Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Abnormal Returns

MARCH 14, 2025

(podcasts.apple.com) Jim Pethokoukis talks the business of space with Matt Weinzierl, co-author of "Space to Grow: Unlocking the Final Economic Frontier." fasterplease.substack.com) Policy Stephen Dubner talks tax myths with Jessica Riedl, a senior fellow in budget, tax, and economic policy at the Manhattan Institute.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

MainStreet Financial Planning

MARCH 12, 2025

Economic uncertaintywhether it’s due to market volatility, rising inflation, or potential recessionscan feel overwhelming. Here are five practical tactics to help retirees weather economic uncertainty: Take a Break from the News Constantly consuming news and social media can lead to unnecessary panic.

Abnormal Returns

DECEMBER 1, 2024

nytimes.com) Budgeting When you do the math, it's hard to find trillions to save in the federal budget. econbrowser.com) The Department of Veteran Affairs now makes up 5% of the federal budget. economist.com) No-limit vouchers are blowing a hole in the state of Arizona's budget. Just ask Norway.

Carson Wealth

JULY 16, 2025

It’s often characterized by economic pessimism and declining investor confidence. Market Metrics & Economic Indicators GDP, CPI, P/E ratios—economic indicators can sound like alphabet soup, but they can be the pulse checks of your investments. It’s the ultimate scorecard for economic health.

Zoe Financial

DECEMBER 28, 2024

Outcome: Define Your Big Financial Goals Set a Clear Spending Plan Create a budget that prioritizes your values. Plan Your Tax Strategy Work with a financial advisor to optimize your tax situation. This could include leveraging tax-advantaged accounts, maximizing deductions, or planning for capital gains.

Carson Wealth

JUNE 27, 2025

Tax planning. Utilizing tax-efficient investment strategies, such as municipal bonds and tax-managed ETFs, may help minimize tax liabilities. Charitable giving and philanthropic activities can also provide tax benefits while supporting causes you care about. Budget for emergencies. Tax planning is crucial.

Validea

APRIL 4, 2025

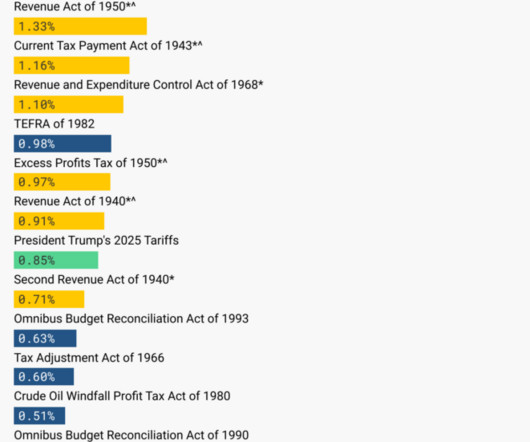

In this episode, dive into the complex world of tariffs, national debt, and economic policies under the current administration. Main Topics Covered: Tariffs Explained: A deep dive into how tariffs function as a corporate tax, their impact on domestic companies, and the challenges of passing costs to consumers.

MainStreet Financial Planning

MARCH 7, 2025

Why a Fee-Only, Flat-Fee Financial Planner is the Better Choice Transparent & Predictable Costs You know exactly what you’re paying, making it easier to budget for financial planning services. Comprehensive Financial Planning is Included Many AUM advisors charge extra for estate planning, tax strategies, and retirement planning.

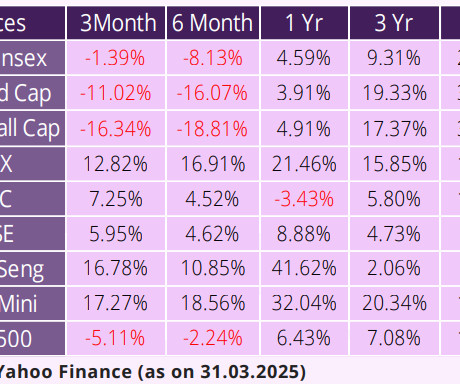

Truemind Capital

JULY 18, 2025

Equity markets in the US also hit record levels due to ease of geopolitical tensions, dovish fed and trade developments, but economic data released in early July for Q1 2025 (Jan-Mar) presents a mixed picture. Historically, when banks sense stronger economic momentum, they are more willing to lend.

Harness Wealth

JULY 14, 2025

Tax season is approaching, which means many people will be exploring the use of tax software to prepare and submit their tax returns themselves. While tax software certainly offers benefits, particularly when it comes to cost, the decision to use it isn’t nearly as straightforward as it may seem.

SEI

JULY 15, 2025

Investor relations Our leadership team Newsroom Locations Careers Featured Login Contact us Careers US US EMEA Canada English Canada Français Our sites US EMEA Canada English Canada Français Insights 1031 Exchanges vs. opportunity zone investments Evaluating and comparing tax strategies for financial professionals.

Clever Girl Finance

JUNE 5, 2025

On this podcast, Laura simplifies many finance topics such as investing, taxes and credit into segments that are under 30 minutes. Our favorite episode of Journey to Launch: How to Stay Financially Grounded in Uncertain Times addresses what to do during uncertain economic times. addresses 7.

Carson Wealth

APRIL 4, 2025

On the other hand, another stated goal is to raise 100s of billions of dollars of revenue from tariffs (to perhaps pay for tax cuts), but in that case you dont want import substitution and reshoring of manufacturing. And rates are falling for the wrong reasons, i.e. because investors expect slower economic growth in the future.

Carson Wealth

APRIL 7, 2025

We will discuss our take on the tariffs and economic fallout below, but we know stocks didnt like the news. From the perspective of tariffs potential impact on the earnings outlook and overall economic risk, the Trump administrations current policy path is not market friendly. More on that below.) Still, the minimum rate is 10%.

Carson Wealth

MARCH 7, 2025

The US is once again putting a self-imposed economic blockade around itself. The Budget Lab at Yale University estimates larger prices increases on items like computers and electronics (+10.6%), apparel (+7.5%), autos (+6.1%), fresh produce like fruits and vegetables (+2.9%), and wood products (+2.9%). We have neither right now.

Bell Investment Advisors

JUNE 27, 2025

From Policy to Portfolio: The Economic Impact of Tariffs On Thursday, June 26 th at 12pm Pacific Time, Financial Advisor Laurent Harrison, CFP® joined Bell Portfolio Manager Ryan Kelley, CFA® for a 45-minute webinar that covered the following topics: Financial Market Returns The U.S. and global economic events. Slide 7: U.S.

Carson Wealth

JULY 11, 2025

One of the opportunities we highlighted early in the year in our 2025 Outlook was a big tax bill that boosted corporate profits, similar to 2017. We got massive tariffs first, and it was quite a struggle to get the tax bill past the finish line. New individual tax benefits that are set to expire in a few years.

The Big Picture

MARCH 17, 2025

Professor Stephanie Kelton teaches Public Policy and Economics at SUNY Stony Brook. You get a bachelor’s, a BA and a BS in Economics and Business at California Sacramento, then University of Cambridge, master’s in Philosophy and Economics, then a PhD in economics at the New School. I happened to pick that one.

Investing Caffeine

JULY 1, 2025

While the name-calling is colorful, the economic pressure is real: U.S. A huge portion of the project costs are dedicated to the budget for NVIDIA super chips. GDP contracted -0.5% in Q1 2025. Powell, however, wants to see the full impact of upcoming tariffs before making a move. Oracle Corp.

The Big Picture

MAY 27, 2025

And I was able to tax campus co-op. I taxed the student body. And, you know, we can’t agree on a budget for 20 months. It’s behavioral economics, behavioral finance. And I came back to campus and I said, you know what? Why are we giving these guys our money? Why don’t we create our own student run store?

Calculated Risk

NOVEMBER 11, 2024

After the election in November 2016, I pointed out that the economy was solid, that there were significant economic tailwinds and that it was unlikely that Mr. Trump would do everything he said during the campaign ( emphasis added ). I was pretty optimistic on the economic outlook! See: The Future is still Bright!

Truemind Capital

APRIL 18, 2025

A combination of average Q3FY25 earnings, sluggish economic data, and persistent FII outflows weighed on the sentiment. While the Union Budget offered some relief with generous tax giveaways, and the RBI followed with a rate cut and liquidity support, these measures werent enough to offset broader concerns.

The Big Picture

APRIL 7, 2025

My back-to-work morning train WFH reads: Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 : Through April 2 The Budget Lab modeled the effect of both the April 2nd tariff announcement in isolation and all US tariffs implemented in 2025.

Harness Wealth

APRIL 11, 2025

Lastly, an update regarding a crucial Fifth Circuit case emphasizing the importance of clearly defined business components when claiming research tax credits. Budget Reconciliation: Tracking the 2025 Trump Tax Cuts By Tax Foundation Extending the expiring 2017 Tax Cuts and Jobs Act (TCJA) would decrease federal tax revenue by $4.5

Discipline Funds

MAY 12, 2025

This is a baseline estimate though and other researchers like the Yale Budget Lab have the figure closer to 17%, although they’re assuming the other countries remain at current levels. estimate we’re talking about extra tax revenue of about $380B and with the 17% rate we’re talking about tax revenue of $550B.

Discipline Funds

NOVEMBER 7, 2024

The last 4 years have been a masterclass in inauthentic economic narratives. I’ve called this the most insulting economic narrative. And being told to shut up and enjoy this “economic boom” was not the right response. This is just the economic side of the coin.

The Big Picture

MAY 19, 2025

consumer VAT tax would reduce corporate revenues 10 to 20%, and profits 20 to 30% (or more). They speak at the Petroleum Club of Houston and the Economic Club in New York; they present at Stanford and Yale and everywhere in between. It was simply a bridge too far. Hence, the markets were priced at least 20% too high.

Mr. Money Mustache

JUNE 13, 2025

A tariff is just a sales tax charged by our government on goods which are imported into the country. On average, tariffs will result in higher prices for everything just like any other broad-based sales tax. And just like most other taxes, the overall effect is to slow the economy and reduce our spending power.

Abnormal Returns

APRIL 16, 2025

bigthink.com) Finance Private equity firms have paused deals with economic uncertainty so high. econofact.org) Taxes Who wins if the IRS is kneecapped? calculatedriskblog.com) Recessions help increase the budget deficit, despite lower rates. (awealthofcommonsense.com) Should you even try to beat the market?

Abnormal Returns

DECEMBER 8, 2024

on.ft.com) What it took to rebuild Notre Dame (nytimes.com) Budgeting The math on any additional tax cuts is tough. prospect.org) Want to cut the federal budget deficit? donmoynihan.substack.com) Climate policy IS economic policy. nytimes.com) The economic schedule for the coming week.

Nerd's Eye View

OCTOBER 4, 2023

And even though numerous signs are pointing to the looming possibility of a more widespread economic downturn – including the reduction of household savings, reduced lending, and the resumption of student loan payments for many borrowers – the job market remains strong. And even though U.S.

The Big Picture

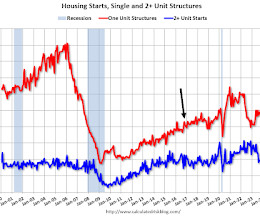

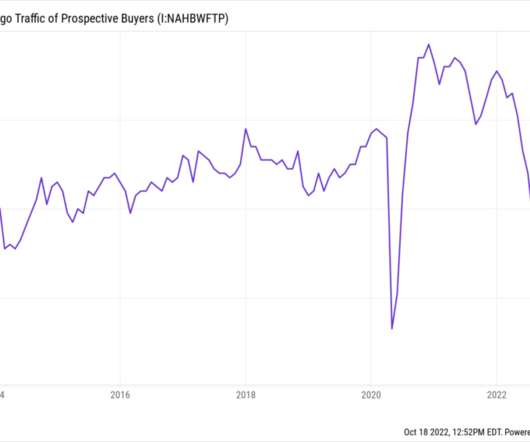

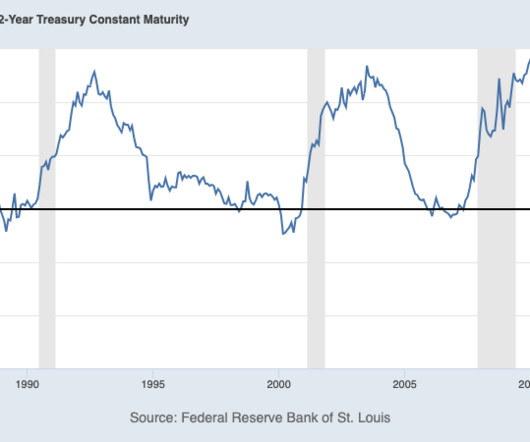

OCTOBER 18, 2022

The four largest drops occurred during distinct periods of economic distress: 1990 (recession), 2006-09 (GFC), 2020 (pandemic/recession), and today (FOMC 300 bp rate hike). This brings us to the chart: The one above shows the traffic of prospective buyers looking at a new home (2014- 2022); the one below goes back to the 1980s.

The Big Picture

OCTOBER 23, 2023

As the Peterson Institute noted: In June, the Congressional Budget Office (CBO) projected that annual net interest costs would total $663 billion in 2023 and almost double over the upcoming decade, soaring from $745 billion in 2024 to $1.4 Note that this is not hindsight bias , but rather discussions we had repeatedly here in the mid-2010s.

Abnormal Returns

JUNE 9, 2024

(humbledollar.com) Russia An increasing portion of Russia's budget is dedicated to fighting Ukraine. wsj.com) Policy What happens if the 2017 tax cuts lapse. wsj.com) Investing in ports has positive spillover economic effects. wsj.com) The economic schedule for the coming week.

The Big Picture

NOVEMBER 25, 2022

That will cause a drop in property taxes and strain city budgets. Stanford Institute for Economic Policy Research ). • But we first need to understand, as well as catalogue, what is causing the current economic carnage. ( New York Times ). The Political Economy Blog ).

Abnormal Returns

OCTOBER 29, 2023

sacra.com) Federal debt How worried should you be about the budget deficit? noahpinion.blog) Why international tax evasion has fallen. bloomberg.com) The economic schedule for the coming week. (tker.co) The AI investing boom is going to break a lot of hearts. ft.com) Meet the kids dropping out of college to start AI companies.

The Big Picture

NOVEMBER 21, 2022

And it was a miserable economic time, with both of these elevated measures together creating a period of unhappy people that the Misery index neatly captured. As Zunbrun observes, “ The Misery Index, as commonly constructed, doesn’t adequately capture how overall economic conditions affect attitudes.”. Should it be? 46, October 2014).

The Big Picture

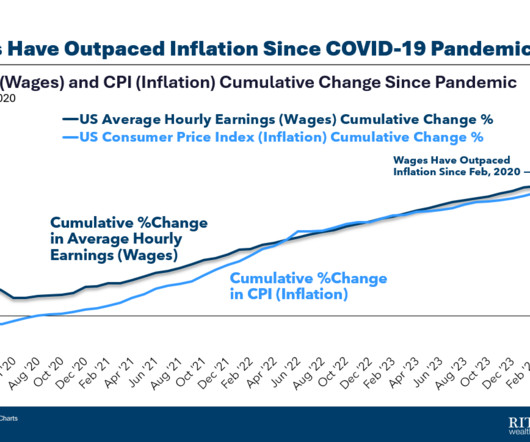

JUNE 27, 2024

If they get a 7% increase in wages, they see a modest increase in their direct deposit of after FICA, federal and state withholding taxes, 401K, etc. It’s mostly invisible. – and energy as a percentage of your household budget is less than it ever was. After that 7% bump, their comp goes up $163 to about $2491.84.

Nationwide Financial

AUGUST 29, 2022

Key Takeaways: Even without new legislation, the prospect of higher taxes in the future is still looming. The impact of higher taxes on retirees could be substantial, so staying up to date on the current tax landscape is vital. But even without new legislation, the prospect of higher taxes in the future is still looming.

Nerd's Eye View

OCTOBER 30, 2023

On the other hand, the past decade has seen an explosion of 'vendor conferences', as more and more companies have discovered it's more economical to simply run their own conferences (at a breakeven or even a small loss) than to heavily sponsor the conferences of industry associations. Read More.

Clever Girl Finance

SEPTEMBER 28, 2022

There are many different ways to come up with your perfect budgeting strategy. Alongside your monthly budget, you should also have a bare bones budget waiting in the wings. What is a bare bones budget? It's a budget that only covers the necessities. That's why this is not a sustainable long-term budget.

Integrity Financial Planning

JULY 3, 2023

These expenses include things like Social Security and Medicare benefits, tax refunds, military salaries, and interest payments on outstanding debt the nation may have. The United States runs a budget deficit, meaning that the nation spends more than it earns through taxes and other means.

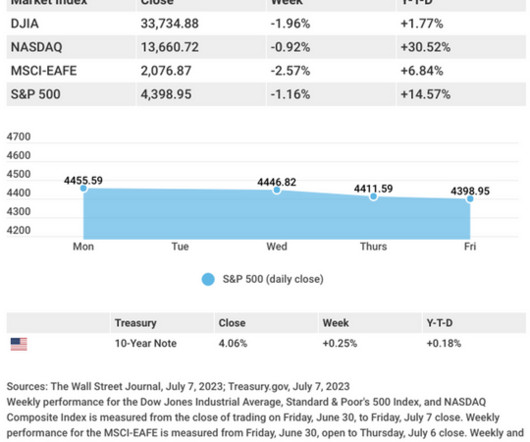

Cornerstone Financial Advisory

JULY 10, 2023

5 This Week: Key Economic Data Wednesday: Consumer Price Index (CPI). Source: Econoday, July 7 , 2023 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. Jobless Claims.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content