September

12

September

12

Tags

From Bretton Woods to BRICS+: Will the $US remain the reserve currency?

By David Nelson, CFA

Markets always climb a wall of worry, and this market is no different. Investors are still trying to swallow 11 rate hikes from a born-again Federal Reserve, as well as increasingly pessimistic news out of the second largest economy on the planet, China. A rising dollar hits U.S. multinationals, the yield curve screams recession and as the saying goes, the Fed keeps hiking until something breaks.

Bloomberg Data

The above alone is enough to keep any investor up at night. These are near-term threats that markets will sort out, but it’s the long-term challenges that back us into a corner, forcing us to scramble for a cure.

Who can deny China’s efforts to infiltrate our universities or the continued theft of intellectual property? They think in decades, we think in terms of an election cycle.

Immigration policy has failed the American people, a crisis building for decades but manifested now in an open border policy that has gutted our cities and put our nation’s youth at risk.

Unfortunately, once again, Washington is ignoring another very large elephant in the room, and today we have to add a few more BRICS to the wall of worry.

Welcome to the Money Runner, I’m David Nelson.

B R I C S. – The term BRIC was coined by Goldman Sachs analyst Peter Oppenheimer all the way back in 2001. Peter, described Brazil, Russia, India and China as fast-growing economies that he predicted would collectively dominate the global economy by 2050. South Africa was later added to the group in 2010.

A few years ago, it was just economic noise. A handful of countries band together to form an economic partnership. They hold a meeting once a year. They dream of a world that isn’t dominated by a US dollar, the Reserve currency of the world. When the meeting is over little is accomplished and the almighty dollar is still king.

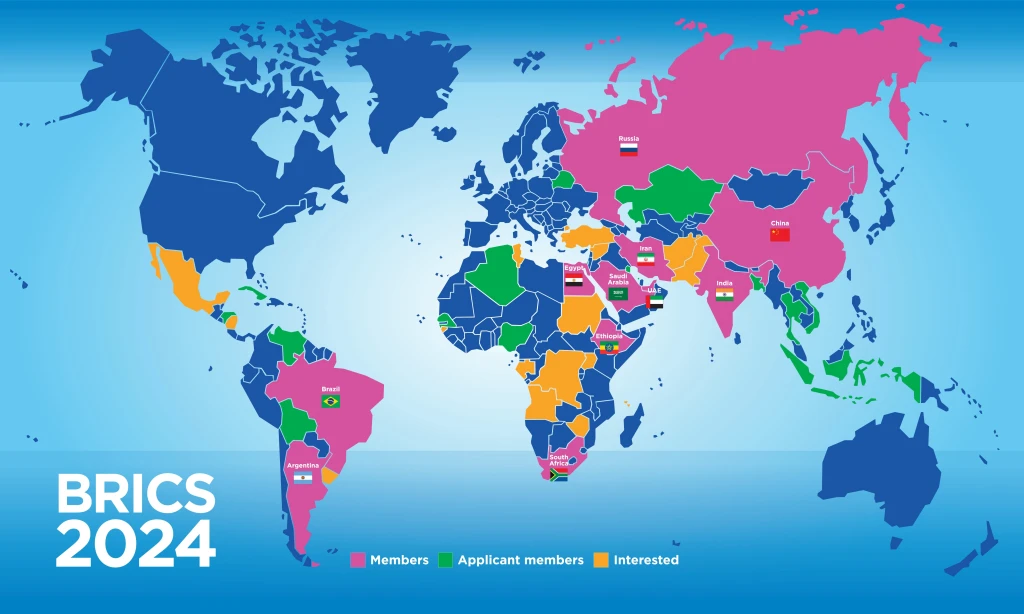

Well, we can’t even call it BRICS anymore. We have to call it BRICS+. This economic club grew a little larger recently with the addition of Saudi Arabia, Iran, Ethiopia, Egypt, Argentina and the United Arab Emirates. Reuters describes it as a move aimed at accelerating its push to reshuffle a world order it sees as outdated.

I think the urgency for BRICS nations to make their economic alliance work more efficiently and get more bang out of their currencies took on new meaning when the United States sanctioned Russia following its invasion of Ukraine last year.

Look, make no mistake. Putin is a murdering thug and war criminal that will meet his fate in this world of the next. But Russia is still one of the major suppliers of the world’s most precious commodity oil. Following the invasion, according to Business Insider, Russia saw $330 billion of its foreign currency reserves frozen on the heels of U.S. sanctions.

Look, make no mistake. Putin is a murdering thug and war criminal that will meet his fate in this world of the next. But Russia is still one of the major suppliers of the world’s most precious commodity oil. Following the invasion, according to Business Insider, Russia saw $330 billion of its foreign currency reserves frozen on the heels of U.S. sanctions.

Weaponization of the dollar

Okay. Put your view of the necessity of this move aside, for just a moment. You can bet that decision didn’t go unnoticed by world leaders, friends and enemies alike. Any country at odds with the United States on a range of issues realized that President Biden had just weaponized the dollar.

If you are a foreign world leader, the reasons why don’t matter. It doesn’t even matter if you believe Russia got what was coming to them. What you’re thinking is the U.S. might do the same thing to my country if we fall out of favor with Washington. Looking for a Plan B became the common goal for BRICS members, hoping to lessen the dependency on the US dollar.

Bretton Woods

How did King Dollar start. In 1944 following the Bretton Woods agreement, 44 nations adopted the US dollar as the official reserve currency. At the time, the decision made perfect sense and the world benefited from being able to trade in a stable currency backed by the rule of law.

King Dollar has its privileges for the home team.

- Lower borrowing costs.

- Increased economic power and influence.

- Increased demand for U.S. goods and services.

- Increased financial stability and reduced exchange rate risk.

Some, including yours, truly, believe the United States is starting to take its reserve currency crown for granted. You can’t look down on the rest of the world regarding their fiscal and monetary failures when you can’t even keep your own house in order. Rising deficits and inflation, along with increased weaponization of the dollar is making our friends and enemies very nervous.

Former hedge fund icon and billionaire investor Ray Dalio has written extensively about the fading dominance of the greenback, pointing out western sanctions against Russia have exposed new risks to holding the currency.

Former hedge fund icon and billionaire investor Ray Dalio has written extensively about the fading dominance of the greenback, pointing out western sanctions against Russia have exposed new risks to holding the currency.

What can other countries do?

One of the main goals of the BRICS+ Alliance is to shift from the dollar to settling transactions between member states in local currency.

J.P. Morgan just put out a research note on this. BRICS now represent 36% of global GDP, 46% of the population, and 36% of the landmass. Add the fact that six of the members are also G-20 members, it shows this economic bloc is gaining clout. One more thing. Five of the top ten world oil producers are now members of BRICS, including Saudi Arabia, Russia, China, Iran, the UAE and Brazil.

To be clear, BRICS members have their differences. There’s certainly no love lost between China and India in an ongoing border dispute.

However, it should be noted that China brokered a deal between Saudi Arabia and Iran. Two countries deeply divided on a range of issues, restoring diplomatic relations in March. A few months later, both become the newest members of BRICS.

BRICS plus is not just about China and Russia. Each of these countries have their own agenda. There won’t be a call for common currency, certainly not any time soon. But what is already taking place is trade between members in local currency. They seek to break the grip of the post-World War II petrodollar dominance.

After all, several of the BRICS plus members geographically sit at critical trade choke points like the Suez Canal and the Straits of Hormuz.

The Emperor has no clothes

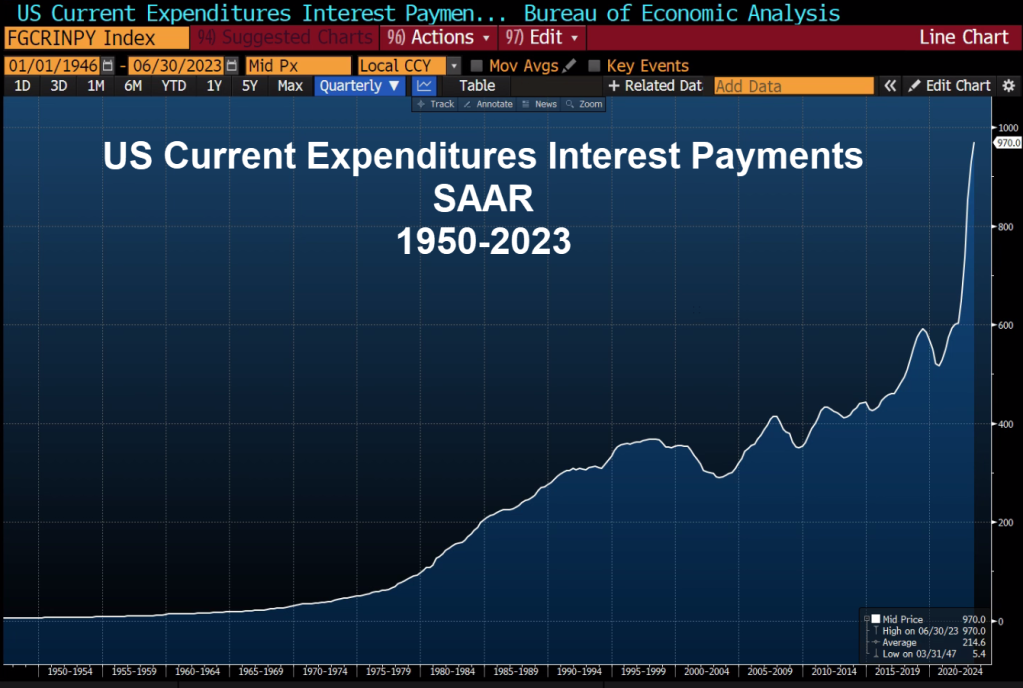

Bloomberg Data

For now, major change is unlikely. However, it is becoming difficult to ignore the de-dollarization forces picking up steam. With U.S. deficits and debt rising at an unsustainable pace, eventually someone is going to stand up and shout out; “The emperor has no clothes!”

Those who don’t learn from history are doomed to repeat it. Isn’t that how the saying goes?

There was a time when the sun never set on the British Empire and the pound enjoyed the same status as the US dollar does today.

Yes, for now the dollar is still king. It’s an advantage we can no longer take for granted. All in the world is watching. Everyone is your friend, as long as there’s something in it for them. The dollar is still the reserve currency of the world, and that designation is ours to lose.

It’s important that we learn the lessons of history. Just thinking we are the United States, and our dominance is guaranteed is a pathway to failure. You have to earn it with your actions each and every day.

With deficits and debt ballooning out of control, it won’t be long before the cost just a service our debt hits a $trillion. Add an endless wave of debt ceiling confrontations and it’s easy to see why so many in the world are becoming concerned.

If we weaponize the dollar further, BRICS aren’t going to have any trouble finding new members for their economic bloc.

Remember, just as dawn breaks after the darkest night, so too do economies. Technologies and societies find their way forward. And as investors and global citizens, it’s not just about understanding the changes around us, but being a part of that change, we wish to see.

The tapestry of tomorrow is woven by our choices today.

I’m David Nelson and this is the Money Runner.

*The above is a transcript from this week’s Money Runner Podcast