(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this Blog were created using InsMark’s Wealthy and Wise® Advanced System.)

It looks like U.S. estate planning has escaped the tax bombs Democrats wanted to drop. With Joe Biden’s Build Back Better (BBB) collapsed, it’s back to rational planning concepts, like the intentionally defective grantor trust (“Grantor Trust” or “IDGT”)1. Special thanks to Senators Manchin and Synema for holding off the BBB.

1An analysis published by the law firm of Knox McLaughlin Gornall & Sennett, P.C., (a comprehensive, easily understood explanation of Grantor Trusts).

I assume many of you listened to the legal experts like Jonathan Blattmachr and Bob Keebler in late 2021 urging year-end completion of IDGTs. I hope you have many clients who took advantage of what appeared to be a narrow window of opportunity.

But, here we go again — IDGTs are back in action. If you have clients/prospects with wealth somewhere north of at least $15 million, get them to consider the tremendous advantages of these trusts. If you don’t have many such clients/prospects, try contacting estate planning attorneys because they have them. Try showing them this Blog to let them know some dynamite planning strategies. They tend to be impressed with the logic of Wealthy and Wise®, and many of our licensees tell us that our do-it vs. don’t-do-it™ is a terrific door-opener-closer.

In Blog #206, I assumed that most of Joe Biden’s tax increases would pass (including the loss of new IDGTs). This current Blog reflects that none of them have passed, and this gives me the chance to demonstrate the power of using InsMark’s Wealthy and Wise® (Advanced) to analyze a current IDGT featuring our specialty, do-it vs. don’t-do-it™. This logic is critical to understanding the value of any recommended planning technique.

You can count on the Democrats reintroducing chunks of BBB. Happily, none of the final proposed legislation eliminated IDGTs, so it should be ultra-safe to implement them. Based on their previous positions, you can likely count on Senators Manchin and Sinema withholding their approval should the issue resurface. Be sure to cover this point with each client’s legal and tax advisers.

Case Study

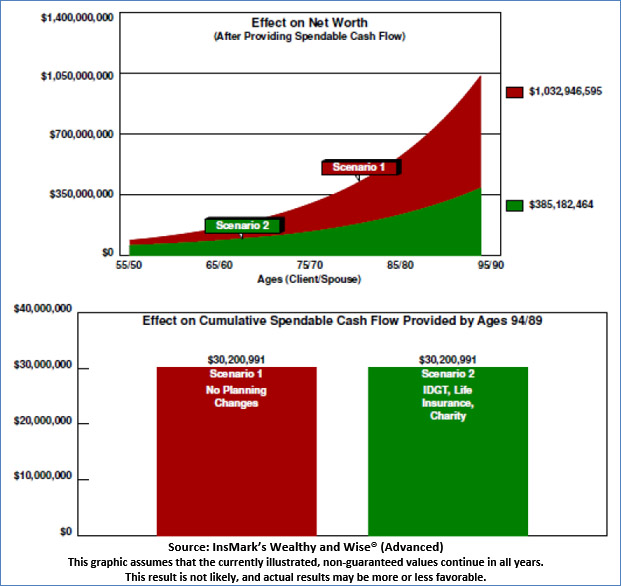

Anthony and Anita Favaro, age 55 and 50, have retired after selling their commercial real estate company for $40 million. They want their annual, after-tax, personal cash flow to be at least $500,000 with an annual 2.00% cost of living adjustment (COLA). In this Case Study, I’ll project that indexed cash flow for 40 years (to their ages 95 and 90 — about three years past their joint life expectancy). This after-tax cash flow totals $30,200,991 due to the initial $500,000 gradually increasing to $1,082,372 in illustration year 40.

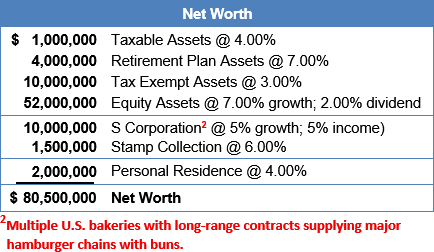

Below is a summary of the Favaros’ current net worth.

Table 1

Click here for comments regarding yields, sequence of returns, and Monte Carlo simulations.

Below is the tax treatment assumed for this analysis.

Table 2

The comparison that follows assumes the Favaros establish an IDGT and:

- Transfer (retitle) $24,120,000 of their equity assets to the IDGT as a tax-free gift.

- Sell their $10,000,000 S Corporation to the IDGT at a valuation of $6,500,0005 financed as a loan taking lifelong advantage of the January 2022 long-term Applicable Federal Rate of 1.82%. S Corporation income is directed to the IDGT’s equity assets.

- Acquire $10,000,000 of non-correlated indexed universal life insurance owned by the IDGT, with 15 scheduled premiums of $900,000 paid from IDGT assets.

- Arrange a testamentary bequest at the second of their deaths so that any taxable portion of the Favaro estate goes to the Favaro Charitable Foundation (thus establishing a Zero Estate Tax Plan).

| 5 | The sale is at a 35% discount (typical for such transactions). The loan of $6,500,000 is at 1.82%, the long-term Applicable Federal Rate for January 2022. |

First, let’s examine the impact of all the changes on Net Worth using an InsMark do-it vs. don’t-do-it analysis. All values include the funding $500,000 of annual, spendable, after-tax cash flow for the Favaros, including a 2.00% cost of living adjustment.

| Image 1 |

| Effect on Net Worth |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

After-tax retirement cash flow is not affected by the IDGT arrangement as either strategy provides $30+ million in indexed retirement cash flow from current assets.

However, as you can see, the Favaros’ personal net worth is seriously impacted due to:

- Transfer (retitle) of $24,120,000 in personal equities to the IDGT;

- Sale of $10,000,000 S Corporation to the IDGT.

- Structure of the IDGT so the Favaros pay the tax on all taxable income generated within the trust.6

| 6 | The grantor personally pays income tax on all taxable trust income using personal assets as a source of the funds. Such tax payments do not constitute gifts to the trust, thus eliminating any gift tax liabilities while also enhancing the trust’s values since no income tax inhibits its growth. |

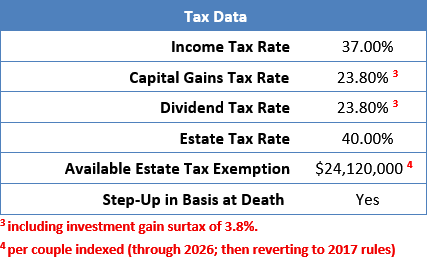

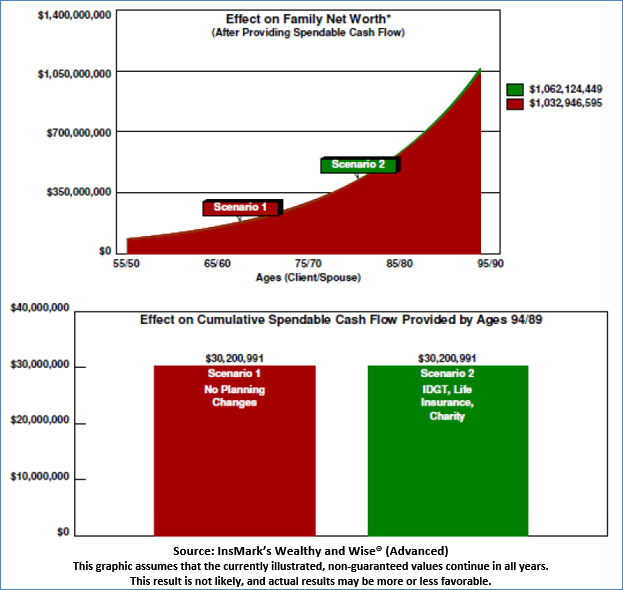

Family Net Worth

Family Net Worth involves the combined Net Worth of more than one generation (i.e., a family group), and it is not historically associated with wealth management and estate planning. It is a crucial concept when assessing the short-, mid-, and long-term potential of wealth accumulation and asset transfer. It has specific application when a significant portion of the parents’ wealth goes to children or grandchildren — or in trust for them — while their parents remain alive.

Can Family Net Worth establish a fundamental distinction? The reduction in the parents’ Net Worth caused by transfers to an IDGT presents itself more clearly in the context of overall, multi-generational Family Net Worth. It is particularly applicable for assets in an IDGT, especially when the Favaros can access trust wealth using loans from the equity account and loan repayments from the S Corporation (previously sold to the trust and subject to a $6,500,000 loan).

Below is the do-it vs. don’t-do-it™ effect of the IDGT on Family Net Worth. All values appear after accounting for $500,000 of annual, spendable, after-tax cash flow for the Favaros, including a 2.00% cost of living adjustment.

| Image 2 |

| Effect on Family Net Worth |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

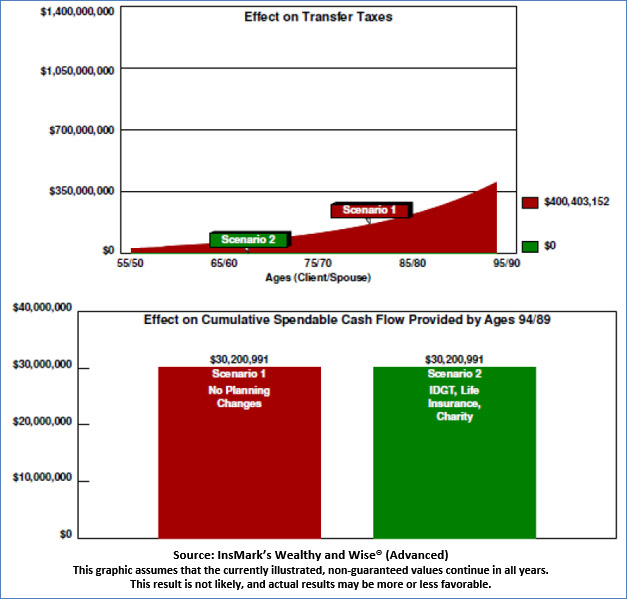

Below is the do-it vs. don’t-do-it™ effect of the IDGT on Transfer Taxes.

| Image 3 |

| Effect on Transfer Taxes |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

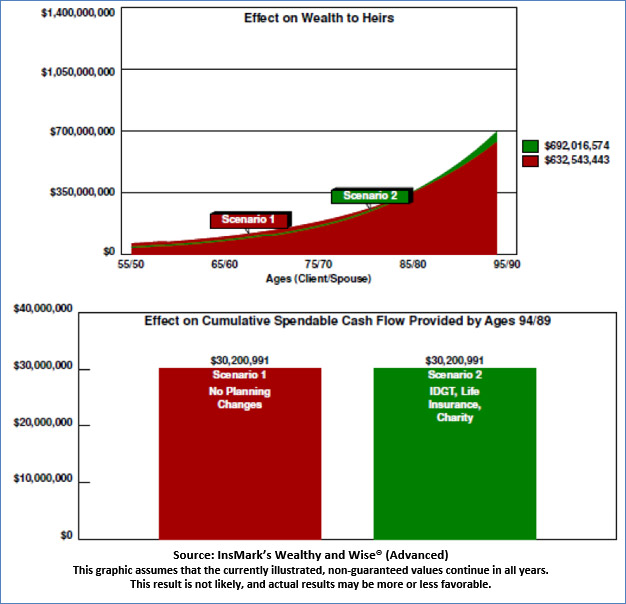

Below is the do-it vs. don’t-do-it™ effect of the IDGT on Wealth to Heirs.

| Image 4 |

| Effect on Wealth to Heirs |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Click here to review all the reports from InsMark’s Wealthy and Wise (Advanced).

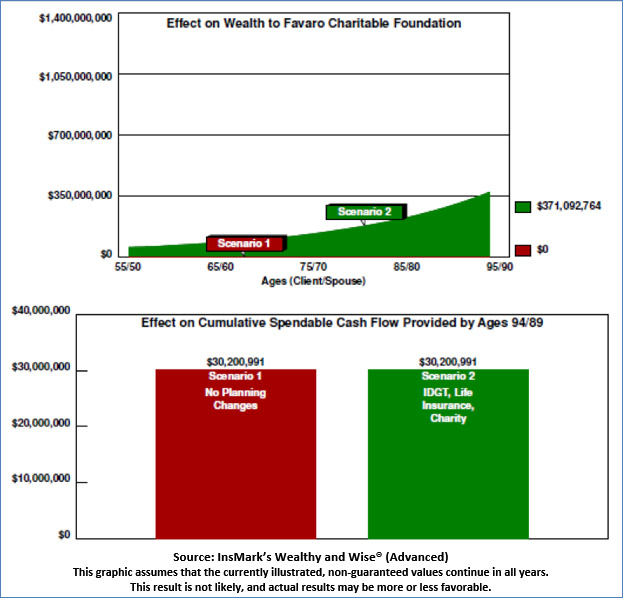

Below is the do-it vs. don’t-do-it™ effect of the IDGT on the Favaro Charitable Foundation.

| Image 5 |

| Effect on Wealth to the Favaro Charitable Foundation |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

The Charitable Foundation does not affect the Favaros’ net worth due to its generation as a testamentary bequest in their Wills. A revocation of the bequest is readily available should the Favaros ever desire to eliminate it before death.

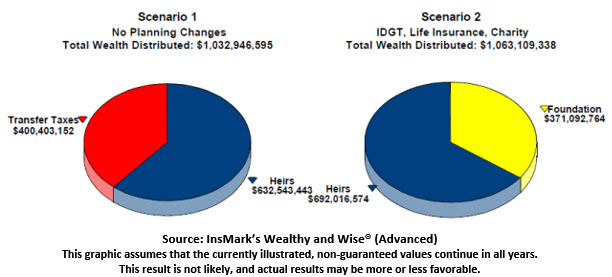

Below is the do-it vs. don’t-do-it™ effect of the IDGT on Wealth to Heirs. Life insurance is included in Scenario 2 and paid for by the IDGT to keep Wealth to Heirs as close as possible to Scenario 1: No Planning Changes.

| Image 6 |

| Effect on Transfer Taxes, Heirs, and Foundation |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Legal and tax advisers who crunch the numbers can produce excellent text and ledgers but rarely have the opportunity to present the graphic displays we have available in InsScribe®, InsMark’s built-in graphics app.

InsScribe® integrates with all InsMark Systems (flow charts, landscape graphs, bar graphs, pie charts, circle summaries, and multiple mini-graphs). It has supplied a lot of oomph for almost 30 years.

You can probably create some significant marketing opportunities by alerting legal and tax advisers of your capacity to enhance their presentations with graphics on such topics as IDGTs, split dollar, premium financing, and estate planning.

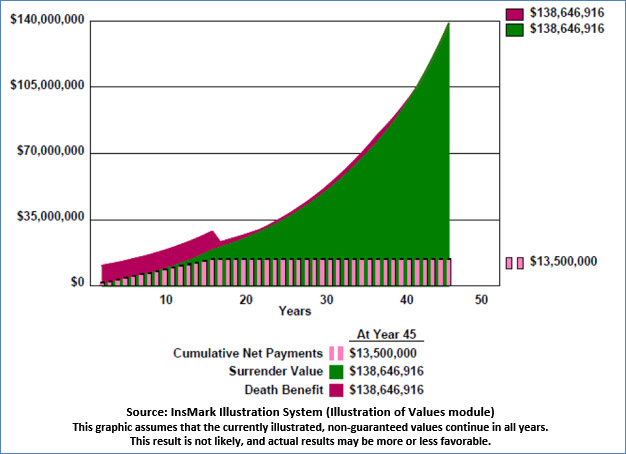

Below is a graphic of the life Insurance owned by the IDGT insuring Anthony Favaro.

| Image 7 |

| $10,000,000 Indexed Universal Life |

| Premiums: $900,000 for 15 Years Paid from IDGT Assets |

Click here to review details of the life insurance.

Grantor Access to Loans from the IDGT

A Grantor can borrow from the IDGT provided the trust has such a provision. Such loans would require a minimum interest rate equal to the Applicable Federal Rate (AFR) based on the term of the loan. (Think of it accruing like a reverse mortgage.)

Wealthy and Wise (Advanced) has a provision to illustrate such loans from liquid assets contained in an IDGT.

InsMark’s Cloud-Based Documents On A Disk™ (DOD) has several specimen Irrevocable Trust documents that accommodate IDGTs, including several with provisions for loans to a grantor. If you are or become licensed for DOD, you have access to that section of trust documents. (See the trusts called Ultimate Trusts.) Your clients’ estate attorneys will likely have their versions of such trusts. If you have no license for DOD, click here to acquire one or learn more about it.

Conclusion

This zero estate tax plan can insulate the Favaros from Federal Estate Taxes forever (and State, too). Some say it is a distinct possibility that a future Democrat triumvirate of House, Senate, and President with unbeatable majorities could attack charitable contributions. In my opinion, this is an unrealistic event due to the lobbying power of U.S. charities and their donors.

The Favaros’ four adult children and their offspring will ultimately control the Favaro Charitable Foundation. However, because the charitable event only occurs on the second to die of their parents, this generous provision in their Wills can be revoked without penalty at any time before the second death should they desire to unwind it.

I believe these potential safeguards will cause similar zero estate tax planning to explode. As a result, estate taxes can be optional no matter their level.

“Control of wealth is the virtual equal of ownership of wealth.”

John Rutledge, Merchant Banker

Features of Wealthy and Wise (Advanced)

Current features in Wealthy and Wise® (Advanced):

|

InsMark Illustrations that Link with Wealthy and Wise (Advanced):

You can easily import data from each of the following benefit plans into Wealthy and Wise® or Wealthy and Wise® (Advanced) for retirement or estate planning.

|

Planned enhancements for Wealthy and Wise® (Advanced):

|

Note: Planned enhancements assume Congress does not eliminate any strategies.

Licensing

If you aren’t licensed for Wealthy and Wise® (Advanced), please contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or visit us online. Institutional inquiries should go to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

If you are currently licensed for Wealthy and Wise®, you can upgrade to the Advanced version.

Your Comments

Please add your comments to this Blog. Your email address will not be published.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions similar to the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

If you would like highly qualified, illustration design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource, discussed below.

Digital Workbook Files For This Blog

Click on Blog 217.zip to download the Digital Workbook File used to prepare this Wealthy and Wise® (Advanced) presentation.

|

Before downloading and reviewing any files, be sure to install the most current updates to your InsMark Systems. Do this using InsMark Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you see this message on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook file to your PC where your InsMark System(s) reside. |

If you obtain the digital Workbook file for Blog #217, click here for a user guide to its content.

For other help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I have used their software for almost 30 years, and it changed my career. This unique and user-friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“The InsMark software is indispensable to my entire planning process. It enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those kinds of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Platinum Power Producer®, New York City, NY

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“Wealthy and Wise allows us to reflect practically ANY planning scenario we have encountered with clients. The ability to flow data easily into the program (without being so granular as to be unwieldy) is, in my opinion, one of the core strengths of Wealthy and Wise. Modeling alternative planning scenarios and being able to present the results in both graphical and numerical formats is undoubtedly welcome, and I can’t imagine doing cash flow and estate growth projections without Wealthy and Wise.”

Mark A. Trewitt, CLU, ChFC, CAP, CFP, AEP

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

“InsMark”, the InsMark logo, InsScribe and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

“do-it vs. don’t-do-it” is a trademark of InsMark, Inc.

© Copyright 2022 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical life insurance illustrations and alternative investments referred to in this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations of life insurance are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #216: Cost of Waiting (Delay is the Deadliest Form of Denial)

Blog #214: Roth Conversion Magic

Blog #213: Missed our May 2021 Virtual Symposium?

Blog #212: InsMark’s Introduction to the Ultimate Professional Coach

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

![]()

-includes-all-the-current-features-of-WW-199x89.jpg)