Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Harness Wealth

MAY 2, 2025

The Tax Cuts and Jobs Act (TCJA)the 2017 tax code overhaul designed to boost economic growthis set to expire on December 31, 2025. Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

SEI

JULY 15, 2025

Investor relations Our leadership team Newsroom Locations Careers Featured Login Contact us Careers US US EMEA Canada English Canada Français Our sites US EMEA Canada English Canada Français Insights 1031 Exchanges vs. opportunity zone investments Evaluating and comparing tax strategies for financial professionals.

Carson Wealth

MARCH 6, 2025

If youre planning a move, keep these three priorities in mind: Taxes Does your new home state have an estate/inheritance tax? Could other state tax laws affect your strategy? The biggest shift in estate planning in decades came from the 2017 Tax Cuts and Jobs Act, signed by President Trump during his first term.

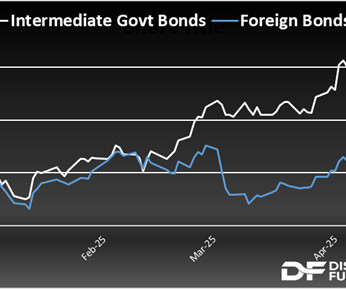

Discipline Funds

APRIL 19, 2025

And as I’ve been saying for a while now, I am not sure how much it matters anyhow because Powell is out in May of 2026 and Trump will replace him with a yes-man. In this case the effective tariff rate drops to 5-10% overall and there is minor economic damage and lots of cheerleading that exaggerates the greatness of the deal.

Carson Wealth

JULY 14, 2025

If you look just at the end point, it looks like a perfectly ordinary year for markets in an economic expansion so far, but we know it’s been anything but. During his first administration, the president also made fiscal policy his top priority, achieved primarily through the Tax Cuts and Jobs Act.

Carson Wealth

JULY 11, 2025

One of the opportunities we highlighted early in the year in our 2025 Outlook was a big tax bill that boosted corporate profits, similar to 2017. We got massive tariffs first, and it was quite a struggle to get the tax bill past the finish line. New individual tax benefits that are set to expire in a few years.

SEI

JUNE 25, 2025

The monetary policies of the major central banks are naturally aligned with the economic conditions of the economies they oversee. Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace," the central bank commented. for both 2025 and 2026, to 2.0%

The Big Picture

JUNE 16, 2025

So a world in which we have to make our own shirts and our own furniture is a world in which the other 350 million Americans who don’t make those things are taxed very heavily. So Pax Americana, 80 years of growth and economic success, much of which accrued to the benefit of the US are, are you implying that that is now at risk?

Wealth Management

JULY 11, 2025

Those differences, politically and economically, took an explosive turn this year as the United States unequivocally declared its focus and preference for digital currencies over CBDCs via its current presidential administration. Specifically, the Russian government can pay a limited number of expenditures starting on Oct.

Harness Wealth

MAY 9, 2025

May flowers are blooming and so are conversations about tax policy changes that could significantly impact your planning! Interested in using Harness at your tax firm, or know a tax firm you’d like to refer to Harness? While capping business SALT could raise additional revenue, it would risk slowing economic growth.

Trade Brains

JULY 3, 2025

ECONOMIC DATA US June Unemployment Rate At 4.1% Lk Vs Estimate Of 1 Lk US June Non-Farm Payrolls Private At 74,000 Lk Vs Estimate Of 1 Lk Congress passes Trump’s ‘big, beautiful bill’ cutting taxes and spending Trump 2.0: ECONOMIC DATA US June Unemployment Rate At 4.1% lakh crore in the first quarter of 2026.

Carson Wealth

FEBRUARY 6, 2025

The tariff policy of the Trump administration should be viewed as an economic and market risk, with some potential negative impact on inflation, interest rates, the dollar (stronger), and the path of rate cuts. All else equal, tariffs are a tax, and that means prices will go up. of GDP in 2015. But the late 2010s were an exception.

Harness Wealth

MAY 2, 2025

Interested in using Harness at your tax firm, or know a tax firm you’d like to refer to Harness? Amidst these pressures, personal estate planning often takes a backseat, which can lead to missed opportunities for minimizing tax exposure and cementing a founder’s legacy. Enjoy your well-deserved breathing room!

Trade Brains

JUNE 13, 2025

Morgan has further said that if geopolitical concerns are downplayed, the target could be low to mid $60 for 2025 and $60 in 2026. Morgan has given a range of targets, stating that an attack on Iran might spike Crude Oil prices to $120, which is 62 percent up from current levels of $74.

Abnormal Returns

NOVEMBER 10, 2024

agglomerations.substack.com) Americans voted for more curbs on property taxes. econbrowser.com) On the odds of a recession before 2026. econbrowser.com) The economic schedule for the coming week. (understandingai.org) Why work flows with AI need to change. tomtunguz.com) Election outcomes How inflation affected voting patterns.

The Big Picture

MAY 22, 2023

All of this represents massive tailwinds powering spending, which has been bolstering economic growth for months. Institutional Investor ) • NYC Skyscrapers Sit Vacant, Exposing Risk City Never Predicted : City says vacancy rate won’t dip below 19% before 2026 Office vacancies hit a record 22.7% this year amid remote work.

Nationwide Financial

AUGUST 29, 2022

Key Takeaways: Even without new legislation, the prospect of higher taxes in the future is still looming. The impact of higher taxes on retirees could be substantial, so staying up to date on the current tax landscape is vital. But even without new legislation, the prospect of higher taxes in the future is still looming.

Harness Wealth

MAY 2, 2025

The Tax Cuts and Jobs Act (TCJA)the 2017 tax code overhaul designed to boost economic growthis set to expire on December 31, 2025. Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect.

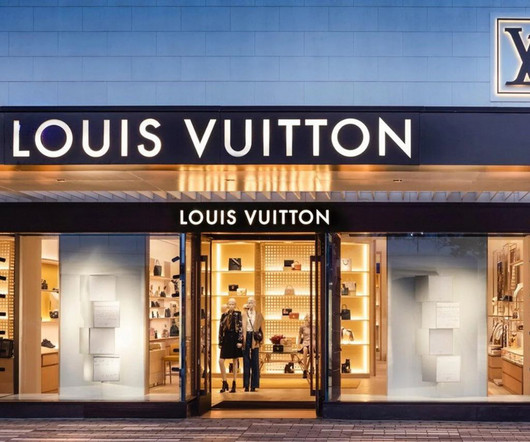

Trade Brains

OCTOBER 21, 2024

The company’s recent financial performance and looming tax increases have raised concerns among investors and industry analysts. China’s ongoing economic headwinds, including a property crisis and high youth unemployment, have dented consumer confidence. Several factors contributed to the disappointing sales figures.

Trade Brains

JANUARY 22, 2024

Although the demand for Autos is back up, the industry is facing tougher situations primarily driven by chip shortages, global economic slowdowns, price shocks, and so on. The industry is expected to grow at a CAGR of approximately 16% from 2022 to 2026. 36% YoY Growth (%) 48% 25% KPIT reported a Profit after tax of Rs.

Brown Advisory

NOVEMBER 1, 2019

This year, two factors will be important considerations in our year-end planning work: 1) current market dynamics (specifically, ongoing market volatility, low interest rates and a flat yield curve), and 2) the 2017 tax overhaul and our ongoing integration of new tax rules into clients’ long-term plans. Non-Taxable Gifts.

WiserAdvisor

JANUARY 23, 2024

Regular updates should include insights into market conditions, economic trends, and how these factors impact your investments. Step 2: See if the financial advisor conducts an annual tax review Ensuring that your financial advisor reviews your tax return annually is a crucial step in maximizing your financial benefits.

Trade Brains

SEPTEMBER 26, 2023

billion by Fiscal 2026. Concurrently, the Profit After Tax (PAT) has grown from ₹4.2 Any demographic or economic changes in these regions could impact business operations. billion in Fiscal 2021. The industry is expected to expand at a CAGR of approximately 14.50% to reach approximately ₹1550.00 crore in March 2021 to ₹182.4

Fortune Financial

AUGUST 7, 2023

Precious metals like gold and silver have been sought after for centuries as a store of value and a hedge against economic uncertainties. trillion by 2021, it is expected to rise to $23 trillion by 2026. Market Conditions and Economic Outlook Consider market conditions and economic outlook when contemplating alternative investments.

Fortune Financial

AUGUST 7, 2023

Precious metals like gold and silver have been sought after for centuries as a store of value and a hedge against economic uncertainties. trillion by 2021, it is expected to rise to $23 trillion by 2026. Market Conditions and Economic Outlook Consider market conditions and economic outlook when contemplating alternative investments.

Trade Brains

AUGUST 22, 2023

The following image will show you the customers the has catered to in the past and present: Moats of the company Following are the economic moats of Polycab India in the wires and cable business: Polycab is the exclusive manufacturer of a comprehensive range of wires and cables in India, boasting 12,000+ SKUs and global certifications.

Trade Brains

AUGUST 10, 2023

As a result, large economies put economic sanctions on other countries which led to a sharp rise in commodity processes and supply chain disruptions. CAGR till 2026, primarily driven by a focus on new and upgraded weapon systems, aircraft for military use and other defence spending.

Carson Wealth

SEPTEMBER 27, 2023

For individuals, a permanent life insurance plan can play a key role in estate planning by helping reduce estate taxes. Offset Taxes in Estate Planning Estate taxes can be a problem for high-net-worth individuals passing on more than the IRS estate tax exclusion, after which the tax rate on transferred money is 40%.

WiserAdvisor

DECEMBER 29, 2023

But estate tax can eat into this wealth and leave the next generation with a smaller nest egg. Despite having significant resources, wealthy individuals face the threat of estate taxes that can reduce the wealth intended for the next generation. It can trigger tax for the estate owner as well as the inheritor.

Investing Caffeine

SEPTEMBER 3, 2024

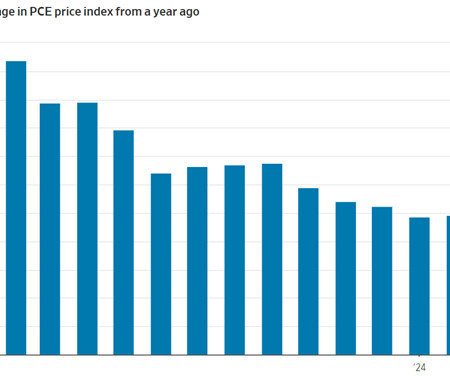

However, despite the long laundry list of concerns, there are plenty of opposing tailwinds supporting the upswell in stock prices, starting with growing record corporate profits with strength forecasted through 2026 ( see chart below ). The latest headline inflation rate (CPI – Consumer Price Index) fell to 2.9%

Cornerstone Financial Advisory

MAY 1, 2023

Stocks Rally As Attention Shifts To Fed’s May Meeting Presented by Cornerstone Financial Advisory, LLC Strong earnings from several mega-cap technology companies offset renewed regional banking jitters and weak economic data, leaving stocks higher for the week. The Nasdaq Composite index rose 1.28% for the week. Armed Forces.

Brown Advisory

APRIL 22, 2021

Tax credits, including an expansion of child tax credits, are the second-largest provision in ARPA and account for $338B over the next ten years. Tax credits, including an expansion of child tax credits, are the second-largest provision in ARPA and account for $338B over the next ten years. Business Tax Provisions.

Brown Advisory

APRIL 22, 2021

The American Rescue Plan Act (ARPA) of 2021, the third in a massive series of COVID-19 relief packages, provides individuals and businesses with support in the form of direct payments, unemployment benefits, forgivable loans and other policy measures to promote the resumption of normal social and economic activities. Business Tax Provisions.

Harness Wealth

MAY 9, 2025

May flowers are blooming and so are conversations about tax policy changes that could significantly impact your planning! Interested in using Harness at your tax firm, or know a tax firm you’d like to refer to Harness? While capping business SALT could raise additional revenue, it would risk slowing economic growth.

Carson Wealth

FEBRUARY 10, 2025

The tariff policy of the Trump administration should be viewed as an economic and market risk, with some potential negative impact on inflation, interest rates, the dollar (stronger), and the path of rate cuts. All else equal, tariffs are a tax, and that means prices will go up. of GDP in 2015. But the late 2010s were an exception.

Carson Wealth

OCTOBER 21, 2024

If Congress does nothing, a lot of elements of the 2017 Tax Cut and Jobs Act (TCJA, which was signed into law by former President Trump) will expire on December 31, 2025. Washington, DC in 2025 is likely to be dominated by tax policy negotiations, which will get ever more feverish as the December deadline approaches.

Carson Wealth

SEPTEMBER 3, 2024

Here’s something former President Trump first proposed, and then Vice President Harris copied: making tips tax-free. For one thing, tipped workers don’t earn much and so their incomes aren’t taxed a lot anyway. Both Harris and Trump have suggested enhancing child tax credits (CTC).

Investing Caffeine

APRIL 1, 2024

Just this last week, we saw the broadest measurement of economic activity, GDP (Gross Domestic Product), get revised higher to +3.4% On the flip side, if economic data slows significantly or the country goes into a recession, then the probability of sooner and/or more Fed interest-rate cuts will increase.

Carson Wealth

MARCH 31, 2025

In general, lower taxes, deregulation, higher fiscal deficits, and (although at risk) lower interest rates are all policies that tend to have a positive impact on corporate profits, which in turn supports stock gains. Slow Burn From a market perspective, its hard to gauge the economic impact (and eventual market impact) of DOGE.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content