November

28

November

28

Tags

Nothing Changes Market Sentiment Like Price

By David Nelson, CFA

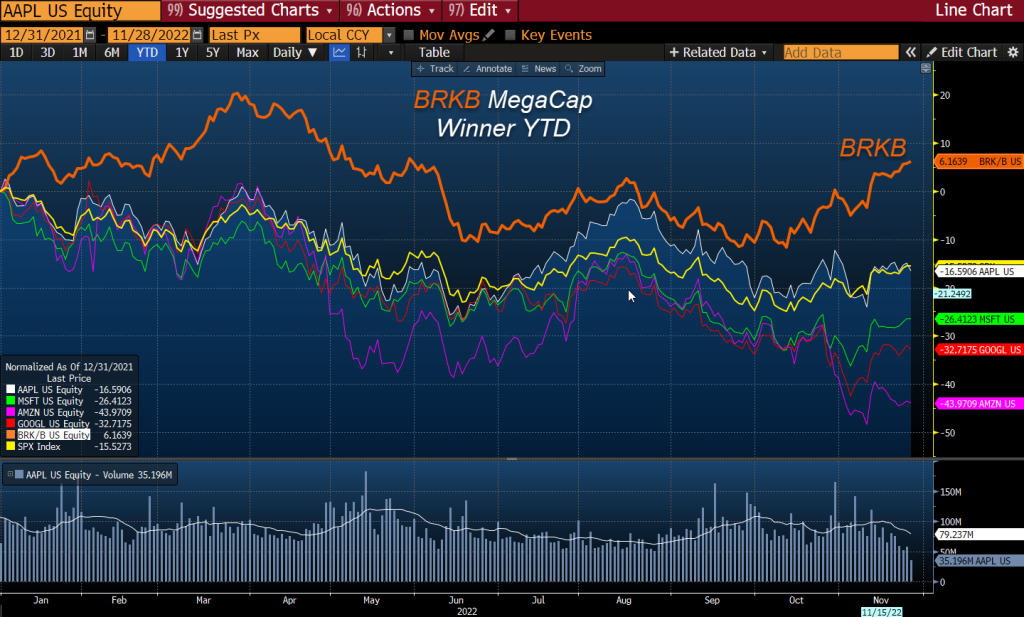

Investors have a myopic focus on U.S. stocks sometimes to the exclusion of most other asset classes. The stock centric thinking becomes even more pronounced when the conversation shifts to the mega cap community including Apple, Microsoft, Alphabet and Amazon.

Tech has dominated investor sentiment for the better part of a decade. If Apple isn’t doing well how could anything else matter?

Mega Cap 1 Year

Forgetaboutit

Tech has at best been a laggard this year with even the once formidable Apple slipping behind the S&P 500 in performance.

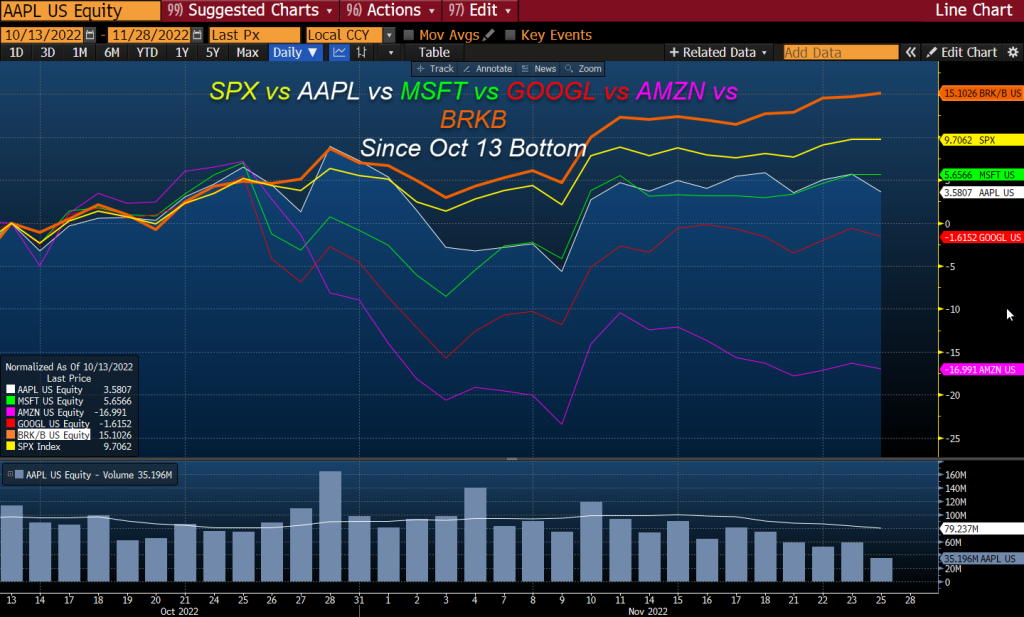

Off the October 13th bottom Forgetaboutit. Since October the only top five market cap contender and hands down winner is none other than value guru Warren Buffet’s Berkshire Hathaway (BRKB).

Off the Oct 13 Low

In case you hadn’t noticed Tesla doesn’t even make the top 5 anymore and META fell out of contention earlier in the year now coming in at #20 in the S&P 500 market cap rankings.

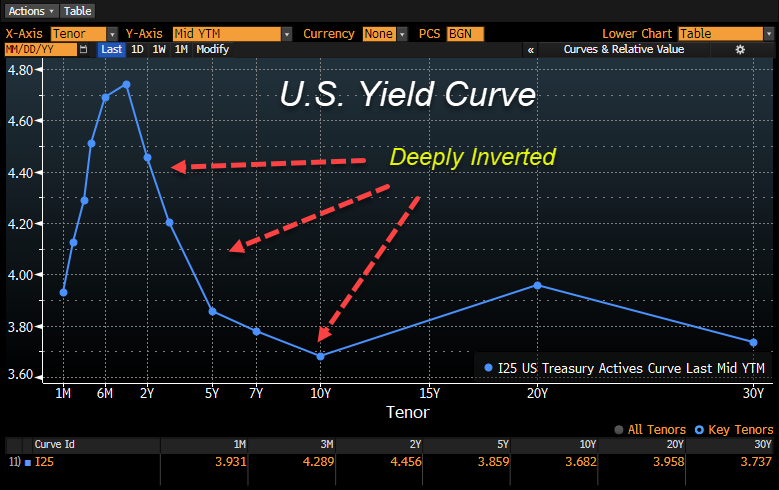

Data for the Market is still suspect

The data for the market is still suspect as estimates continue to roll over and as I pointed out in last week’s post the deeply inverted yield curve more than suggests a recession lies in front of us.

Risqué du jour

China’s Zero Covid policy is the current risk du jour. Demonstrations are spreading throughout the country threatening global supply chains. The Wall Street Journal is reporting that (AAPL) could see a 6 million iPhone Pro shortfall as unrest spreads throughout China’s manufacturing centers. Many are calling the crackdowns the largest since the Tiananmen Square protests in 1989.

Portfolio managers including yours truly have reduced or even eliminated (AAPL) from models as iPhones still make up a significant portion of the revenue stream not to mention it is the center of the ecosystem.

Nothing changes sentiment like price

Data and price are in a Bull/Bear debate. Estimate revisions and an inverted yield curve point to something more ominous in 2023 yet markets around the world have staged an impressive comeback many challenging their downtrends putting a big test right at our doorsteps.

SPX 1 Year

The S&P 500 is threatening to break a major down trend and probably needs to take out 4300 to really convince skeptics. We have a small head shoulders pattern to get through and we’re coming right up on the 200 day moving average.

TLT iShares 20 Year Treasury ETF

It isn’t just stocks that have jumped off the bottom. Dare I say bonds, and I mean long term bonds have a bid. TLT hasn’t broken out but is threatening.

GLD 1 Year

Gold is staging an impressive comeback as well. The dollar is 7% off the highs and Crypto the biggest challenger to Gold as the preferred alternative to fiat currencies is in the toilet.

MSCI EAFE Currency Hedged ETF

In recent weeks currency hedged DBEF is also outperforming. Relative strength at 74 isn’t 90 but still well ahead of the S&P at 62

In local currency Europe is outperforming U.S. shares and even in dollar terms is challenging.

Earnings season is all but over but we still have 3 major pieces of data before year end as potential roadblocks. Payrolls hit Friday and the following week we have a back-to-back CPI and FOMC decision.

It’s important to understand the title of today’s post Nothing Changes Sentiment Like Price works in both directions. In the end price always wins the debate.

*At the time of this post some funds managed by David were long SPY, TLT, GLD, DBEF, AAPL, MSFT and GOOGL.