7th Inning Stretch

The Big Picture

OCTOBER 1, 2022

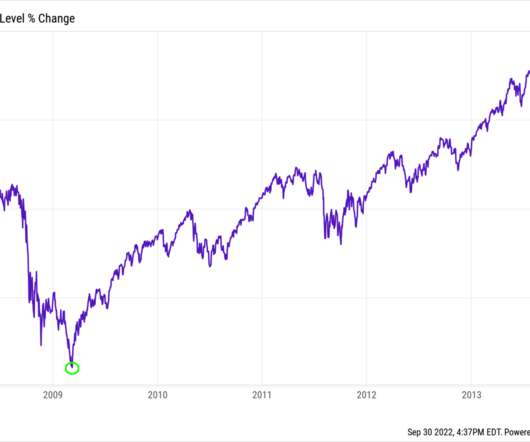

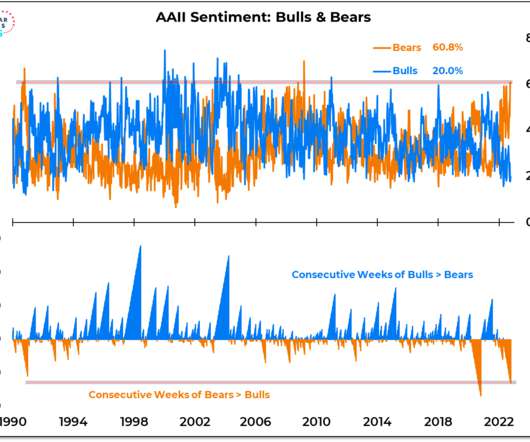

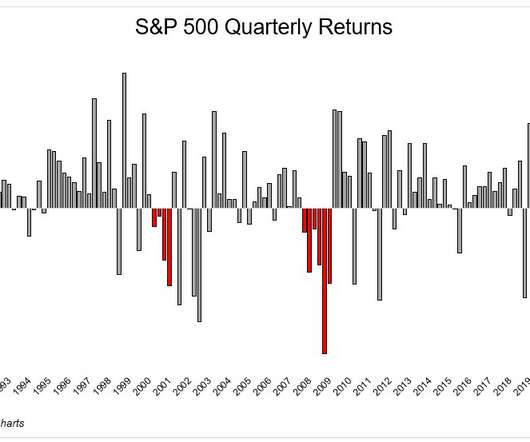

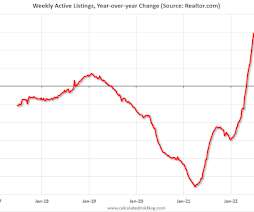

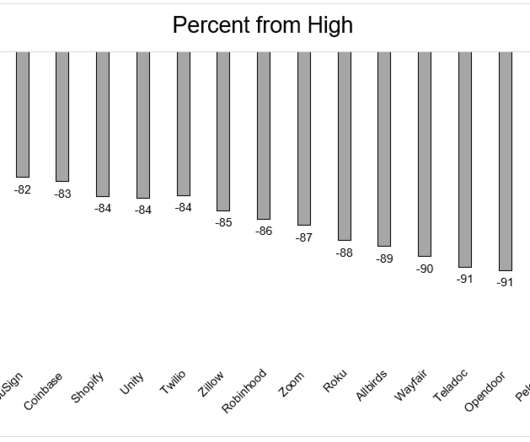

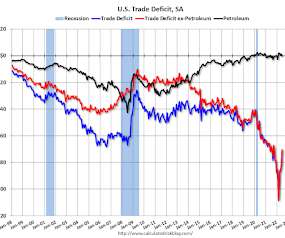

“ Are we there yet? ” is not just a line from the kids the in the back of the car. It’s a question that investors, speculators, and professional traders have been asking themselves. The tl:dr is almost. We are almost there – down ~25% this year (so far). I wouldn’t call this an orderly sell-off, but it also hasn’t been the sort of collapse associated with true crashes like the 2000 tech wreck or the subprime mortgage/derivatives crisis.

Let's personalize your content