Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

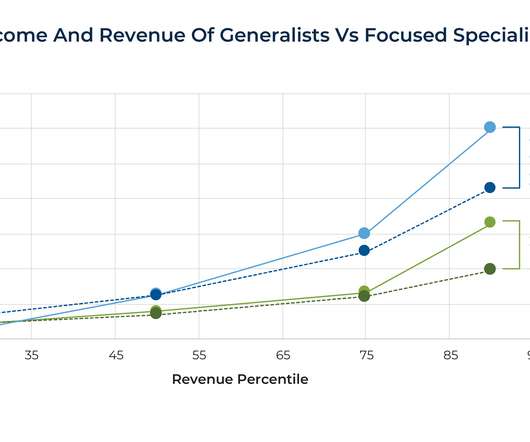

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?). Read More.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JULY 11, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that, amidst the growing number of RIAs it supervises, the Securities and Exchange Commission (SEC) is moving ahead with a potential plan to raise the $100 million regulatory assets under management threshold for SEC registration, (..)

Wealth Management

JUNE 27, 2025

So far, I’ve written about AI notetaker Jump and its integration with the financial planning application RightCapital , and the AI-powered financial planning application and company Conquest Planning and its $80 million fund raise to help accelerate its U.S. It has become a challenge to keep up with new rollouts.

Nerd's Eye View

APRIL 18, 2025

Which could create opportunities for firms to seek opportunities to move 'upmarket' by trying to add new HNW clients who might not have an advice relationship (or whose current advisor doesn't provide sufficiently comprehensive service).

MainStreet Financial Planning

MARCH 7, 2025

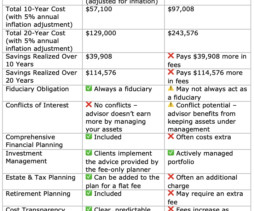

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). Instead, they provide objective, conflict-free financial advice at a predictable cost. Are There Any Benefits to AUM-Based Advisors?

International College of Financial Planning

JULY 2, 2025

As individuals and families strive to build wealth, protect their future, and achieve life goals, they increasingly seek trusted professionals who can offer sound, holistic financial advice. This is where competent, ethical, and client-first financial planners step in. What is the CFP Certification?

Darrow Wealth Management

NOVEMBER 4, 2024

Here are five ways you can find a full-time fiduciary financial advisor. A fiduciary advisor is a financial professional who is legally obligated to act in the best interest of their clients. Only registered investment advisors have a full-time fiduciary duty to their clients. What is a fiduciary advisor?

Steve Sanduski

APRIL 8, 2025

Maintaining a consistent client experience while growing. Transitioning clients between advisors and managing referrals who come to the firm expecting to work with the boss. Keen Wealth’s checklist-driven financial planning process. Do you have an estate plan? The questioning is a client experience.

FMG

JULY 9, 2025

Ask clients to leave detailed feedback on sites like Google, Wealthtender, Facebook, and VouchedFor. Format Content Using Natural Language and Q&As People ask AI tools questions like: “Who is the best financial advisor in Memphis who also does estate planning and taxes?” Specific details make all the difference.

Nerd's Eye View

FEBRUARY 14, 2025

Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g., Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g.,

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Dear Mr. Market

DECEMBER 3, 2024

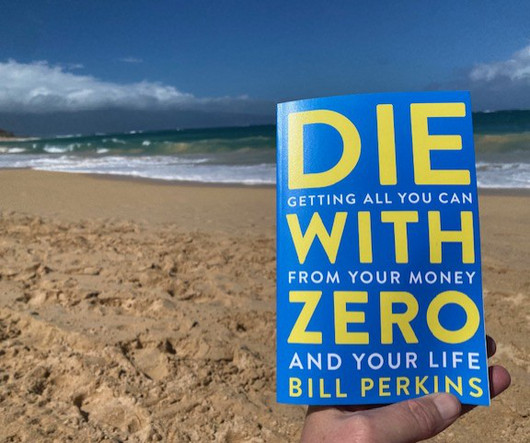

As someone deeply entrenched in financial planning and chronologically standing on the threshold of pre-retirement, the book was more than just a leisure read—it was a revelation. My reading list is usually dominated by stock market noise, economic reports, and client-related materials. Submit a form.

Midstream Marketing

DECEMBER 10, 2024

Key Highlights We will discuss how to build a strong brand identity and use referrals to attract clients. Learn how to tailor your messages for different clients. Introduction In todays challenging market, financial advisors need strong financial advisor marketing strategies. They must attract potential clients attention.

Indigo Marketing Agency

MARCH 5, 2025

Seminar Marketing for Financial Advisors Guide to Seminar Marketing for Financial Advisors: Generate Endless High-Quality Leads Theres a reason some of the most successful and fast-growing financial advisor businesses spend a great deal of their marketing efforts promoting and hosting seminars. What is that reason?

Cornerstone Financial Advisory

JANUARY 27, 2025

Tim Flick, CFP, CKA Certified Financial Planner Professional Certified Kingdom Advisor Founder, Investment Advisor Cornerstone Financial Advisory Phone: 317-947-7047 Email: tflick@cornerfi.com All Bible verses in this article are English Standard Version (ESV). What Does God Say About Financial Planning for an Estate?

Indigo Marketing Agency

JUNE 14, 2025

Leading With Attitude and Building Trusted Partnerships In the financial advisory world, relationships matter. But for Bryan Trugman , managing partner and co-founder of Attitude Financial Advisors , they’re everything. Bryan’s approach isn’t one of passing names back and forth, it’s one of solving real client problems together.

Indigo Marketing Agency

JUNE 10, 2025

These AI assistants act like savvy gatekeepers, filtering options before potential clients even visit your site. Read: AI for Financial Advisors: From Automation to a Competitive Edge How Do You Get Discovered by ChatGPT and Friends? Speak your clients’ language. The difference now is where and how clients find you.

Nerd's Eye View

JUNE 21, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5 million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey.

Nerd's Eye View

DECEMBER 1, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the U.S. Supreme Court heard arguments this week in the case of SEC v.

Nerd's Eye View

JUNE 7, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that recent surveys indicate that consumers continue to trust human financial advisors more than Artificial Intelligence (AI)-powered tools.

Abnormal Returns

SEPTEMBER 9, 2024

podcasts.apple.com) Michael Kitces and Carl Richards on the opportunity when clients bring you something 'off the Internet.' kitces.com) Ownership Nearly half of all financial planners surveyed by the CFP Board have an ownership stake in the company where they work. kitces.com) How planning changes for the child-free.

Abnormal Returns

DECEMBER 5, 2022

Podcasts Rick Ferri talks estate planning with Ryan Barrett and Mike Piper. bloomberg.com) Charitable giving strategies are as varied as the client. bloomberg.com) Charitable giving strategies are as varied as the client. wealthmanagement.com) Should you write your clients an annual letter?

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively. A lot has changed since 2020, though.

Abnormal Returns

JULY 31, 2023

(riaintel.com) Creative Planning has inked a custody deal with Goldman Sachs ($GS). investmentnews.com) Portfolio management How to evaluate a client's investment portfolio. financial-planning.com) Why some people feel the need to take Social Security early. kitces.com) How pro bono planning can change your life as an adviser.

The Big Picture

MAY 29, 2024

In today’s ATM, we discuss the advantages of having a financial captain in charge of all of your financial affairs Full transcript below. ~~~ About this week’s guest: Peter Mallouk is CEO of Creative Planning, with over $300 billion in client assets. He’s the CEO of Creative Planning.

eMoney Advisor

MARCH 7, 2023

Stepchildren, remarriages, and ex-spouses: For the modern wealth management client with a blended family, planning to transfer wealth presents a web of complexity. Fortunately, financial professionals have tools and wealth transfer strategies that can help couples be intentional about the use of their assets in an estate plan.

International College of Financial Planning

OCTOBER 26, 2023

The Imperative of Estate Planning: Not Just for the Affluent Often, there’s a prevailing misconception that estate planning is a luxury reserved for the wealthy elite. Real estate planning is a crucial undertaking that every adult and family should prioritize.

International College of Financial Planning

APRIL 20, 2022

If you are a student looking to make a career in finance, becoming a financial planner is a great place to start. Financial planning is a rewarding, stable career that can give you the opportunity to help people make the most of their money. They advise on investments, taxes, retirement, and estate planning.

eMoney Advisor

APRIL 4, 2023

As a financial professional, you are likely aware of what the media is calling the Great Wealth Transfer—where $84 trillion is set to be passed to younger generations over the next two decades. 1 But have you been putting any effort into ensuring you will continue to work with the heirs of this wealth when your older clients hand it over?

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. If you are in the middle of estate planning , consider the following strategies to develop a sound plan amidst widespread economic challenges. . Create a Trust .

Your Richest Life

JULY 17, 2024

Here are the top ten money lessons that I have learned after working with more than 150 clients over the past decade: Money lesson #1: You have more power than you think. When I meet with a new client, sometimes they think their goals are unreachable, or they feel stuck in a rut and can’t see a way out.

International College of Financial Planning

FEBRUARY 23, 2024

In the professional domain of finance, the role of a financial planner has become increasingly pivotal. As individuals and businesses alike strive for financial stability and growth, the demand for skilled financial planners has surged.

International College of Financial Planning

JULY 30, 2022

Certified Financial Planner (CFP) is globally the most respected financial designation for personal assets management. Credentials matter in any profession and when it comes to personal finance, there’s no certification more highly coveted than Certified Financial Planner.

International College of Financial Planning

JANUARY 18, 2023

Selecting a career as a “financial planner” will aid in opening doors to success. If you are aspiring to become a successful financial planner? Overview of CFP New Framework The Certified Financial Planner (CFP) Board of Standards recently announced the launch of a new framework for CFP certification.

International College of Financial Planning

MAY 6, 2022

A Certified Financial Planner (CFP) is a professional designation awarded to individuals who have completed a rigorous course of study and passed a comprehensive exam. The CFP designation is recognized worldwide and marks excellence in the financial planning industry. FP designation.

Carson Wealth

JULY 12, 2022

Translating from the secret language of financial planning, the sentence would read “Tammy specializes in insurance. She reviewed two types of annuity contracts often used for retirement and helped determine which one is the best fit for her client.” . Quite a bit of discovery from one sentence filled with planner-speak! .

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” And you’ll see in our Q&A below, that tax advisors can bring estate planning into the conversation early on in a client relationship.

Indigo Marketing Agency

APRIL 28, 2023

Essentially, you should try to convey the value you offer to your specific clients. Terms like “Wealth Manager,” “Financial Advisor,” and “Estate Planning” are more powerful than “Founder,” “Managing Partner,” or “CEO” from a keyword search perspective.

International College of Financial Planning

DECEMBER 29, 2024

The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field. As markets evolve and client needs become more sophisticated, the demand for qualified financial planners continues to grow exponentially.

Ballast Advisors

MAY 8, 2023

Often, the financial lessons and advice passed down from generation to generation shape an individual’s approach to finances. In honor of Mother’s Day, we are delighted to have a multi-generational family of Ballast Advisors clients, Jean, Val, and Amanda, who have agreed to share their experiences and insights with us.

eMoney Advisor

FEBRUARY 16, 2023

There’s nothing quite like the flurry of excitement and activity around onboarding a new client and getting started on their financial plan. This can be a tricky time and it’s tempting to think about adding services to your practice to help the client see your value.

International College of Financial Planning

APRIL 25, 2024

Achieving the status of Certified Financial Planner® (CFP®) represents a significant professional milestone in financial services. What Is a Certified Financial Planner®? A Certified Financial Planner® is a distinguished professional who has met the stringent standards set by the FPSB Board.

International College of Financial Planning

DECEMBER 4, 2023

As financial markets grow more intricate and client needs to diversify, particularly in India, the focus on a financial advisor’s qualifications have intensified. In India, the call for such qualified professionals is on the rise, driven by an increased awareness of financial planning and investment.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content