by Calculated Risk on 9/07/2023 11:23:00 AM

Thursday, September 07, 2023

FDIC: Number of Problem Banks Unchanged in Q2 2023

The FDIC released the Quarterly Banking Profile for Q2 2023:

Reports from 4,645 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $70.8 billion in second quarter 2023. Though second-quarter net income decreased by $9.0 billion (11.3 percent) from first quarter 2023, after excluding the effects on acquirers‘ incomes of their acquisition of three failed banks in 2023, quarter-over-quarter net income would have been roughly flat for the second consecutive quarter. Declines in noninterest income, reflecting the accounting treatment of the acquisition of three failed institutions, lower net interest income, and higher provision expenses were the drivers of the decline in net income. These and other financial results for second quarter 2023 are included in the FDIC‘s latest Quarterly Banking Profile released today.

...

Asset Quality Metrics Remained Favorable Despite Modest Deterioration: Loans that were 90 days or more past due or in nonaccrual status (i.e., noncurrent loans) increased to 0.76 percent of total loans, up 1 basis point from the prior quarter. Noncurrent nonfarm, nonresidential commercial real estate loan balances drove the increase in the noncurrent rate. Net charge-offs as a ratio of total loans increased 7 basis points from the prior quarter and 25 basis points from a year prior to 0.48 percent. The industry’s net charge-off rate is now equal to its pre-pandemic average.

emphasis added

Click on graph for larger image.

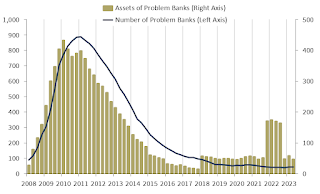

Click on graph for larger image.The FDIC reported the number of problem banks was unchanged at 43.

The number of FDIC-insured institutions declined from 4,672 in first quarter to 4,645 this quarter. During the quarter, two banks opened, one bank failed, and 27 institutions merged. In addition, one bank failed during the third quarter and did not file a second quarter 2023 Call Report. The number of banks on the FDIC’s “Problem Bank List” remained unchanged at 43. Total assets of problem banks decreased from $58.0 billion to $46.0 billionThis graph from the FDIC shows the number of problem banks and assets at problem institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list. An even larger unknown bank was added to the list in Q4 2021, and - since problem assets dropped sharply last year - that bank is now off the problem list.