The Future Of Advisor Platforms: Reducing Overhead Costs With Services (Not Technology)

Nerd's Eye View

MARCH 13, 2023

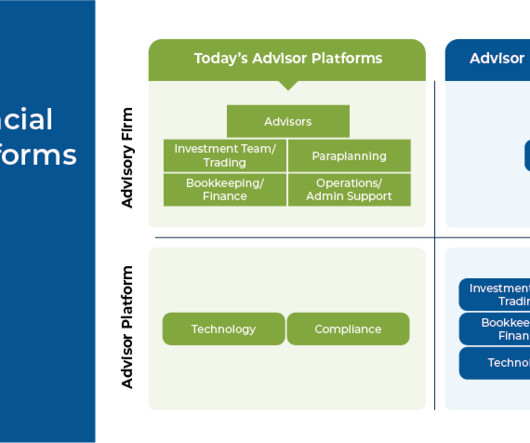

For the past several decades, platforms for advisors have differentiated with the quality of their technology. The focus on ‘tech’ was a natural evolution for advisor platforms away from their roots – which was originally to differentiate by the quality of their proprietary product shelf, the primary means that brokerage firms and insurance companies attracted advisors to them in the 1960s, 70s, and 80s.

Let's personalize your content