My Two-for-Tuesday morning train WFH reads:

• What Happens After a Bad Year in the Stock Market? The year is still young of course but there is an obvious divergence in the price action between 2022 and 2023. This is a good reminder about what generally tends to happen in different market environments. Volatility clusters in a downtrend so you get both big down days and big up days even as the market’s general direction is lower. In up-trending markets you don’t see as many big moves in either direction. You take the stairs up at a measured pace and the elevators down in a hurry. (A Wealth of Common Sense) see also Here’s a Better Way to Identify Quality Stocks: According to new research, the annual return on a portfolio of quality stocks can be enhanced by an average of .60 percent when investors include intangible assets in their definition of quality. (Institutional Investor)

• The Future of AI Relies on a High School Teacher’s Free Database: With over five billion images, LAION has become central to the future of artificial intelligence — and a growing debate over how to regulate it. (Bloomberg)

• The iPhone Setting Thieves Use to Lock You Out of Your Apple Account: The recovery key was designed to make Apple IDs safer. Instead, these victims permanently lost family photos and other precious digital possessions. (Wall Street Journal) see also Apple’s New Savings Account Makes iPhones More Valuable—for Thieves: Apple is now paying you to have an iPhone! That’s right. Sign up for the savings account now available through Apple Wallet, administered by Goldman Sachs, and you will get an interest rate of 4.15%, Apple. (The Information)

• The global economy’s slow-motion reset: We are now in the early stages of a slow-moving process of markets, companies and governments adapting and readjusting to that reality. (Axios)

• Why Tucker Carlson’s Exit From Fox News Looks Like an Execution: The biggest star in cable news didn’t get to give a proper goodbye from his prime-time perch. But will Carlson go quietly into the night? (Vanity Fair) but see also Tucker’s Successor Will Be Worse: The history of Fox News shows that the network and its issues are larger than any one anchor. (The Atlantic)

• Schizophrenia at the IMF: At long last, the International Monetary Fund has begun to recognize that the best way to reduce sovereign debt is by boosting economic growth, rather than insisting on fiscal retrenchment. But this new understanding is being undermined by a lingering adherence to growth-inhibiting austerity policies. (Project Syndicate)

• What Was Twitter, Anyway? Whether the platform is dying or not, it’s time to reckon with how exactly it broke our brains. (New York Times Magazine) see also How Elon Musk Turned the Blue Checkmark Into a Scarlet Letter: A weekend-long masterclass in business failure. (Slate)

• 5 Big Wine Books to Buy Now and Use Forever: The reference guides our wine columnist relies on are ambitious, comprehensive, deeply researched and enduringly relevant. These are the books, old and new, she gives her highest recommendation. (Wall Street Journal)

• Judicial record undermines Clarence Thomas defence in luxury gifts scandal: Republican mega-donor Harlan Crow was linked to a conservative group that had court business while Thomas was on the bench. (The Guardian) see also The controversial article Matthew Kacsmaryk did not disclose to the Senate: The judge who delivered a high-stakes abortion pills ruling last week removed his name from a law review article during his judicial nomination process, emails show (Washington Post)

• The Wildest Seat in the NBA Is the One Next to Steve Ballmer: The owner of the Los Angeles Clippers goes viral for his courtside reactions—and no one’s more aware of it than his game day neighbors. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Brian Hamburger, founder of MarketCounsel and Hamburger Law Firm. He is an entrepreneur, attorney, consultant, and advocate for independent investment advisers, which is a $97 trillion industry. MarketCounsel and Hamburger Law Firm are the leading business & regulatory compliance consultancy to the country’s preeminent entrepreneurial independent investment advisers in the investment and securities industry.

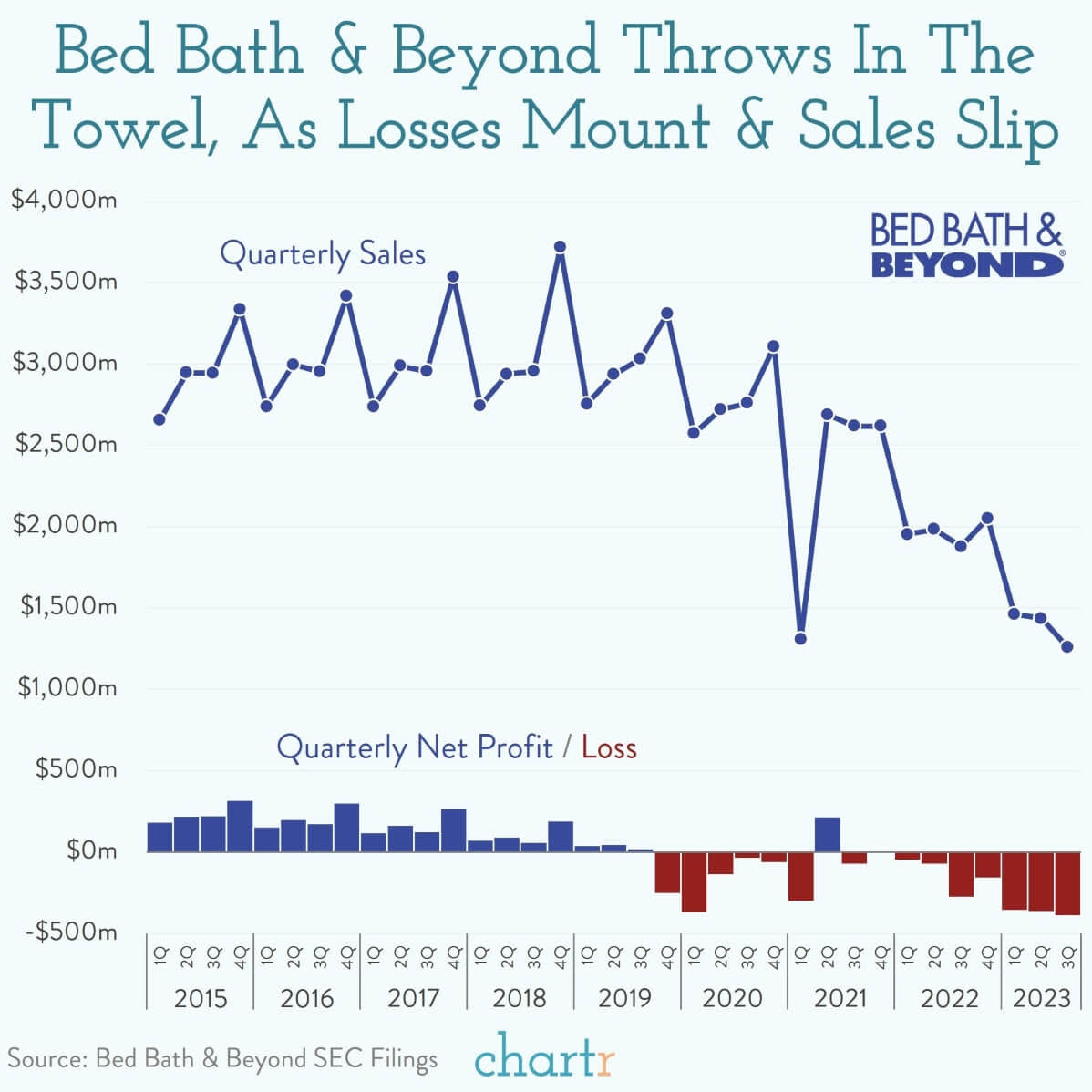

Once a staple of retail outlets across the country, Bed Bath & Beyond is finally calling it quits

Source: Chartr

Sign up for our reads-only mailing list here.