Countertrend ?

The Big Picture

AUGUST 15, 2022

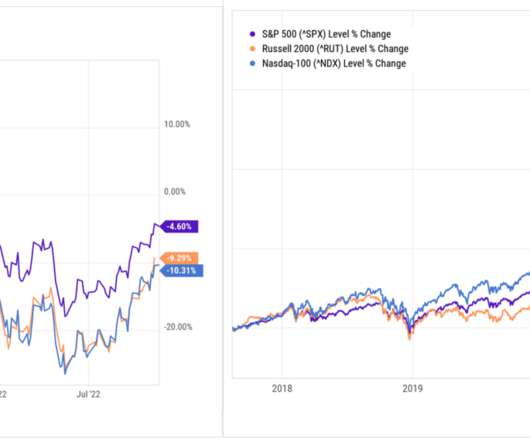

One of my favorite ways to contextualize market trends is to divide long periods of time into secular bull and bear markets. When we look at the past century, we can see decades-long eras where the economy is generally robust, supporting markets trending higher, with expanding multiples. We call these eras Secular Bull Markets. The best examples are 1946-66, 1982-2000, and 2013 forward.

Let's personalize your content