Dare Ya

The Big Picture

OCTOBER 28, 2022

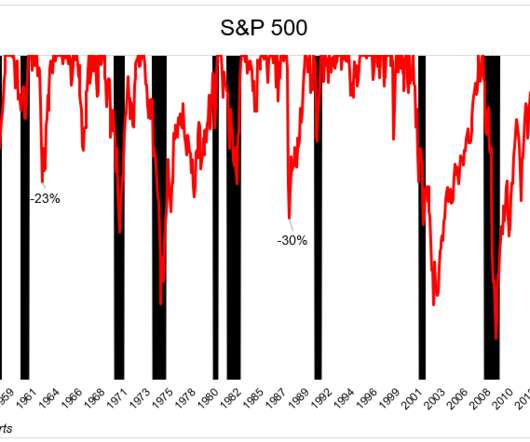

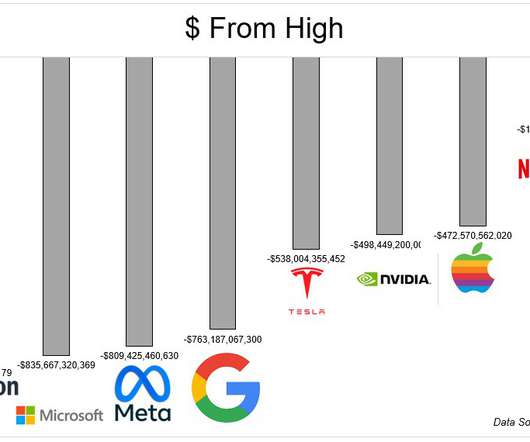

is Mr. Market daring Jerome Powell to keep raising rates? That’s one way to read into today’s surging market — Nasdaq up 2.9%, the Dow tacking on over 800 points (2.6%), and the S&P 500 added 2.5%. Despite the carnage in big-cap tech stocks like Facebook, Amazon and Google, the Nasdaq is up 2% for the past week. The S&P500 has gained nearly 4% for the week, and is up almost 7% for the past 30 days.

Let's personalize your content