Risk & Reward: Two Sides of Same Coin

The Big Picture

JULY 20, 2022

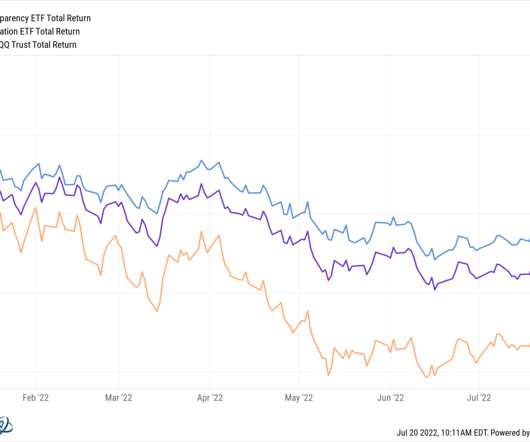

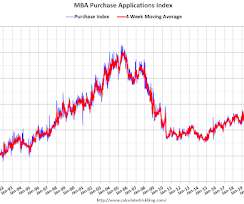

Barry Ritholtz, Ritholtz Wealth Management Chairman and CIO & “Masters in Business” host, discusses investing in a volatile market and the probability the Fed causes a recession. Risk, Reward Two Sides of Same Coin, says Ritholtz. ?. Source: Bloomberg , July 19th, 2022. Previously : Rally , Multiple Compression , Earnings¯_(?)_/¯ Recession , Double Bottom (July 18, 2022).

Let's personalize your content