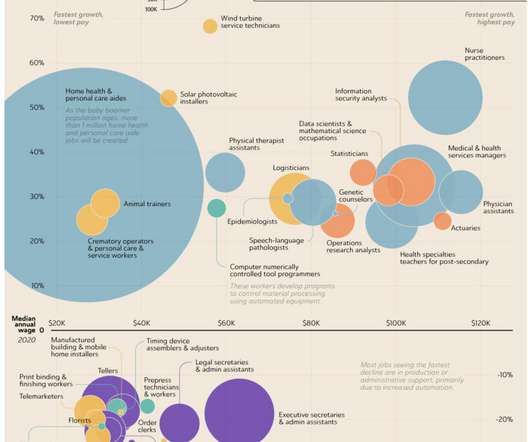

What Employment Sectors Are Growing the Fastest?

The Big Picture

AUGUST 5, 2022

Source: Visual Capitalist. It’s light summer posting season! I am heading out of town for a wedding, and then on to the “ Shadow Kansas City Federal Reserve Board ” next week, then some family gatherings. Meanwhile, mull over this chart of the 20 fastest growing jobs over the next decade. Enjoy what’s left of the Summer! The post What Employment Sectors Are Growing the Fastest?

Let's personalize your content