All eyes on SPX 4,000

The Reformed Broker

AUGUST 27, 2022

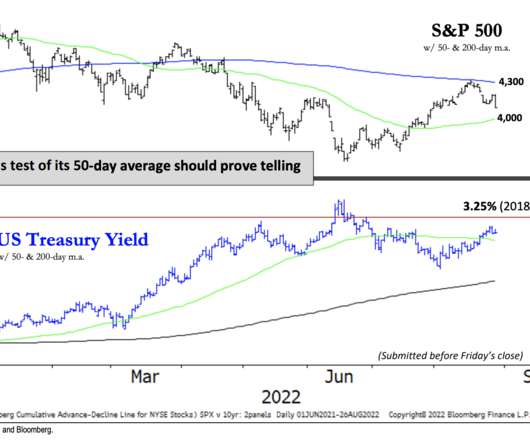

I like the way Ari Wald at Oppenheimer frames the current technical set-up for the S&P 500. Now we’re caught between the declining 200-day and the rising 50-day – the latter might be the next major pivot point for short-term traders and for general sentiment depending on what happens if and when we get there: Here’s Ari: A Bullish Base vs. a Resuming Bear The S&P 500’s rejection from its 200-d.

Let's personalize your content