Bull or Bear?

The Big Picture

JANUARY 20, 2023

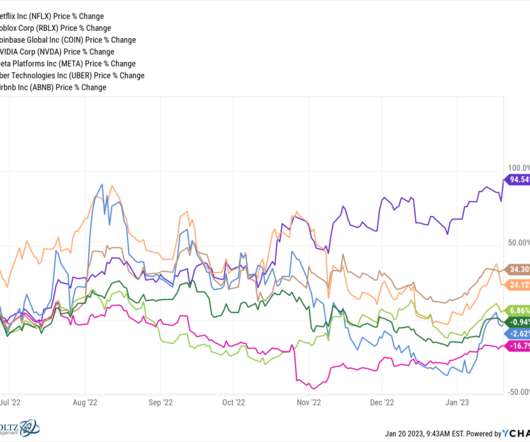

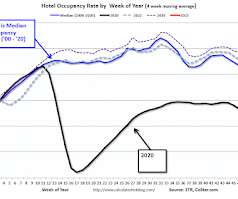

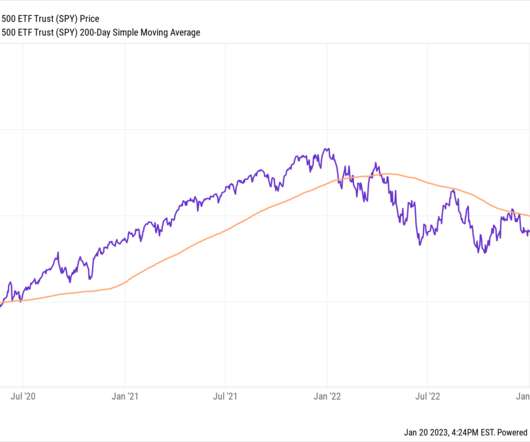

There seems to be a debate going on today between economists and market technicians (!?) as to whether we are in a bull or bear market. I’ve defined markets in the past (see this) so those who want to delve deeper can. Regardless of where fall in the bull/bear spectrum – I have been constructive here – allow me to point out some bullish items you may have overlooked (I’ll discuss bearish concerns next week).

Let's personalize your content