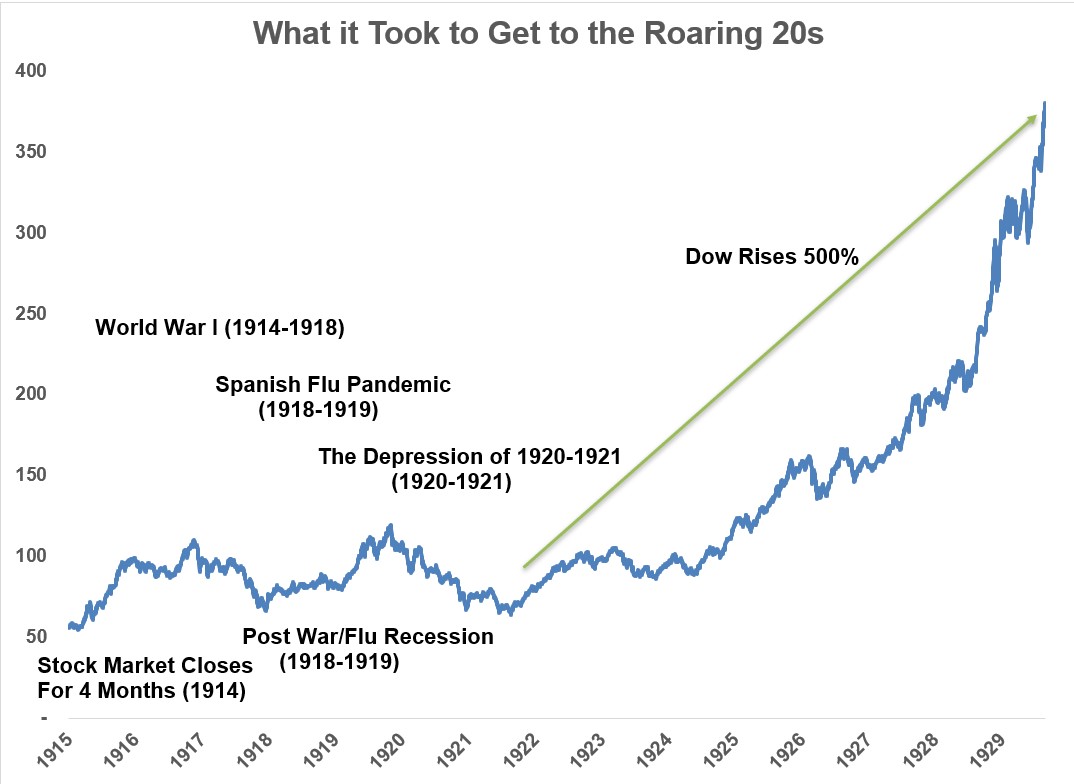

In March 2020, at the height of uncertainty at the outset of the pandemic, I wrote about what it took to get to the roaring 1920s.

This chart sums it up nicely:

Here’s what I wrote at the time:

How many people at the time would have predicted during the war/pandemic/recession/depression years that the 1920s would be one of the most innovative, prosperous periods our country had ever seen?

The 1920s ushered in the automobile, the airplane, the radio, the assembly line, the refrigerator, electric razor, washing machine, jukebox, television and more.

There was a massive stock market boom and explosion of spending by consumers the likes of which were unrivaled at the time. After the immense pressure of the Great War, many people simply wanted to have fun and spend money.

If you had told me back then how well the economy would be doing now I’m not sure I would have believed you.

I’m going to make the case that we got our Roaring 20s.

Net worth is at all-time highs.

The stock market is at all-time highs.

Housing prices are at all-time highs.

Economic activity is at all-time highs.

The unemployment rate has been below 4% for more than two years.

You can even earn 5% on your cash!

Now, some of this is simply number go up, but there’s more to it than that.

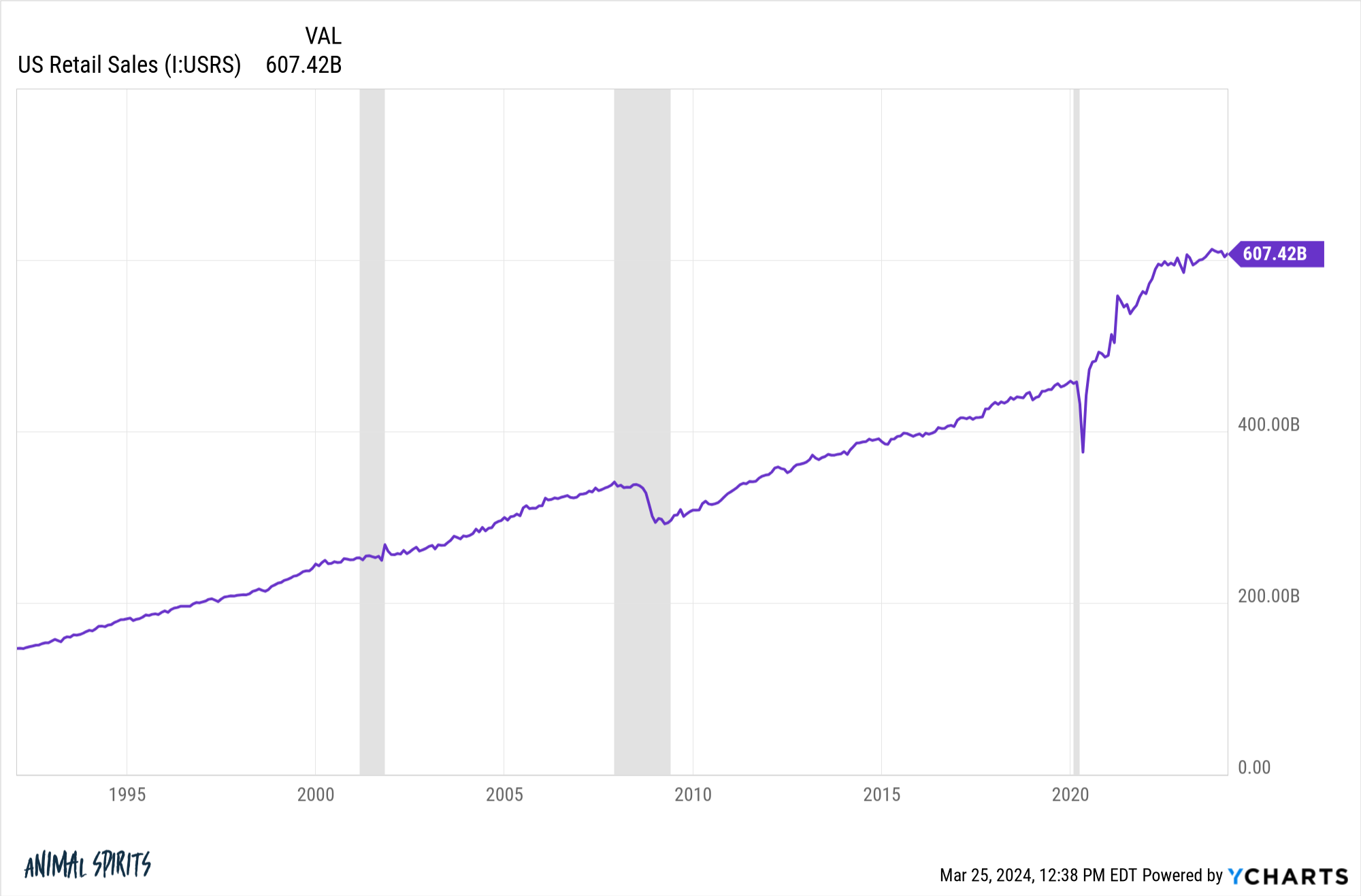

People are spending money like crazy.

Look at the massive jump in retail sales from per-pandemic levels:

Inflation partially explains this but even on a real basis these numbers are so much higher than the prepandemic trend.

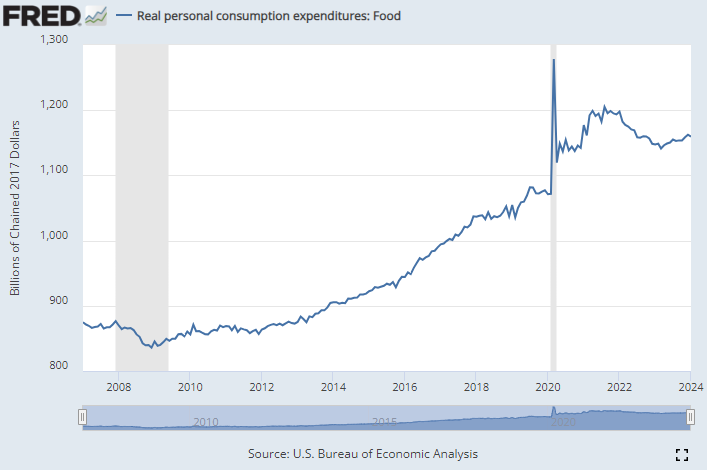

Even after accounting for inflation, people are spending way more money on food these days:

Yes we love to complain about prices at the grocery store but that hasn’t slowed people down from spending.

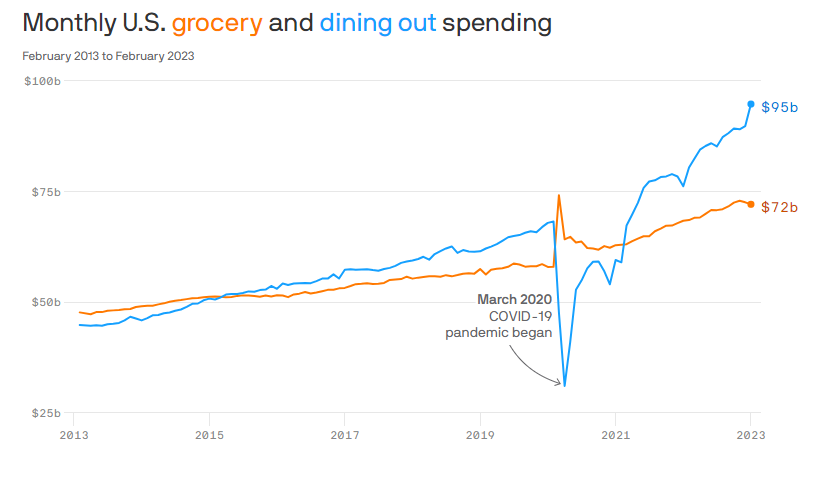

In fact, people are eating out more than ever these days:

That period of Covid restrictions around eating out obviously sparked something in people that made everybody want to go out to eat more than ever before.

It’s not just eating out. People are traveling like crazy now too.

I’ve been on a handful of trips these past few months. Every airport is packed. U.S. spring passenger airline travel is expected to hit another new all-time high in March and April.

Plus, we’re in the midst of an AI boom.

In a keynote address last week, NVIDIA’s Jensen Huang listed all of the companies that now rely on the chipmaker:

NVIDIA’s market cap has gained nearly $1.7 trillion since the start of 2022.

Call it a bubble if you want but the AI revolution is coming regardless of current tech stock valuations. The future will include robots and AI-based personal assistants and tutors for your children and who knows what else.

Consumer sentiment doesn’t exactly line up with a roaring 20s mentality because people hate inflation and higher interest rates.1 But you have to watch what people do, not what they say.

People are spending money on food, travel, clothes and technology.

They’re investing in their 401k, IRA or brokerage account. They’re gambling in their Draft Kings or Fan Duel account. They’re day trading options in their Robinhood account.

People are acting like it’s the Roaring 20s, whether they agree with that sentiment or not.

Some will point out that, given our system’s inherent wealth inequality, such a boom is impossible.

Most people probably don’t realize the 1920s was one of the worst decades in modern economic history for wealth inequality.

According to the BLS, nearly 60% of all households by the end of the 1920s made less than $2,000 a year, which was the minimum livable income at the time. By 1928, the top 1% earned nearly 25% of all wages.

It’s also worth pointing out that the orgy that was the Roaring 20s was followed by the Great Depression.

Booms are inevitably followed by busts. So it goes.

Edward Chancellor wrote about the Roaring 20s and their comeuppance in his excellent book Devil Take the Hindmost:

Perhaps, as some claimed, the Roaring Twenties were morally degenerate years deserving of a biblical visitation: but they were also a period when people exhibited a capacity for dreaming, a faith in the future, an entrepreneurial appetite for risk, and a belief in individual freedom. These profoundly American traits took a severe knocking in October 1929 and appeared to be extinguished during the Great Depression. They would return.

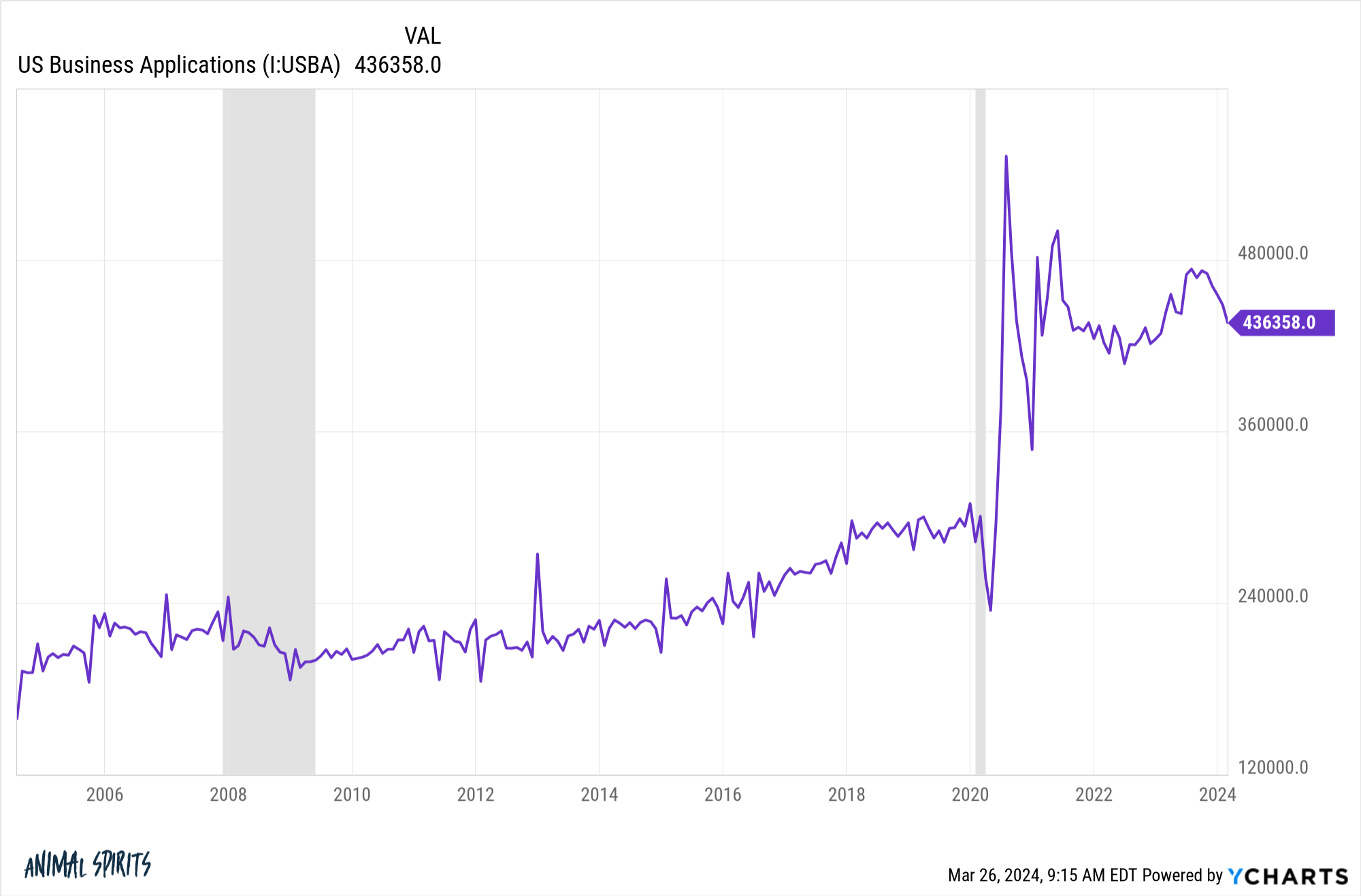

The current post-pandemic period also unleashed an entrepreneurial appetite for risk in this country the likes of which we’ve never seen before:

Things could always be better.

But it’s crazy to be where we are considering where we were just four short years ago during the outbreak of Covid.

As far as I’m concerned, the Roaring 2020s are here.

Enjoy it while it lasts.

Further Reading:

How Did We Ever Get to the Roaring Twenties?

1And the combination of social media and 24/7 news coverage has warped many people’s views of reality.