Tuesday links: the tech set

Abnormal Returns

DECEMBER 27, 2022

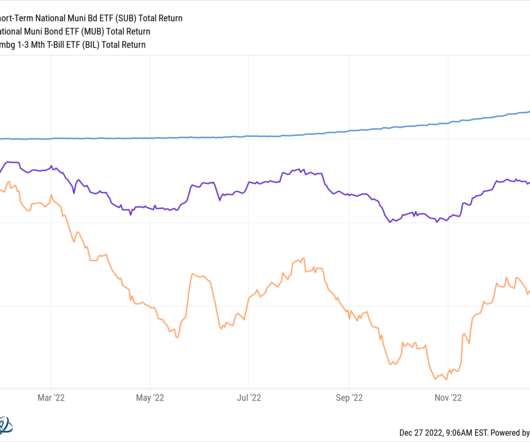

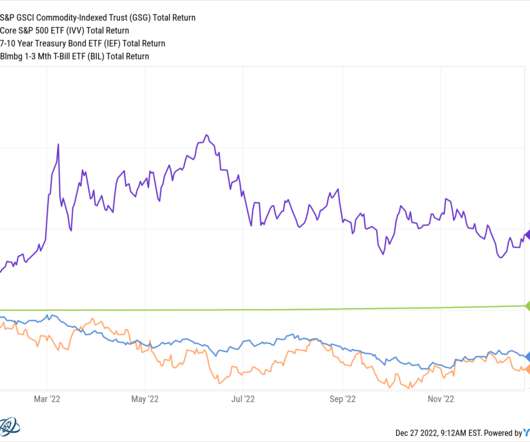

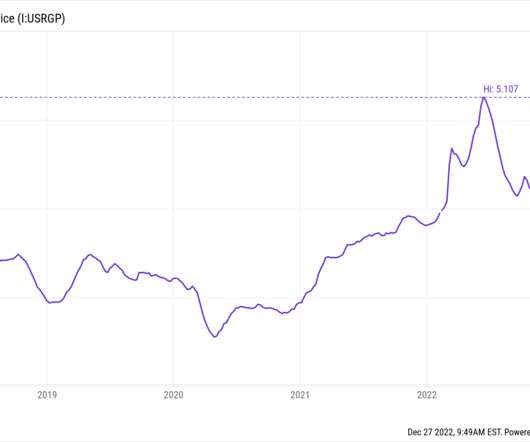

Markets The markets were bad in 2022, but things could always be worse. (humbledollar.com) Commodity returns stood out in 2022. (capitalspectator.com) A look at the best charts of 2022. (topdowncharts.substack.com) Strategy There is a big difference between forecasting stock and bond returns. (fortunesandfrictions.com) Why you need to look at base rates when forecasting stock returns.

Let's personalize your content