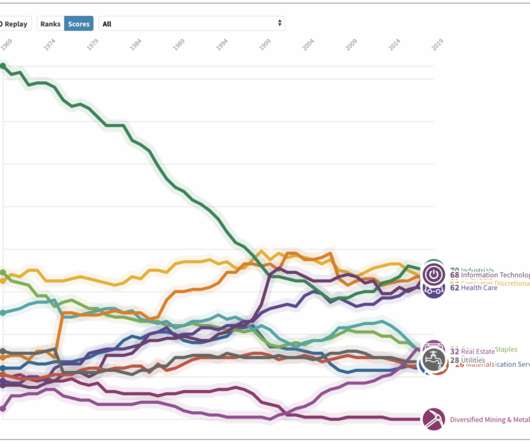

History of Industries Listed on S&P 500

The Big Picture

DECEMBER 30, 2022

Source: QAD Blog. A perfect way to end the 2022 annus horriblis is to remind readers that not just individual stocks, but entire sectors fall in and out of favor. It iss extremely challenging to select the right sector at the right time (and for the right reasons). Almost nobody does this well consistently over time. Here is QAD from 2019: In business, change is inevitable , and those that fail to adapt and innovate are often doomed to failure.

Let's personalize your content