Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Wealth Management

JULY 2, 2025

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. Younger Gen Xers tend to be more akin to millennials, preferring shorter, more frequent digital communication from their advisors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 10, 2025

RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth Jalina Kerr of Charles Schwab shares how the most adaptive firms are expanding beyond portfolio management, into areas like estate and tax planning.

Harness Wealth

MARCH 7, 2025

This weeks Tax Advisor news roundup covers key updates for financial professionals. Last but not least, we have a rundown of the IRSs ‘Dirty Dozen’ tax scams for 2025. Wealth Taxes in Europe, 2025 ( Cristina Enache , Tax Foundation) Net wealth taxes are recurrent taxes on an individuals wealth, net of debt.

Nerd's Eye View

APRIL 16, 2025

Market pullbacks may create openings for tax-loss harvesting, 'discounted' Roth conversions, and portfolio rebalancing – allowing clients to focus on what they can still control, even when headlines feel overwhelming. Finally, volatile markets offer a powerful opportunity for advisors to reinforce the value of financial advice.

Darrow Wealth Management

APRIL 23, 2025

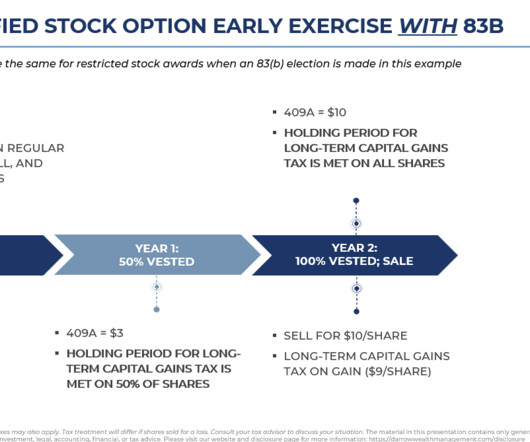

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. Section 83(b) of the tax code gives individuals the ability to accelerate the taxation of their unvested equity grant. What is an 83(b) election?

SEI

JULY 15, 2025

These tax-advantaged funds provide capital to small and midsized U.S. Tax efficiency: Like real estate investment trusts (REITs), most BDCs avoid entity-level taxation by distributing at least 90% of their taxable income to shareholders, resulting in pass-through treatment. However, distributions are generally taxed as ordinary income.

Darrow Wealth Management

MARCH 3, 2025

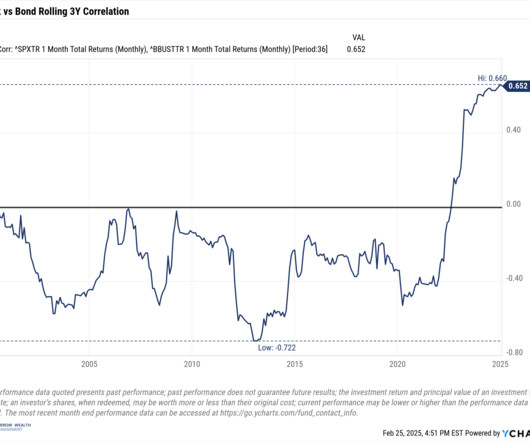

Taxes, fees, expenses, trading costs, etc. As economic conditions and income needs change, so too will your asset allocation. The choice between stocks and bonds depends on their individual circumstances, such as risk tolerance, time horizon, and financial goals. can all weigh on performance.

The Big Picture

JULY 1, 2025

Bachelor’s in economics and a BS in computer science from Wellesley in Boston and then an MBA from Harvard Business School. So it was Pascal then c plus plus, and then I took an economics class and that’s when the lights went off because it was a very mathematical field in many ways, but also with a link to the Rio economy.

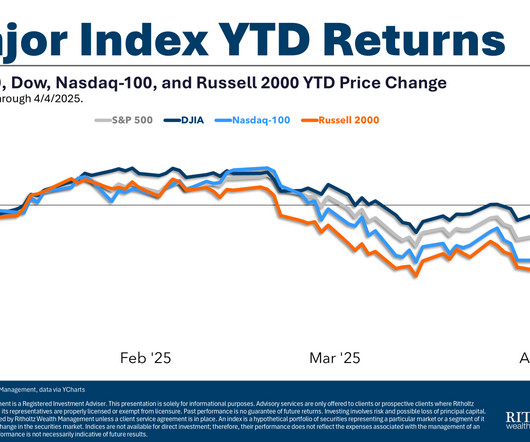

Carson Wealth

JANUARY 6, 2025

That change tells a lot of the economic story for the year. Our general view is that lower taxes, deregulation, higher fiscal deficits, and lower interest rates are all policies that tend to have a positive impact on corporate profits, which in turn support stock gains. The pivot point is the two-year yield, which hardly moved.

Midstream Marketing

NOVEMBER 6, 2024

Pain Points: These are issues like market ups and downs, tax problems, and money planning being hard. Share economic signs and how they might affect your investment strategies. Tax Planning: Help clients learn smart tax strategies. Tax Planning: Help clients learn smart tax strategies.

SEI

JULY 15, 2025

Investor relations Our leadership team Newsroom Locations Careers Featured Login Contact us Careers US US EMEA Canada English Canada Français Our sites US EMEA Canada English Canada Français Insights 1031 Exchanges vs. opportunity zone investments Evaluating and comparing tax strategies for financial professionals.

The Big Picture

MARCH 4, 2025

And in my summer in between I worked for Mayor Daley in Chicago on economic development issues. So taxes and bonds for sure. So kind of an, you know, easy transition taxes and bonds to, to corporate bonds. You could get tax free yield at 7% imagine and, and a rated not junk.

Clever Girl Finance

JUNE 5, 2025

On this podcast, Laura simplifies many finance topics such as investing, taxes and credit into segments that are under 30 minutes. Our favorite episode of Journey to Launch: How to Stay Financially Grounded in Uncertain Times addresses what to do during uncertain economic times. addresses 7.

Zoe Financial

FEBRUARY 24, 2025

Economic Update: Walmart Earnings : Reported lower-than-expected sales guidance, indicating potential weakness in U.S. Sector Performance : Energy, healthcare, and communication services are outperforming; technology and consumer discretionary sectors are underperforming. Stock Market Update: S&P 500 : Down 1.7% for the year.

The Big Picture

APRIL 7, 2025

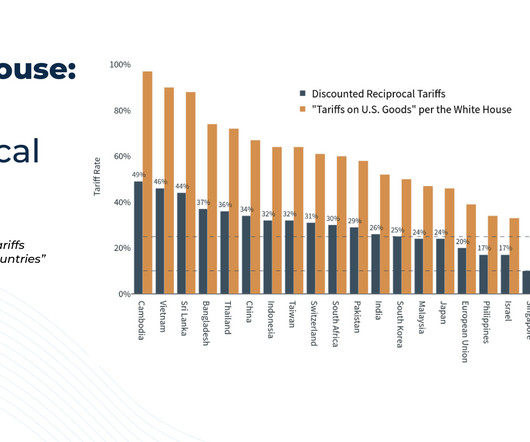

Most corporate executives thought we would be getting tax cuts, deregulation, and a business-friendly environment. How transparent are we communicating our intentions to our trading partners and citizens? April 2nd revealed that the president and his economic team do not truly understand how global economies and trade work.

Bell Investment Advisors

JUNE 27, 2025

From Policy to Portfolio: The Economic Impact of Tariffs On Thursday, June 26 th at 12pm Pacific Time, Financial Advisor Laurent Harrison, CFP® joined Bell Portfolio Manager Ryan Kelley, CFA® for a 45-minute webinar that covered the following topics: Financial Market Returns The U.S. and global economic events. Slide 7: U.S.

The Big Picture

FEBRUARY 4, 2025

But still he’s communicating how wrong everybody else is and how right he’s been and why you should be pretty constructive about the state of both employment and credit and the stock market he has. WA was the career plan, always economics and finance. And I studied economics in university.

The Big Picture

JUNE 16, 2025

So a world in which we have to make our own shirts and our own furniture is a world in which the other 350 million Americans who don’t make those things are taxed very heavily. So Pax Americana, 80 years of growth and economic success, much of which accrued to the benefit of the US are, are you implying that that is now at risk?

The Big Picture

MARCH 25, 2025

So, the reason I am an economics, I have a degree in economics. The reason for that was I had maybe six more credits, four to six more credits in economics than I had in history. But with me, it’s always more like I’m fascinated by the thought or the message that’s being communicated. Absolutely correct.

Trade Brains

JUNE 12, 2025

These hubs offer tax advantages and simpler business regulations. Sustainable scaling is requiring revenue growth with a healthier unit of economics. Complex Market Regulations: Each country has a unique set of tax laws, import and export norms and standards, and compliance standards.

Discipline Funds

MAY 12, 2025

estimate we’re talking about extra tax revenue of about $380B and with the 17% rate we’re talking about tax revenue of $550B. These are still significant tax increases, but they’re a far cry from the rhetoric of just a month ago when it looked like the USA was going full blown isolationist. With the 12.6%

The Big Picture

MAY 19, 2025

But don’t overlook the opaque and ham-fisted communications strategy that accompanied them. consumer VAT tax would reduce corporate revenues 10 to 20%, and profits 20 to 30% (or more). A compare & contrast with how the Federal Reserve communicates changes in interest rate policy is instructive.

The Big Picture

MARCH 11, 2025

00:02:07 [Speaker Changed] So, so let’s start with a little bit, I wanna talk about the book, but before we get to that, let’s talk a little bit about your background, which is kind of fascinating for an American, you get a bachelor’s at Oxford, a PhD at the London School of Economics. I’m not American.

Abnormal Returns

APRIL 21, 2024

philbak.substack.com) Taxes How much do higher taxes prompt millionaires to relocate? theatlantic.com) Is there a better way to maximize charitable giving instead of a tax deduction? vox.com) Trying to tax all families equitably is a dilemma. disciplinefunds.com) The Fed's communication regime is a mess.

Nerd's Eye View

APRIL 25, 2023

We conclude with why Ari feels grateful that the advisory business model is so successful, as it takes away the pressure to focus on the business economics and instead gives him more opportunities to connect with the human aspect of financial planning and create deep and meaningful relationships with the people around him and in his life.

Cornerstone Financial Advisory

FEBRUARY 26, 2024

Stocks Rally To Record Highs Stocks traded in a fairly tight range for the first half of the short week, yawning at the lack of economic data while awaiting earnings results from one key company that creates chips that power the artificial intelligence operations of many firms. 3,4 This Week: Key Economic Data Monday: New Home Sales.

Cornerstone Financial Advisory

OCTOBER 23, 2023

Yields rose after traders speculated that strong economic data might persuade the Fed to raise rates. Economic Strength, Housing Weakness The economy continued to evidence surprising strength according to data released last week. 6,7 This Week: Key Economic Data Tuesday: Purchasing Managers’ Index (PMI). Durable Goods Orders.

Cornerstone Financial Advisory

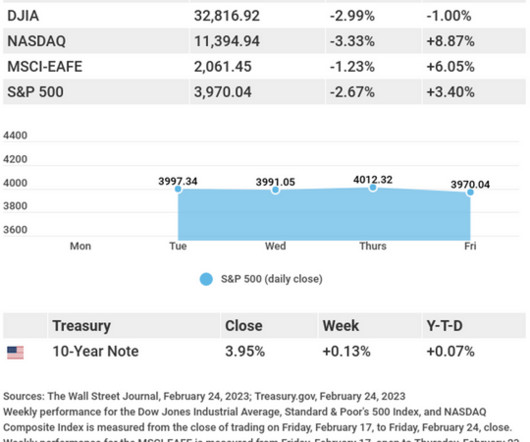

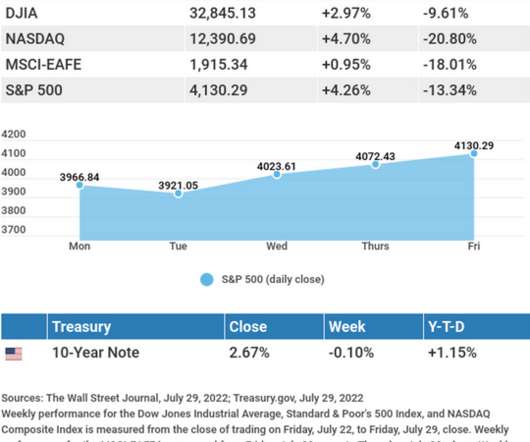

FEBRUARY 27, 2023

FOMC Says Inflation Is Still Too High Presented by Cornerstone Financial Advisory, LLC Concerns over a firmer monetary policy were heightened by fresh economic data, touching off a climb in bond yields and a slide in stock prices last week. 6 This Week: Key Economic Data Monday: Durable Goods Orders. Thursday: Jobless Claims.

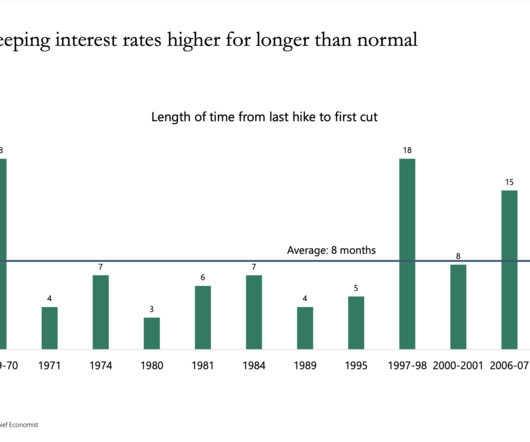

Cornerstone Financial Advisory

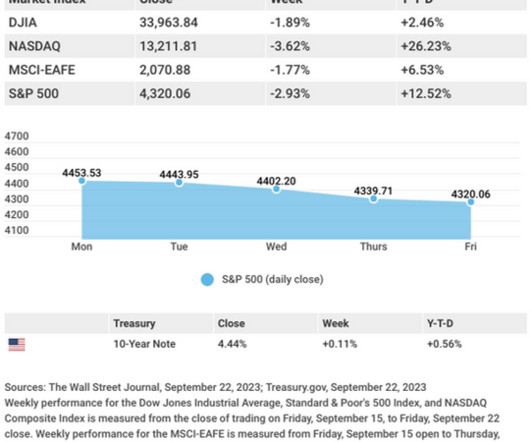

SEPTEMBER 25, 2023

In his post-announcement press conference, Fed Chair Powell remarked the inflation battle would continue, and upcoming economic data would inform the FOMC’s future rate hike decision. In their economic projections, 12 of 19 Fed officials expect to raise rates once more this year. in the fourth quarter, down from June’s 3.9%

Cornerstone Financial Advisory

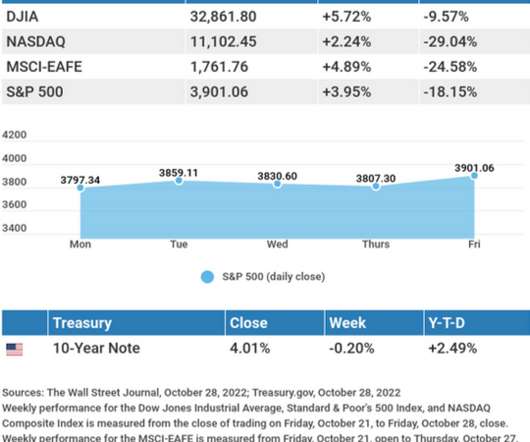

OCTOBER 31, 2022

Stocks overcame poor earnings results from some of America’s largest companies to post gains last week as investors cheered positive earnings surprises, easing inflation and a rebound in economic growth. Economic Growth Exceeds Expectations. This Week: Key Economic Data. Get tax help. It increased 4.2%, well below the 7.3%

Cornerstone Financial Advisory

FEBRUARY 19, 2024

Weekly Market Insights: Market Retreats On Inflation, Economic Reports Presented by Cornerstone Financial Advisory, LLC Stocks fell last week as investors reacted to disappointing inflation updates and other economic reports that fell short of estimates. 4 This Week: Key Economic Data Tuesday: Leading Indicators.

Cornerstone Financial Advisory

JANUARY 29, 2024

Weekly Market Insights: Excitement Around Big Tech Continues Presented by Cornerstone Financial Advisory, LLC Stocks continued their upward climb last week as excitement around big tech continued; positive economic reports stoked investors’ belief that the Federal Reserve has pulled off a soft landing. Core inflation was 3.2%

Cornerstone Financial Advisory

FEBRUARY 5, 2024

3 This Week: Key Economic Data Monday: ISM Services Index. Source: Investors Business Daily – Econoday economic calendar; February 2, 2024 The Econoday economic calendar lists upcoming U.S. For tax purposes, it’s critical to divide the expenses of a property into personal and business purposes. Fed Balance Sheet.

Cornerstone Financial Advisory

OCTOBER 30, 2023

Economic data released on Thursday showed remarkable economic strength, with above-consensus forecast growth in third-quarter Gross Domestic Product (GDP) and September’s durable goods orders, with only a minor uptick in initial jobless claims. 5 This Week: Key Economic Data Wednesday: FOMC Announcement. Jobless Claims.

Cornerstone Financial Advisory

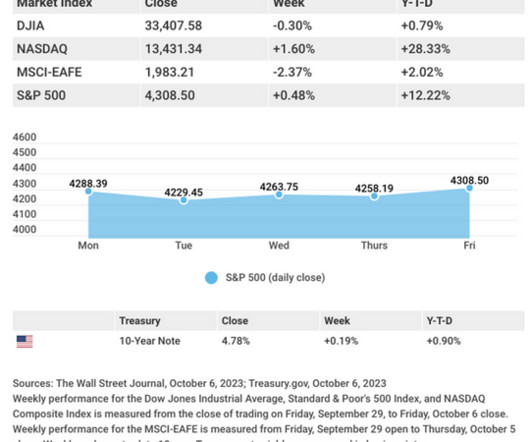

OCTOBER 2, 2023

Mixed Economic Signals Amid recent signs of a labor market cooling (a hopeful sign for ending rate hikes), last Thursday’s initial jobless claims report showed only a slight increase of 204,000. 6 This Week: Key Economic Data Monday: Institute for Supply Management (ISM) Manufacturing Index. PCE is the Fed’s preferred inflation gauge.)

Cornerstone Financial Advisory

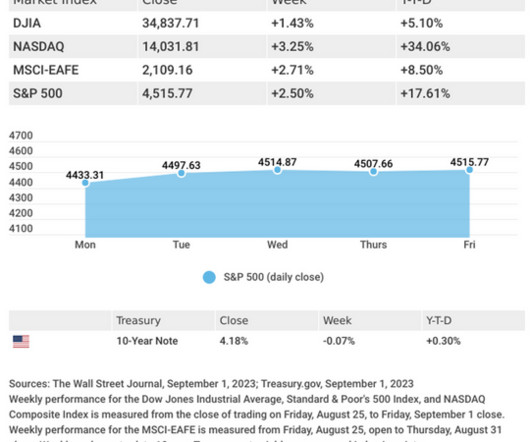

SEPTEMBER 5, 2023

Weekly Market Insights: September Stocks Open In Positive Territory Presented by Cornerstone Financial Advisory, LLC Falling bond yields–spurred by weak economic data–helped lift stocks to weekly gains. A downward revision of Q2 economic growth and fresh signs of a cooling labor market reversed the recent rise in bond yield.

Cornerstone Financial Advisory

AUGUST 1, 2022

Stocks on Thursday shrugged off news of a second-consecutive quarter of negative economic growth to build on Wednesday’s gains as fresh earnings continued to comfort, if not impress, investors. It was the second-consecutive quarter of negative economic growth, meeting the technical definition of a recession. Economy Contracts .

Cornerstone Financial Advisory

OCTOBER 9, 2023

7 This Week: Key Economic Data Wednesday: Producer Price Index (PPI). Source: Econoday, October 6, 2023 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. .”

Cornerstone Financial Advisory

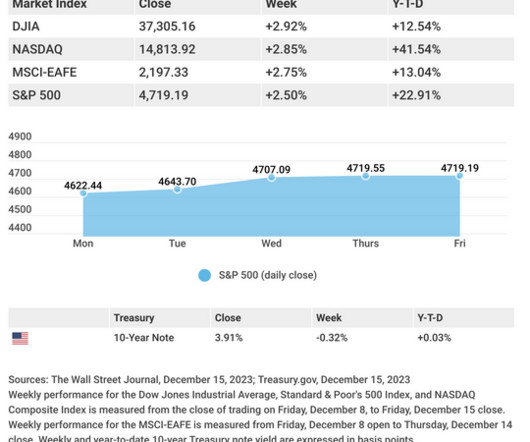

DECEMBER 18, 2023

6 This Week: Key Economic Data Tuesday: Housing Starts. Index of Leading Economic Indicators. Source: Econoday, December 15, 2023 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials.

Cornerstone Financial Advisory

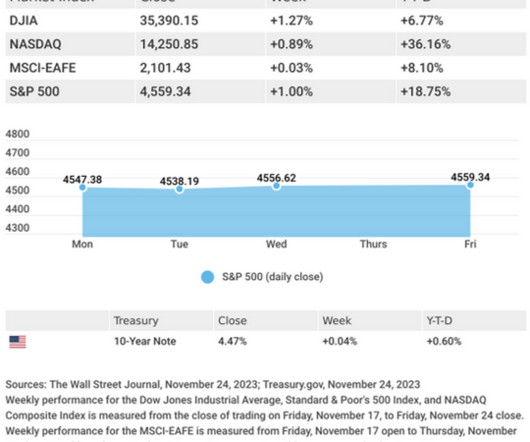

NOVEMBER 27, 2023

They further said that future rate decisions will be based on fresh economic data, offering no indication that a rate cut was forthcoming, as many analysts are increasingly anticipating for 2024. This Week: Key Economic Data Monday: New Home Sales. Source: Econoday, November 24, 2023 The Econoday economic calendar lists upcoming U.S.

Cornerstone Financial Advisory

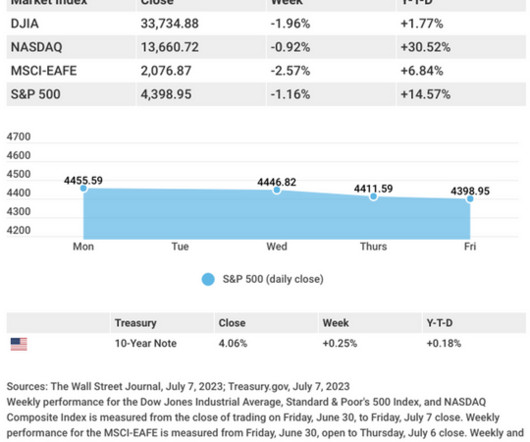

JULY 10, 2023

5 This Week: Key Economic Data Wednesday: Consumer Price Index (CPI). Source: Econoday, July 7 , 2023 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. . Jobless Claims.

Cornerstone Financial Advisory

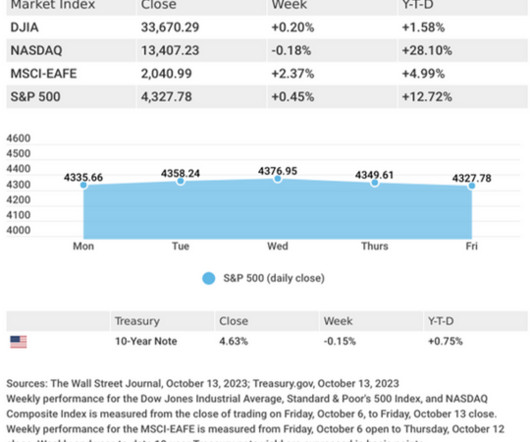

OCTOBER 16, 2023

5 This Week: Key Economic Data Tuesday: Retail Sales. Index of Leading Economic Indicators. Source: Econoday, October 13, 2023 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials.

Harness Wealth

MAY 14, 2025

When it comes to choosing a business structure, understanding the tax implications is crucial. A Cooperative (Co-op) offers a unique model that differs significantly from traditional corporations or LLCs, especially in how taxes are handled. Table of Contents What Is a Cooperative (Co-op)? Who is the Co-op for?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content