Dear Mr. Market:

Journalists write about you daily. Investors constantly think and talk about you. Analysts and economists spend their entire careers trying to figure you out. You’re a complex yet simple character, Mr. Market! All that said, today we want to share with our readers a substantial part of you that doesn’t get enough appreciation (pun intended). Let’s talk dividends!

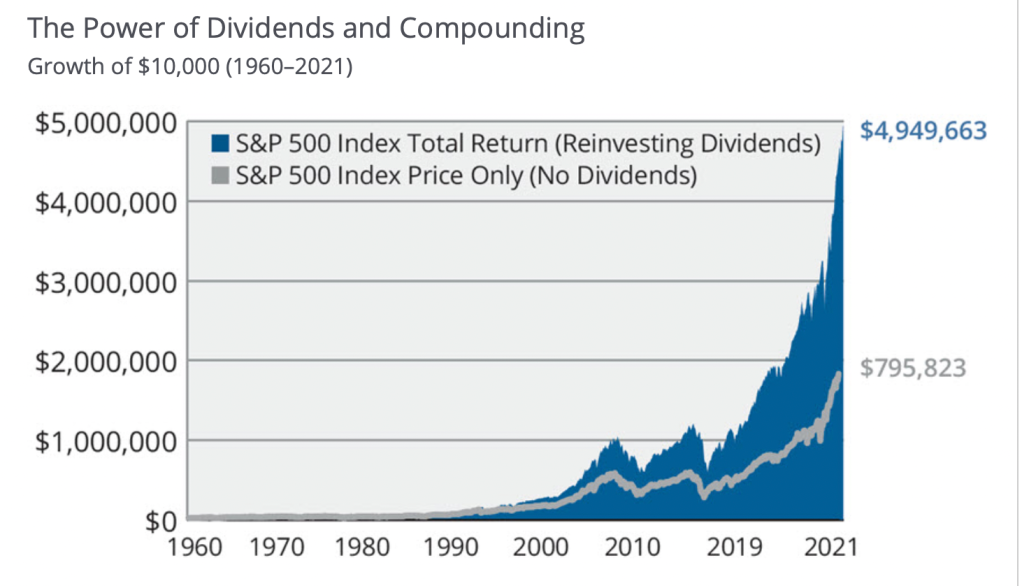

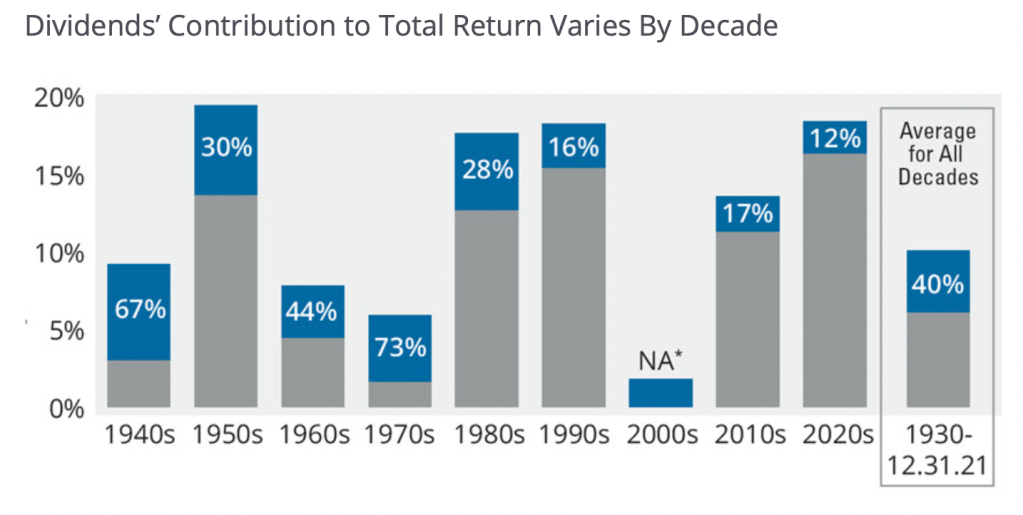

Many investors naturally focus on growth (who doesn’t want that, right?) but what they don’t realize is how powerful dividends are and how they make up a major portion of cumulative returns in the market. Dividends constitute almost 40% of the total U.S. stock market’s return since 1930. Take that one step further with the magic of compounding and reinvesting those dividends… and it attributes to over 84% of the overall return! We’ve all seen the charts of a $10,000 initial investment and how that can grow over time, but if you need a visual reinforcement for the powerful combination we just described, check this out:

Dividends aren’t just free money being doled out by public companies to shareholders; they’re often a sign that a company is thriving, mature with dominant market position, and therefore has the ability to generate free cash. Data shows that since 1973, companies that grew or initiated a dividend compared to companies that cut or eliminated theirs, have experienced the highest returns with significantly less volatility.

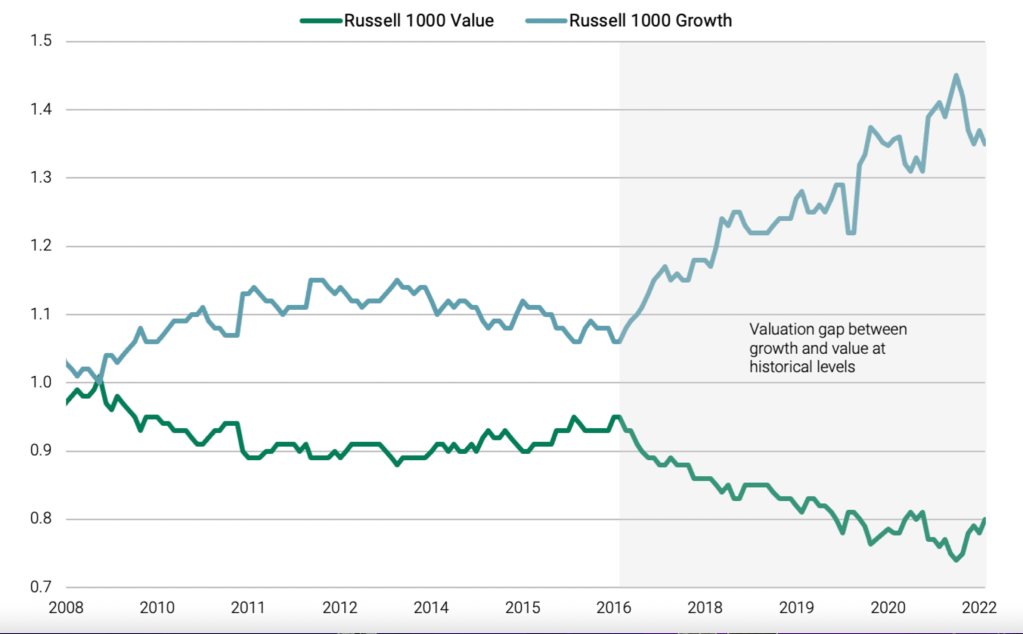

The past several decades have been led by growth but eventually the pendulum not only begins to swing the other way but markets also rotate in leadership (growth versus value). Inflation is currently at 40 year highs with increasing signs of slowing economic growth. We’re currently seeing one of the largest disparities in valuations between growth and value stocks which in our opinion presents a very appealing opportunity for dividend seeking investors.

While everyone is bantering about the official definitions of what a recession is, we’re very likely to see a period of stagflation. Couple this scenario with a dismal bond (fixed income) environment, and there are many similarities to the 1970s where dividend stocks flourished. A few other tailwinds that bode well for dividend-paying stocks include historically high levels of corporate cash, low bond yields, and a demographic of baby boomers needing income to last throughout retirement.

Not only are we sharing the importance of dividends in this article, but it’s also the official roll-out of the Top 10 Dividend Growth Portfolio strategy managed by My Portfolio Guide, LLC. Going forward we’ll update our readers and clients about the strategy and performance on a quarterly basis.

On some quarters, where there may not be changes to any holdings within the portfolio, we may dive more in depth on a specific company or two. For clients following this type of portfolio strategy, we’ll share some basic rules here but if you’re interested in learning more, please reach out directly.

- The Top 10 Dividend Growth Portfolio strategy is a concentrated portfolio. While the intent is to ideally find companies diversified across several industries, on occasion there could be some obvious overlap.

- Anyone can run a screener filtering for stocks that have dividends and then pick the ones they like best or have the highest yield; that’s NOT what we’re doing here. My Portfolio Guide, LLC has a proprietary methodology in selecting each company that gets added to the portfolio. While all holdings will have a dividend, there may be certain stocks that don’t yield as much as others from the entire universe we have to choose from (yet they may offer some other catalyst or growth factor that we’ve identified and find attractive).

- Holdings in the Top 10 Dividend Growth Portfolio are also not beholden to any specific sector, style, or market cap. That being said, most companies will be large, well established, blue-chip, companies that not only have a dividend but show a track record or propensity to continue growing it as well.

- This strategy can be used as a standalone portfolio (if it suits your investment profile and risk tolerance) or as a sleeve within a more broadly diversified investment portfolio. For example, in a typical “60/40” type allocation, we can incorporate the Top 10 Dividend Growth Portfolio as part of the 60% that would be invested in equities.

- The Top 10 Dividend Growth Portfolio is not a “pick and choose what you like, flush or hold off on what you don’t”. In other words, while everyone is entitled to their own opinions and preferences, this is an actively managed portfolio such that when we replace one holding with a new one, we do so across the board for all clients. Ideally we hold on to companies over the long-term but things can obviously change quickly and in this portfolio there are no sacred cows.

We bring up that latter point with Ford being one of our current holdings. It’s actually had such a nice run lately that it may be a candidate for some profit taking but the point of it all is…we’re not married to any company nor handcuffed with personal biases. If you’re a “I’d rather push a Chevy than drive a Ford” person, realize that on the other side of that equation is someone who believes in FORD (First On Race Day)! Long story short….all stocks have a following (sometimes even cultish!) and usually some sort of reason to buy them. We’re extremely calloused in not only our selection but also unemotional about saying our goodbyes. Buying is the easy part…knowing when to sell is where the art and discipline come into play.

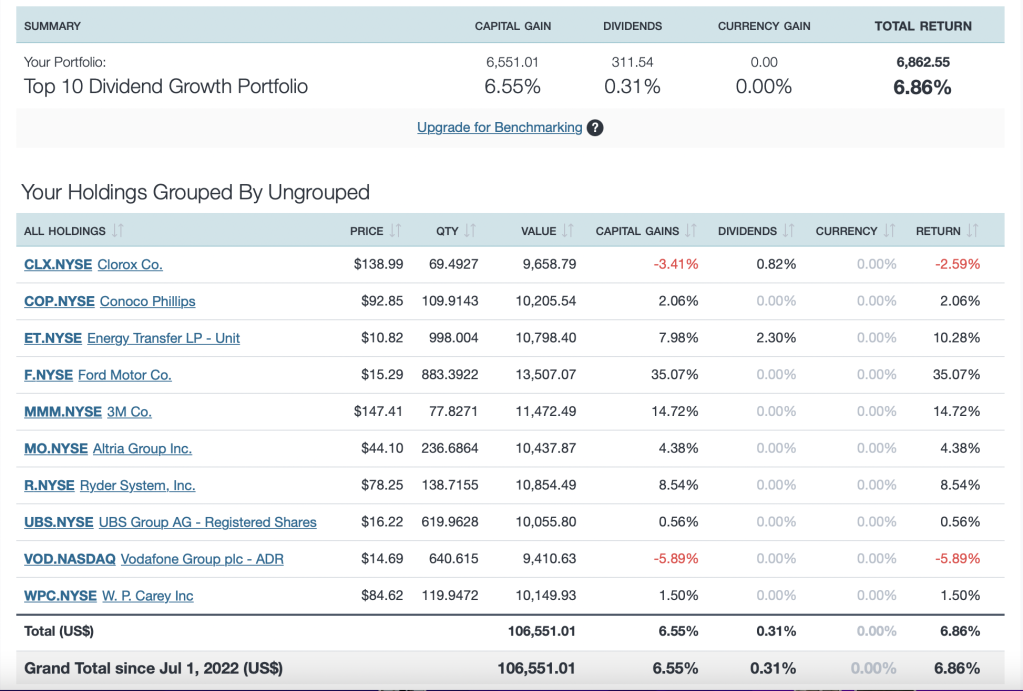

Speaking of what’s under the hood of the Top 10 Dividend Growth Portfolio, here is the current list of positions owned with performance starting as of July 1, 2022 (click the image below to enlarge) :

Over time and within our periodic or quarterly updates, we’ll provide performance updates along with some rationale on portfolio moves we make. The Top 10 Dividend Growth Portfolio was actually created last year and began trading live in January of 2022. The above performance and inception date follows a July 1, 2022 start date and a $100,000 investment. Thus far, as you’ll see from above, there have only been two companies that issued dividends since July 1, 2022 (Clorox and Energy Transfer) and the overall return for the portfolio is +6.86%. As an aside, it was interesting to see considerable resilience through the steepest part of the bear market earlier this year where the Top 10 Dividend Growth Portfolio was actually up +2.9% compared to the overall stock market which was down -22%. (obviously this is no indication nor guarantee that such outperformance will continue but interesting to note).

Lastly, in no particular order, here’s the current dividend yield, price/range, valuation, and embedded link on each stock (click on the ticker symbol for added detail):

The Clorox Company (CLX) Dividend Yield 3.26%, Currently trading at $138.99, 52 week range $120 to $186, P/E ratio 37.46

3M Company (MMM) Dividend Yield 4.15%, Currently trading at $147.41, 52 week range $125 to $202, P/E ratio 20.59

UBS Group (UBS) Dividend Yield, Currently trading at $16.22, 52 week range $14 to $21, P/E ratio 7.08

Ryder System Inc. (R) Dividend Yield 3.22%, Currently trading at $78.25, 52 week range $61 to $93, P/E ratio 5.59

Vodafone Group (VOD) Dividend Yield 6.55%, Currently trading at $14.69, 52 week range $14 to $19, P/E ratio 20.12

Ford Motor Company (F) Dividend Yield 2.64%, Currently trading at $15.30, 52 week range $10 to $25, P/E ratio 5.41

Energy Transfer (ET) Dividend Yield 8.18%, Currently trading at $10.82, 52 week range $7 to $12, P/E ratio 10.30

W.P. Carey Inc. REIT (WPC) Dividend Yield 4.99%, Currently trading at $84.62, 52 week range $73 to $89, P/E ratio 31.11

Altria Group (MO) Dividend Yield 8.14%, Currently trading at $44.10, 52 week range $41 to $57, P/E ratio 45.00

ConocoPhillips (COP) Dividend Yield 2.10%, Currently trading at $92.85, 52 week range $51 to $124, P/E ratio 9.71

Feel free to share this article with anyone who you think may have interest in learning more or reach out directly with any additional questions.