Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

NOVEMBER 1, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that SIFMA, which represents broker-dealers, investment banks, and asset managers, released a white paper that argues that CFP Board "increasingly functions as a de facto private regulator for CFP certificants" and proposes that CFP (..)

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year.

Nerd's Eye View

MAY 16, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Republicans in the House of Representatives this week released their long-awaited tax plan to address the impending sunset of many measures in the 2017 Tax Cuts and Jobs Act.

WiserAdvisor

JULY 9, 2025

If you are someone who loves a good Do It Yourself (DIY) challenge, whether it is fixing your own car or kitchen sink, you might think investing is just another task you can master on your own. Self-investing, or DIY investing, is incredibly popular. That is exactly what this article explores.

Harness Wealth

JULY 14, 2025

Alternative investments such as private equity, cryptocurrencies, and collectibles now represent a significant part of the investment arena, in particular to high-income individuals. Table of Contents What are alternative investments? What are the key tax strategies for alternative investments in 2025?

The Big Picture

JULY 16, 2025

After decades of working, saving, and investing, pivoting to spending down your accumulated wealth can be surprisingly difficult. She joins Barry Ritholtz to discuss what you need to know about planning for retirement. She’s published numerous books on money investing and retirement. Could you ask me again?

Harness Wealth

APRIL 17, 2025

Items costing less than $2,500 can typically be expensed immediately, while more substantial investments may require depreciation over time according to IRS guidelines. This option is particularly valuable for businesses seeking to minimize current-year tax liability while investing in growth-oriented assets.

Harness Wealth

APRIL 30, 2025

When you understand various exit strategies and their tax implications early, you position yourself to make informed decisions that maximize after-tax value while ensuring a smooth transition. To maximize the value you ultimately receive from your exit, incorporating comprehensive tax planning into your strategy is highly advantageous.

Harness Wealth

APRIL 17, 2025

The ability to deduct the full fair market value of contributed long-term appreciated assets creates substantial tax savings for professionals looking to optimize their tax situation. DAFs also introduce welcome simplification at tax time by consolidating multiple charitable activities under a single receipt.

Harness Wealth

APRIL 30, 2025

In today’s dynamic economy, millions have embraced a diverse portfolio of income streamsfrom traditional employment to creative side hustles, equity compensation, and investment ventures. This makes income classification a crucial factor in tax planning, loss utilization strategies, and overall financial health.

Cordant Wealth Partners

NOVEMBER 18, 2024

This article covers what a donor-advised fund is and why you should consider one. We also get you up to speed on the tax benefits of using a DAF. If you've heard of a DAF and are curious about incorporating it into your giving and tax planning strategy, this article is for you. What is a Donor Advised Fund?

Tobias Financial

JUNE 16, 2025

These events may affect your investment approach, tax planning strategies, insurance needs, and estate planning documents. Without periodic evaluations, it’s possible for parts of your plan to become misaligned with your current circumstances.

Wealth Management

JUNE 11, 2025

Whether clients support the policies with cash gifts or split-dollar, the discussion of options will necessarily involve a combination of insurance planning, tax planning, income and gift tax-oriented wealth transfer planning and investment planning.

Harness Wealth

APRIL 17, 2025

As Doug Waite of LexTax explains, “Whether to take itemized or standard deduction all depends on if your itemized deductions (medical, state and local taxes, mortgage and investment interest expense, charitable contributions, and certain miscellaneous expenses) exceed your standard deduction.”

Harness Wealth

JANUARY 29, 2025

A full list of tax provisions for states affected by natural disasters can be found here. In this article, well examine the most effective end-of-year tax strategies to help maximize your deductions and reduce your taxable income. This can be especially beneficial if you expect to be in a lower tax bracket in the following year.

Midstream Marketing

DECEMBER 6, 2024

Running focused social media campaigns that highlight their services and share their skills in areas like tax planning or retirement planning. Registered Investment Advisers (RIAs) have to follow several SEC rules. This is very important when you discuss investment results or share testimonials.

Harness Wealth

JULY 14, 2025

Real estate investment is one of the more common—and arguably more consistent—avenues to wealth creation, delivering capital appreciation, rental income, and portfolio diversification. Table of Contents Understanding real estate taxes What are the most tax-efficient ownership structures? Net Investment Income Tax (NIIT): A 3.8%

Harness Wealth

MARCH 6, 2025

Determining the fair market value of stock options, for example, can be time-consuming, with a tax extension allowing individuals to make sure theyre maximizing the potential tax benefits of their equity compensation. This article should not be considered tax or legal advice and is provided for informational purposes only.

Wealth Management

JULY 2, 2025

He is a member of the Tax Management Estates, Gifts and Trusts Advisory Board, and an Editorial Advisory Board Member of Trusts & Estates Magazine for which he currently writes the monthly "Tax Update" column. David is a co-author of a book on estate planning, Drafting the Estate Plan: Law and Forms.

Harness Wealth

MARCH 14, 2025

The hours spent managing administrative tasks , following up on missing paperwork, and ensuring compliance take away from time that could be spent on higher-value tax planning services. From a business perspective, automation enables tax firms to grow without adding more staff.

Darrow Wealth Management

APRIL 21, 2025

Converting a traditional IRA to a Roth doesnt make sense unless you have cash to pay taxes without dipping into your retirement savings. Funds that have already been taxed wont be subject to double-taxation. Inheritance and estate planning There are a couple ways a Roth IRA conversion can assist with estate and legacy planning.

Carson Wealth

FEBRUARY 4, 2025

While most taxpayers dont need to worry about estate and gift taxes, having significant assets can make them a challenge. Also, like most UHNW individuals, you may have income from several sources like investments, real estate, and business interests that may require special tax planning. Donate to qualified charities.

Harness Wealth

APRIL 28, 2025

Private equity and alternative investments create unique tax reporting complexities that demand attention. Inside these investment structures, K-1 and 1099 forms represent fundamentally different approaches to reporting income and losses, each with its own set of rules and implications.

Darrow Wealth Management

NOVEMBER 7, 2024

Here’s an outline of key considerations; the rest of this article discusses these items in detail. Exercise strategy: Timing: Consider the tax implications of exercising vested options before or after the IPO, timing of sales, and tax planning opportunities. So it’s important to seek investment advice.

Yardley Wealth Management

FEBRUARY 18, 2025

In this article, we’ll break down the concept of waterfall wealth distribution, its benefits, and how it compares to traditional investment strategies. We’ll also explore the role of income tiers, provide real-world case studies, and highlight key considerations when implementing this strategy in your financial plan.

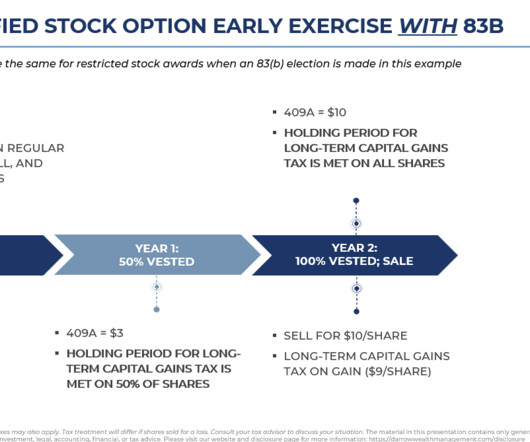

Harness Wealth

DECEMBER 30, 2024

In an effort to help employees manage their tax liabilities more effectively, the Internal Revenue Code offers provisions like the 83(b) election , which allows employees to pay tax on the fair market value of restricted stock at the time of its granting as opposed to vesting. This article is a product of Harness Tax LLC.

Harness Wealth

MARCH 27, 2025

Secondary transactions (or Secondaries as theyre known) involve the buying and selling of pre-existing investments in private funds or stakes in the portfolio companies those funds own. Secondaries are typically traded before the fund or business is sold in a traditional wayessentially, being the resale market for private investments.

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Every element, from structure to price negotiations, hinges on understanding tax implications for all parties involved. To qualify for tax-free treatment under IRC Section 368 , attention to detail is essential.

Harness Wealth

JANUARY 9, 2025

The approach comes with more limited investment options. While a Mega Backdoor offers greater potential for individual contributions, pursuing the strategy can be a complex process as not all 401(k) plans support the necessary features. On the other hand, IRAs typically provide greater investment flexibility and lower fees.

Darrow Wealth Management

APRIL 23, 2025

The 83(b) election has the potential to significantly reduce the overall tax liability, especially for startup founders and employees who receive stock-based compensation. It’s usually a key part of pre-IPO tax planning and exit strategies.

Harness Wealth

JANUARY 29, 2025

Tax-loss harvesting is a powerful strategy that investors can use to reduce their taxable income. This type of strategy typically involves selling underperforming investments at a loss to offset capital gains (or ordinary income) to optimize portfolio returns. Is tax-loss harvesting right for you?

Harness Wealth

MAY 8, 2025

When considering the various business structures available, understanding the tax implications is crucial for making informed decisions. A Limited Partnership (LP) offers a unique blend of operational flexibility and liability protection, but its tax treatment can be complex. Table of Contents What Is a Limited Partnership (LP)?

Harness Wealth

JANUARY 10, 2025

Tax advice is a common topic on social media platforms like TikTok. Influencers promise easy ways to secure tax deductions, simplifying complex ideas into bite-sized claims that gloss over important details in the process. Harness Wealth Advisers LLC is a paid promoter, internet registered investment adviser.

Harness Wealth

APRIL 30, 2025

In this article, well examine the nature of IRS audits, the common audit red flags that result in IRS scrutiny, and how professional tax advisors can help reduce the risk of you being audited. This process ensures compliance with tax laws, scrutinizing income, deductions, and credits for potential discrepancies or errors.

Harness Wealth

MARCH 6, 2025

A good rule of thumb is to set aside at least 30% of every payment you receive to cover your estimated tax obligationshowever, this percentage may need to be adjusted based on your individual tax bracket. On the whole, its advisable to consult a tax adviso r to develop a dependable tax plan.

Harness Wealth

APRIL 16, 2025

Let us face ittech startups encounter a unique set of tax challenges that can make or break their financial future. The complex interplay between traditional tax regulations and the innovative nature of tech businesses demands smart planning from day one.

Harness Wealth

FEBRUARY 5, 2025

The rise of remote work and digital nomadism has made FEIE a common tax minimization strategy for Americans living abroad. Given FEIEs increased popularity, were going to explore the provision in this article, provide some understanding of how FEIE works in practice, and examine some of the other exemptions that U.S.

Tobias Financial

JUNE 2, 2025

Vanilla helps us create a clearer, more organized view of a clients estate by integrating their financial and legacy planning. The software connects with Orion, our portfolio managing software, ensuring that investment assets are automatically included, providing an accurate snapshot of the entire estate.

Darrow Wealth Management

NOVEMBER 11, 2024

Note that non-deductible IRAs differ from money in a Roth IRA where withdrawals are tax-free provided the requirements are met Regardless of the type of contribution above, the overall funding limit is the lesser of: $7,000 in 2024 and 2025, $8,000 (if age 50+), or your earned income. An additional 3.8%

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Carson Wealth

JANUARY 28, 2025

When you have the resources to make an impact, this type of planning helps you pinpoint what you want to accomplish for your family, community, and society. Steps to Setting Up a Philanthropy Fund Taking the proper steps in the beginning can give your charitable giving plan a solid foundation.

Harness Wealth

MARCH 27, 2025

Allowing a pass-through entity to pay state income taxes directly, PTET effectively shifts the tax burden from individual owners to the business itself. In doing so, PTET effectively turns an entity’s state tax payments into a deductible business expense that can help reduce federal tax liabilities.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content