The Many Ways the FOMC Can Be Wrong…

The Big Picture

NOVEMBER 4, 2022

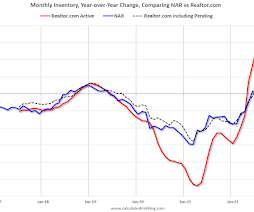

Since it is late on a Friday, I thought I might share some quick thoughts about the week. I have been wondering, more than usual, about the disconnect between what we see in falling prices and the Federal Reserve’s anti-inflation actions. It is difficult to reconcile Fed rhetoric with the actual price of Goods. One can reach only so many conclusions: Perhaps the Fed is right and everybody else is wrong.

Let's personalize your content