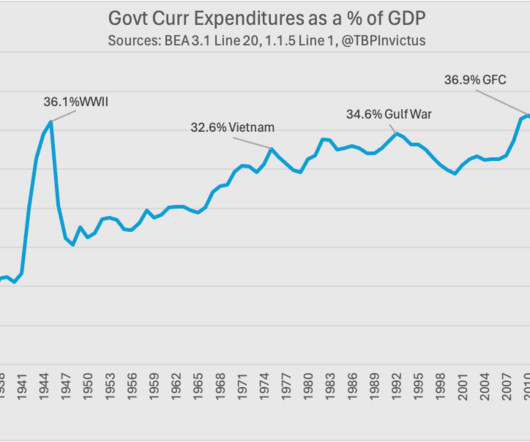

Government Spending Is Out of Control! LOL

The Big Picture

MARCH 24, 2025

investment firm. The text accompanying that chart reads: “ Consumption: in 2024, one third of GDP came from government spending, a record high excluding periods of war or crisis; this was financed by 6-7% budget deficits, another unwelcome peacetime record.” That has been the case over decades of reading everything.

Let's personalize your content