Three thoughts on the trade-offs involved in the economy, markets and life:

1. There is no such thing as a perfect economy.

This was the general environment for the 2010s:

- Low GDP growth

- Low inflation

- Stagnating wages

- A slow labor market

- High(ish) unemployment rate

- 0% interest rates

- A booming stock market

This is the post-pandemic 2020s (so far):

- Higher GDP growth

- Higher wage growth

- Higher inflation

- A booming labor market

- Low unemployment rate

- Higher interest rates

- An OK stock market1

You want higher wage growth? You’re going to have to have higher inflation too.

You want low mortgage rates? You’re going to have to deal with low rates on your savings account.

You want higher economic growth? You’re going to have to deal with a tighter labor market.

These relationships are not set in stone but the dichotomy between the last two economic cycles shows how everything involves trade-offs.

There is not going to be a perfect economic environment where interest rates are high for savers, wages are growing, it’s easy to get a job, you can borrow for low rates, economic growth is booming and inflation is low.

Unfortunately, it doesn’t work like that.

So people complain about the economy in the 2010s and they complain about the economy in the 2020s.

It’s always going to be something.

2. It feels like we’re in a no-win situation for prospective homebuyers.

Here’s my take on the trade-off happening in the current housing market:

Stronger economic growth -> Higher mortgage rates -> No one wants to sell because they have a 3% mortgage -> It’s difficult to find a house to buy from lack of inventory

Weaker economic growth -> Lower mortgage rates -> More demand for housing -> Harder to buy because of increased competition/less negotiating power

Again, this is not set in stone but there is a pattern emerging with housing activity.

When mortgage rates get to 7% or so the housing data seems to cool off. And when mortgage rates get down to 6% or so the housing data seems to pick up gain.

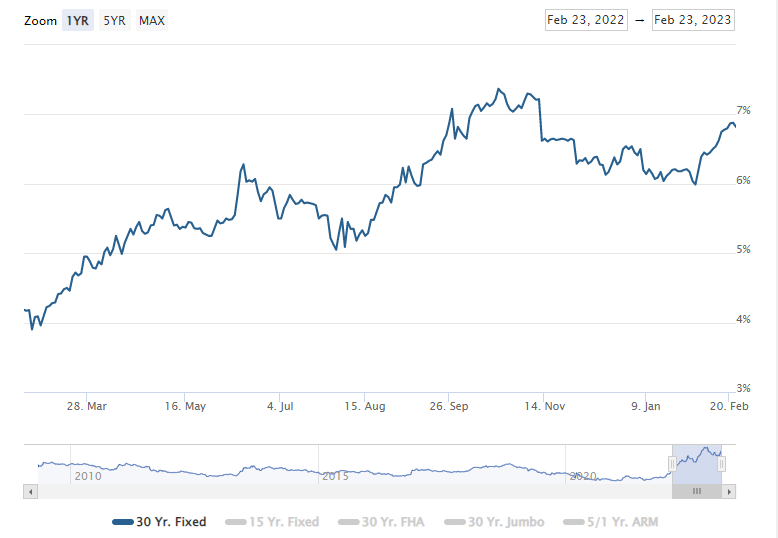

The volatility in mortgage rates probably isn’t helping:

A year ago the 30 year fixed was at 4%. Eight months later they briefly touched 7.3%. Three months after that we were closer to 6% for a bit. Now it’s taken just 3 weeks to go from 6% back to nearly 7%.

One thing is clear — higher mortgage rates combined with rapidly rising housing prices from the pandemic have slowed housing activity considerably.

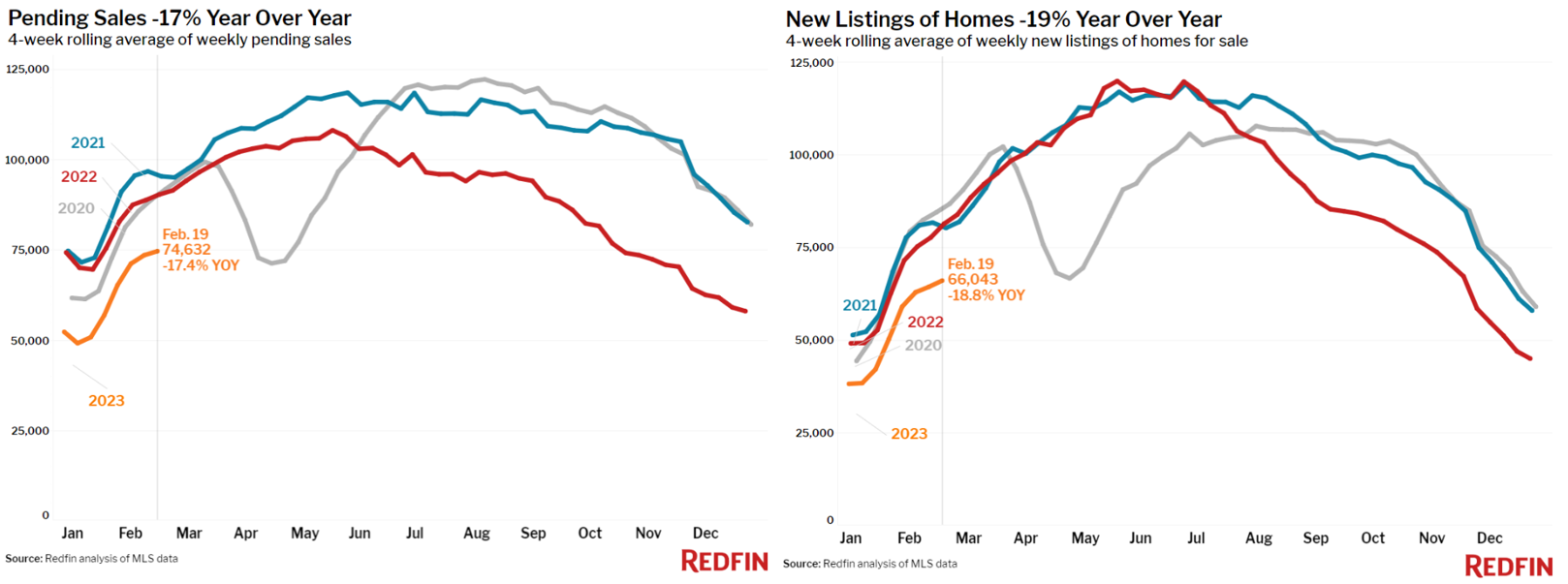

Redfin’s latest update shows pending home sales and new listings are both way down again this year compared with 2020, 2021 and 2022. And those years were already low in comparison to historical norms.

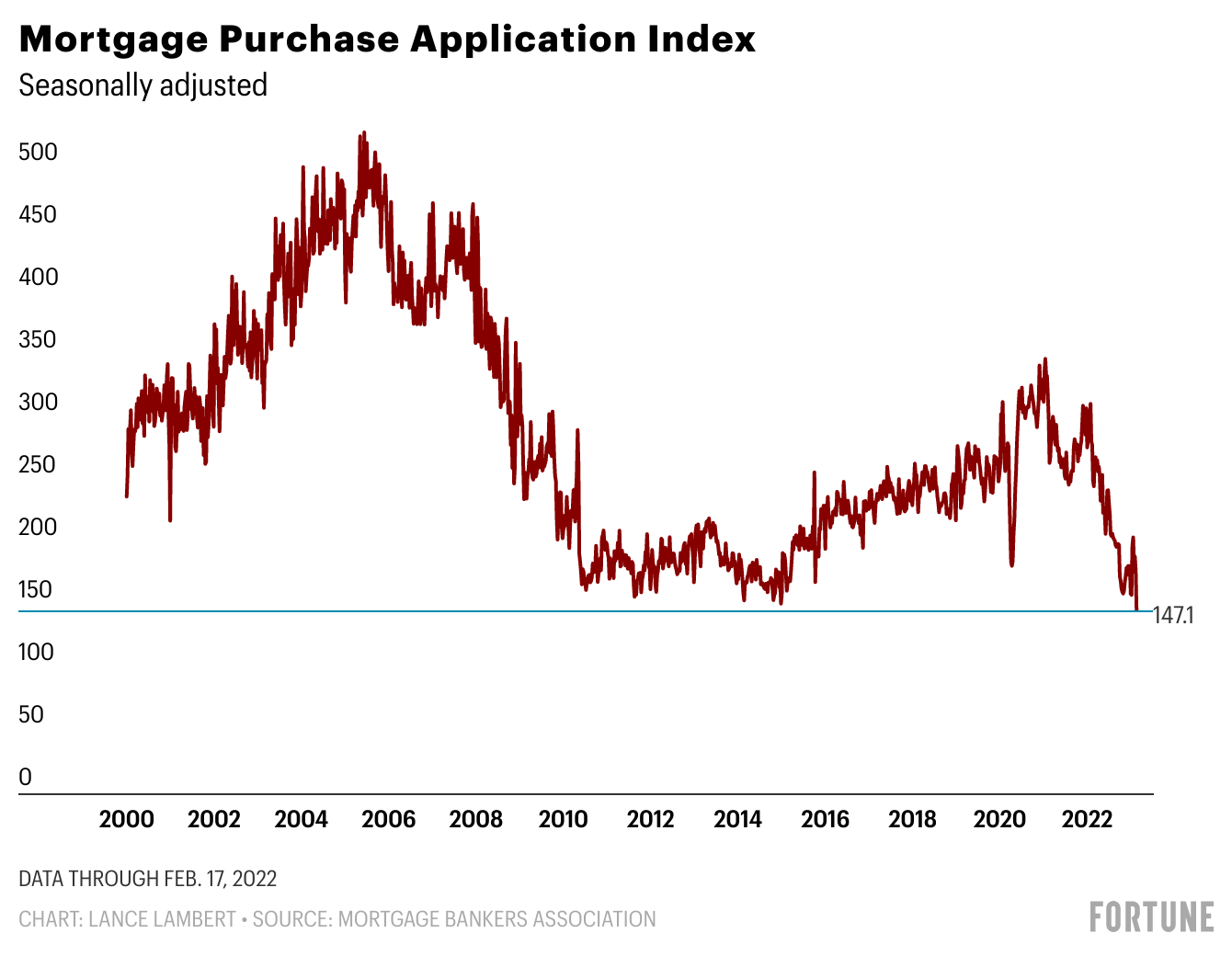

Mortgage purchase applications are now at their lowest level this century, even lower than the aftermath of the housing bust following the 2008 crash:

There are still transactions taking place and always will be. Marriage, divorce, death, new jobs and household formation will never come to a complete halt.

But it would be nice if one of the biggest segments of the U.S. economy wasn’t hitting new lows on a consistent basis.

Lower mortgage rates would help increase housing activity but I don’t see how we get out of this situation without lower housing prices.

Inventories are low because few people are willing to trade a 3% mortgage for a 7% mortgage, we underbuilt new housing supply for a decade and housing prices are up 50% since the start of the pandemic.

I feel for people who are currently searching for a home to purchase. It’s not an easy environment to be a buyer.

3. No one has the perfect balance between saving and spending.

I got some good feedback on my post from earlier this week about how much is enough to retire comfortably.

Some people said you need to look more at the spending side of the equation to determine the size of the nest egg (I agree). Some people said it’s more important to spend more while you’re young. Some people said it’s more important to save more when you’re young. Some people said your net worth should peak in your 50s and fall from there. Others would rather see their wealth continue to grow or not touch their principal in retirement.

My main takeaway from these types of conversations is that no one has it all figured out.

It’s like the George Carlin bit that anyone driving slower than you is an idiot and anyone driving faster than you is a maniac.

Anyone saving more than you is an idiot and anyone spending more than you is a maniac (or vice versa depending on your financial position).

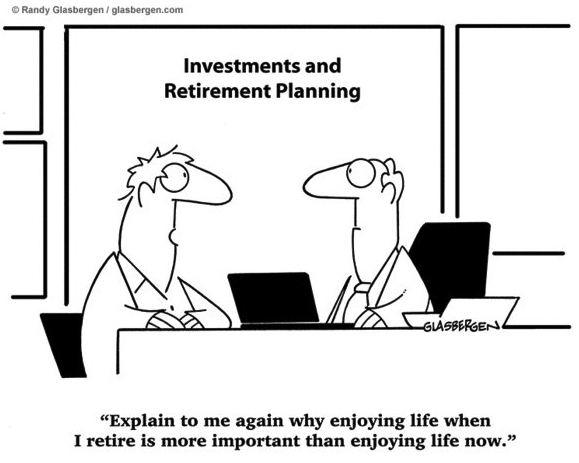

I find myself coming back to one of my all-time favorite money-related comics on a regular basis when thinking through the balance necessarily between enjoying yourself now and ensuring you have enough in the future:

Life is a series of trade-offs.

I think the most important thing when considering where to save and where to spend comes down to priorities.

I’m perfectly fine spending lots of money on the things I prioritize in life (family, travel, experiences, having a subscription to every streaming service known to man, etc.).

But to balance that out I’m perfectly fine cutting back on other areas of life that aren’t as important (fine dining, luxury automobiles, high-end clothing, expensive hobbies, etc.).

You just have to figure out how to spend money on the things that bring you joy and cut back on the stuff that doesn’t move the needle in terms of contentment.

Further Reading:

5 Numbers That Will Tell You How the Economy Does This Year

Now here’s what I’ve been reading lately:

- Would you trade places with Warren Buffett? (The Long Run)

- Trying hard is an abysmal investment strategy (A Teachable Moment)

- A short history of investing in small cap stocks (Dollars & Data)

- The power of storytelling (Young Money)

- What’s the surest route to investing excellence? (Morningstar)

- The economy is too strong to avoid a recession (Irrelevant Investor)

- The end of Succession is near (New Yorker)

1It may come as a surprise to some considering last year’s dreadful year but the S&P 500 is still up almost 9% per year in the 2020s.