Dear Mr. Market:

In a year where the stock market has provided zero safe places to hide…you may have changed, the markets certainly have, but one thing has not; the Permanent Portfolio.

We’ve reviewed the Permanent Portfolio before but believe it’s time to check in and provide an update on how it’s doing relative to the broad markets now as well as chime in on whether the strategy still has merit going forward. For some quick background, our first original review was written in June of 2013 (click here to see that). Most recently we revisited the topic with an update in November of 2020 (click here) as we climbed out of one of the wildest years in world history amidst a global pandemic.

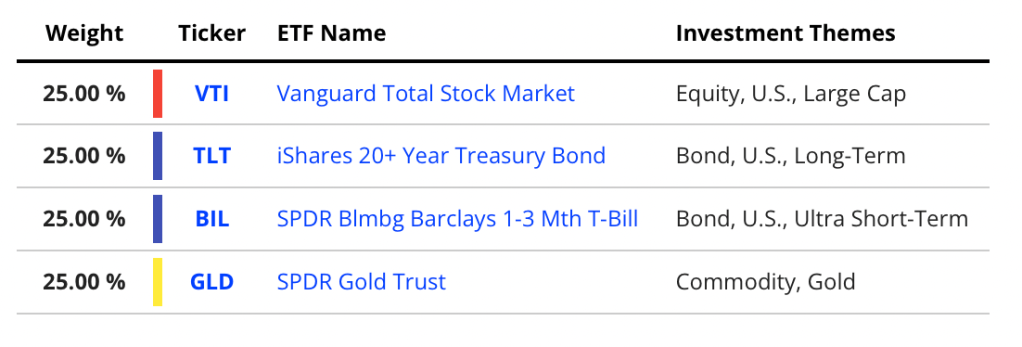

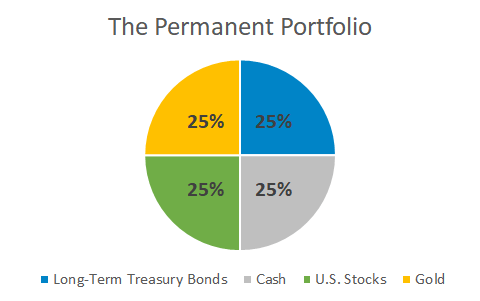

If you didn’t hit the embedded article links above, the Permanent Portfolio is pretty simple at face value. The Permanent Portfolio is a seemingly basic portfolio allocation strategy created by investment advisor Harry Browne in the 1980’s and outlined in his book Fail-Safe Investing back in 2001. Here’s the secret (simple) sauce and how each asset class should do during repeatable economic cycles:

- 25% Total US Stock Market (economic expansion)

- 25% Long-Term Bonds (deflation)

- 25% Cash (economic recession)

- 25% Gold (inflation)

We’ll briefly review of each of these four asset classes but in sum, how has the Permanent Portfolio done in this tumultuous year? Using four simple and popular ETFs (exchange traded funds) you could build the Permanent Portfolio as follows:

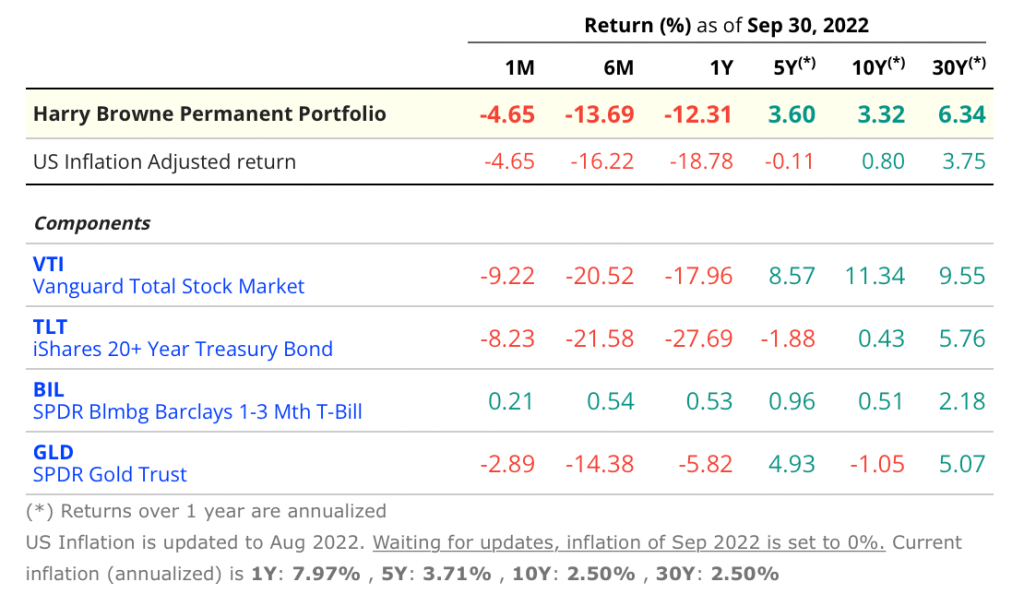

Here’s the performance YTD as of 9/30/22:

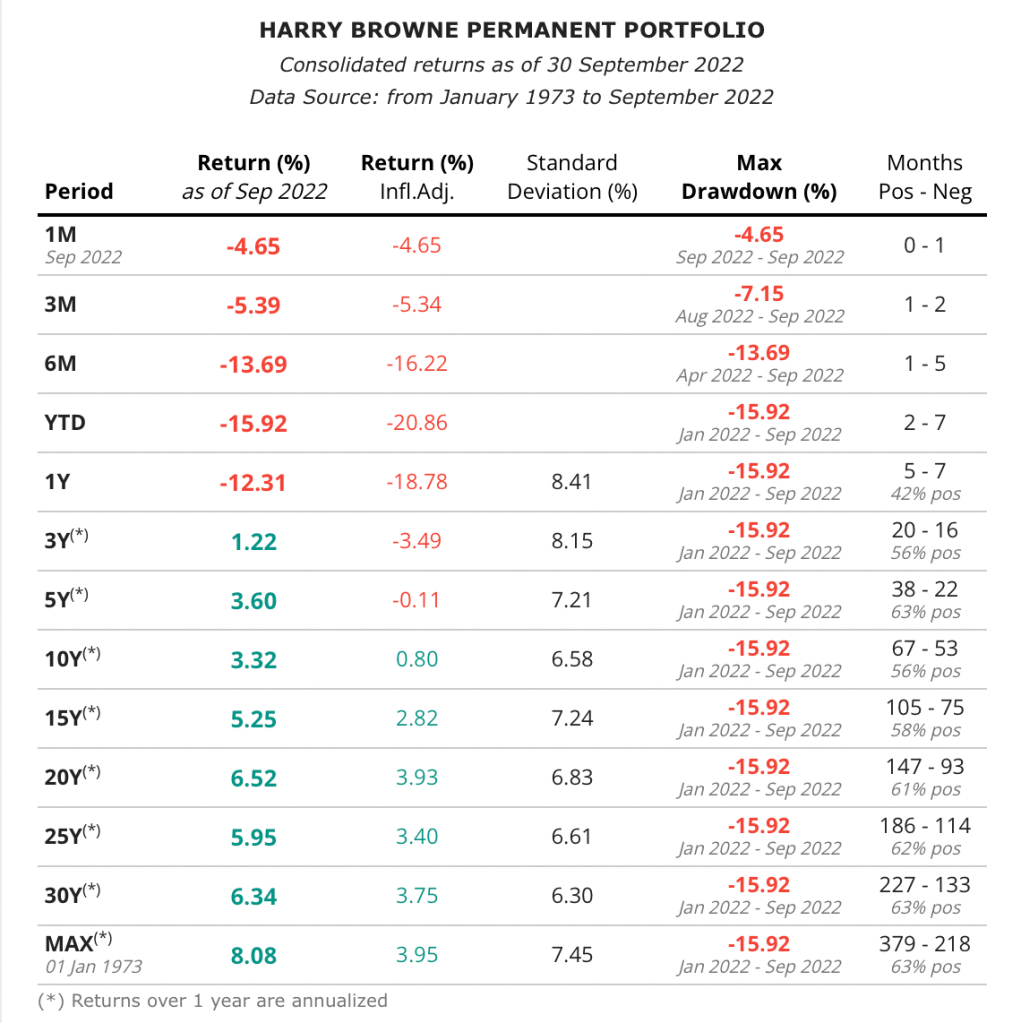

Another chart, with proper credit given to the site (lazyportfolioetf.com), shows the performance YTD along with max drawdowns:

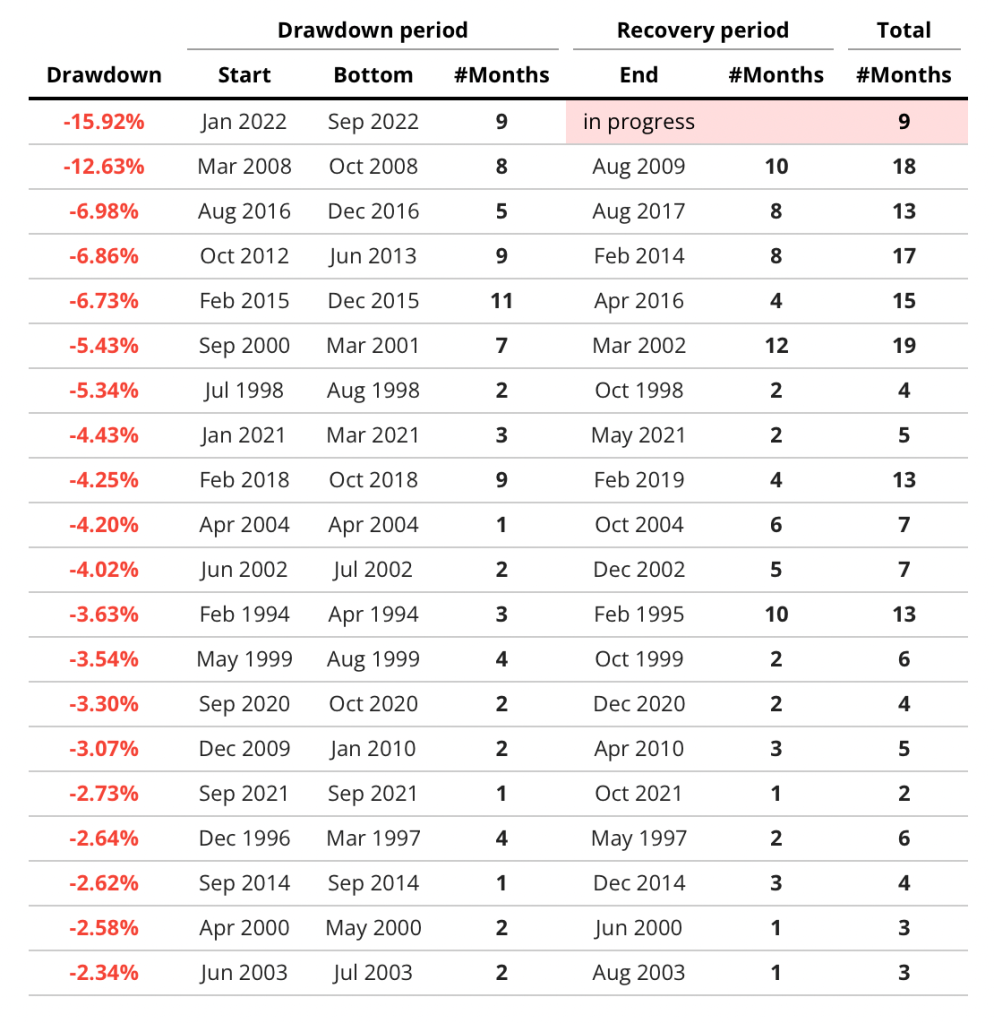

Lastly, a final chart depicts the Permanent Portfolio Drawdown & Recovery Periods:

Briefly digging into each asset class, and circling back to our opening theme of a brutal year where virtually nothing has worked, we’re basically seeing strong correlations (all down) amongst stocks, bonds, and precious metals. At almost every period in history we’ve had at least one lifebuoy thrown to rescue investors (ergo the Permanent Portfolio thesis)…but not this year.

We won’t rehash the obvious news that stocks are in the midst of a bear market. That said, bear markets don’t last forever and capitulation is gradually flushing out weak hands. We saw a recent bounce to start Q4 after an absolutely brutal September. This market action was similar to the bear market rallies we saw in July after a sharp drawdown in June. Whether the market is looking for solid footing or holding out for the Fed to walk back some of its hawkish rhetoric, it’s the tug of war we’re in; that’s the reality and until either the Fed tones it down or we get some seasonal midterm election love, the sledding will continue to be tough until the bear finally gets tired. The only good news for those in a Permanent Portfolio is that stocks (which have the highest upside long-term) are capped at 25% so even as the sky is falling, they can only hurt so much.

On the bonds front, we’re in truly unprecedented territory. While some of the “writing was on the wall” with rates on the rise from historic lows, rarely have we seen an inverted yield curve to the degree we are witnessing now. As bad as bonds have behaved, staying short on the yield curve and hunting for high grade quality paper, could likely still fare better than equities if we retest stock market lows from September. By the way, you can pick up a two year Treasury yielding 4.30% right now compared to a year ago at 0.32%!

“Cash is king”…although with 40 year highs in inflation that too can be argued! The third part to the Permanent Portfolio may actually perform best in the very near-term but on it’s own that is mainly from a “sleep well at night” perspective. After a year like this it seems like a victory to see your cash at least at the same balance as it was the day prior.

The final piece to the Permanent Portfolio puzzle is gold. What’s concerned most metals investors (in particular gold) is that while it’s supposed to have hedging qualities against inflation, that simply has not held true…yet. Gold is down about -7% YTD, which feels awful, but that beats the snot out of bonds (historically safe) with the aggregate bond index down -17% YTD and stocks at -20% (and even lower prior to this writing). One major anchor that we feel will turn soon has been the temporary headwind to gold, which is the strong dollar. We’re even more bullish on gold now with it actually holding up fairly well considering that the dollar is at a 20 year high. There will be a reversion to the mean at some point in the near future and you’ll see why owning gold makes even more sense.

Piggy backing on that last point, however, is why the Permanent Portfolio is so simple yet so hard to follow. It’s not about trying to weight the asset class you think or “feel” should do best going forward; it’s about maintaining a rigid discipline to staying the course with this allocation and strategy. Comparing the tried and true allocation of the past (a typical “60/40” type asset mix) being down -22.19% for its worst return to date ever, the Permanent Portfolio is actually winning the race this year.

So in summation, why do we bring up the Permanent Portfolio again and offer your eyes a third review of it? If you have more than a 10 year time horizon, stick with stocks. They will win out. Bonds and cash are used (at least historically) to help mitigate volatility and drawdowns but since we’re navigating new waters now, that may not work. My Portfolio Guide, LLC is actually closer to a Permanent Portfolio type allocation for many of our base models with clients that may have shorter time horizons. Simply put, while no one allocation or strategy is completely bulletproof, this allocation allows you to weather the storm better than most. Combining it with some customization, such as overweighting certain economic sectors, holding solid dividend yielding stocks within the equity portion, staying shorter on the bond duration piece, or adding commodities to further hedge inflation can be (in our opinion) the one best allocation to get us out of this hole over the next couple years.

Pingback: March Madness: Final Four Investing Bracket 2023 | Dear Mr. Market: