10 Thursday AM Reads

The Big Picture

OCTOBER 6, 2022

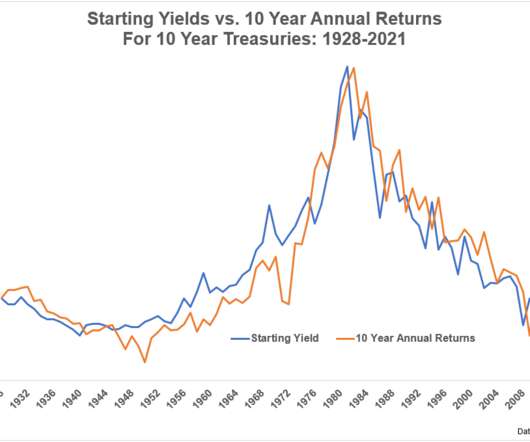

My morning train WFH reads: • Is the Era of Low Interest Rates Over? There were fundamental reasons interest rates were so low three years ago. Those fundamentals haven’t changed; if anything, they’ve gotten stronger. So it’s hard to understand why, once the dust from the fight against inflation has settled, we won’t go back to a very-low-rate world. ( New York Times ). • What to Buy?

Let's personalize your content