by Calculated Risk on 12/26/2022 02:45:00 PM

Monday, December 26, 2022

Review: Ten Economic Questions for 2022

At the end of each year, I post Ten Economic Questions for the following year (2022). I followed up with a brief post on each question. Here is review (we don't have all data yet, but enough). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments.

I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong. As an example, when the pandemic hit, I switched from being mostly positive on the economy to calling a recession in early March 2020.

10) Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

"The bottom line is inventory will probably set new record lows over the next couple of months, and then inventory will likely increase YoY later in the year. However, it seems unlikely that inventory will be back up to the 2017 - 2019 levels. Inventory is always something to watch!"

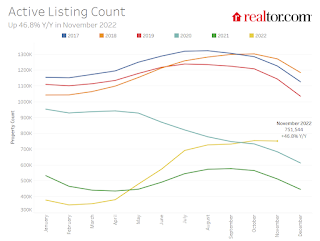

Here is a graph from Realtor.com showing active inventory through November 2022.

As expected, inventory hit new record lows early in 2022, and is finishing the year up significantly year-over-year - but not close to the 2017 - 2019 levels.

Note: The NAR reported inventory was up 2.7% year-over-year in November compared to November 2021. This appears to include some pending sales and doesn’t match some other measures of inventory (Altos and Realtor.com).

9) Question #9 for 2022: What will happen with house prices in 2022?

"[B]ased on my inventory forecast and further progress with the pandemic, my guess is that year-over-year price increases will probably be the strongest early in the year, and then soften towards the end of 2022. Price appreciation will decrease from the unsustainable 2021 pace but seems likely to still be in the mid-to-high single digit range in 2022."

This was mostly correct. The year-over-year change in the Case-Shiller index peaked in March 2022, and then softened as the year progressed.

This was mostly correct. The year-over-year change in the Case-Shiller index peaked in March 2022, and then softened as the year progressed.As of September, the National Case-Shiller index SA was up 10.6% year-over-year. (Case-Shiller for October will be released tomorrow).

House prices are now falling month-to-month, but it appears prices will still be up mid-single digits in December.

8) Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

"Mortgage equity withdrawal will probably decline in 2022, since fewer homeowners will refinance their mortgages. However, there is some concern about banks easing lending standards, and the rapid increase in non-QM loans. This will be something to watch in 2022, but overall lending is still solid (unlike during the housing bubble)."Mortgage equity withdrawal was surprising still solid in 2022 as homeowners switched from refinancing existing mortgages to using home equity loans (2nd loans) to extract equity from their homes.

Banks generally tightened standards on mortgage loans.

7) Question #7 for 2022: How much will Residential investment change in 2022? How about housing starts and new home sales in 2022?

6) Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

5) Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

4) Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

3) Question #3 for 2022: What will the unemployment rate be in December 2022?

2) Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

As of the November employed report, the year-over-year change was +4.9 million jobs - well above my guess.

As of the November employed report, the year-over-year change was +4.9 million jobs - well above my guess.

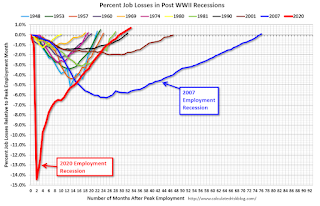

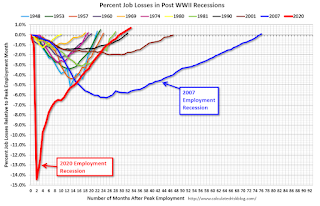

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

7) Question #7 for 2022: How much will Residential investment change in 2022? How about housing starts and new home sales in 2022?

"My guess is starts will be down low-to-mid single digits year-over-year in 2022. New home sales could pick up solidly if existing home inventory stays low, supply issues are resolved, and mortgage rates stay low, but my guess is new home sales will be mostly unchanged year-over-year."Through November, total starts, year-to-date, were down 1.2% compared to the same period in 2021. New home sales were down 15.2% compared to the same period in 2021. Starts were as expected, but new home sales were down as mortgage rates increased quicker than expected.

6) Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

"Currently I expect asset purchases to end as planned in March, and the 1st rate hike to happen at the March meeting, and perhaps a 2nd hike in June. Subsequent rate hikes will depend on the course of the pandemic, inflation and employment, but 3 rate hikes in 2022 seem likely."Huge miss. Inflation was much higher than I expected, and the Fed raised rates far more the expected.

5) Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

"The pandemic was the cause of the inflation spike, with supply constraints, a shifting of demand from services to goods, large fiscal transfers, and a smaller labor force pushing up wages. If the pandemic eases, I expect these pressures to ease. My guess is core PCE inflation (year-over-year) will decrease in 2022 (from the current 4.7%), and I think core PCE inflation will be at or below 3% by the end of 2022."According to the November Personal Income and Outlays report, the November PCE price index increased 5.5 percent year-over-year and the November PCE price index, excluding food and energy, increased 4.7 percent year-over-year. Inflation was higher than expected but has been slowing recently.

4) Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

"My guess, based on the impact of the pandemic easing, is that most of these people will return to the labor force. I don't expect that participation rate to increase to pre-pandemic levels (63.4%), but it seems reasonable the participation rate will increase to the mid 62s by year end, before trending down again later in the decade."This was mostly correct. The Labor Force Participation Rate was at 62.1% in November.

3) Question #3 for 2022: What will the unemployment rate be in December 2022?

"Depending on the estimate for the participation rate and job growth (next question), my guess is the unemployment rate will decline into the mid 3% range by December 2022 from the current 4.2%."The unemployment rates was at 3.7% in November.

2) Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

"My guess is something like 2.5 to 3.0 million jobs could be added in 2022, but it will depend on the pandemic (and policy). This fits with my view of sluggish labor force growth, an increase in the participation rate, and a decline in the unemployment rate. That would mean there are still fewer jobs at the end of 2022, than before the pandemic."

As of the November employed report, the year-over-year change was +4.9 million jobs - well above my guess.

As of the November employed report, the year-over-year change was +4.9 million jobs - well above my guess.This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

As of August 2022, the total number of jobs had returned and are now 1.044 million above pre-pandemic levels.

1) Question #1 for 2022: How much will the economy grow in 2022?

My biggest misses were on inflation (and Fed policy), GDP (too optimistic) and employment (too pessimistic).

1) Question #1 for 2022: How much will the economy grow in 2022?

"My sense is growth will slow in 2022 noticeably. Some sectors, like vehicle sales, will pick up since vehicle sales were supply constrained in 2021. Other sectors will continue to recover (like travel related) and service sectors. However, some goods sectors will likely decline, and real estate will likely be mostly flat in 2022. Also, fiscal and monetary supply will give less of a boost in 2022. My guess is the real GDP growth will probably be in the 2.5% to 3.5% range in 2022."It now appears GDP growth will be under 1% in 2022.

My biggest misses were on inflation (and Fed policy), GDP (too optimistic) and employment (too pessimistic).