It’s time to review my list of predictions from 2023 to see what I got right and what I got wrong. Here’s what I wrote a year ago:

Market predictions are silly. We all learned this a long time ago. But that doesn’t mean they’re completely worthless. Even though forecasts are almost always wrong, they can be entertaining and educational. That’s all I’m trying to do with this post. Entertain and educate. Needless to say, but I have to say it anyway, nothing in this list is investment advice. I’m not doing anything with my portfolio based on these predictions, and neither should you.

Here is my list from a year ago. I got some right and a lot wrong, which is hardly a surprise. I expect my predictions to have a terrible track record, and that’s why I try to ride the market rather than outsmart it. So why am I doing this? Well, it’s fun to look back on what you thought was possible a year ago. When you see that you were so off on some things, it reminds you just how difficult it is to predict the future. I also learn a lot by doing this. I uncovered some things that I didn’t know or forgot I knew. So with that, these are my ten predictions for 2023.

- Bonds hold their own as a diversifying asset ✅X

- Tech continues its layoffs ✅

- Jeff Bezos returns to Amazon X

- The IPO market remains frozen ✅

- Value Outperforms Growth Again X

- Gold makes a new all-time high X

- The Housing Market Doesn’t Crash ✅

- International Stocks Outperform X

- Bitcoin gains 100% ✅

- Energy stocks continue to outperform X

- Bonus. The market avoids a recession, and stocks gain double digits. ✅

My list had five wins, five losses, and one tie. Let’s review.

- Bonds hold their own as a diversifying asset ✅X

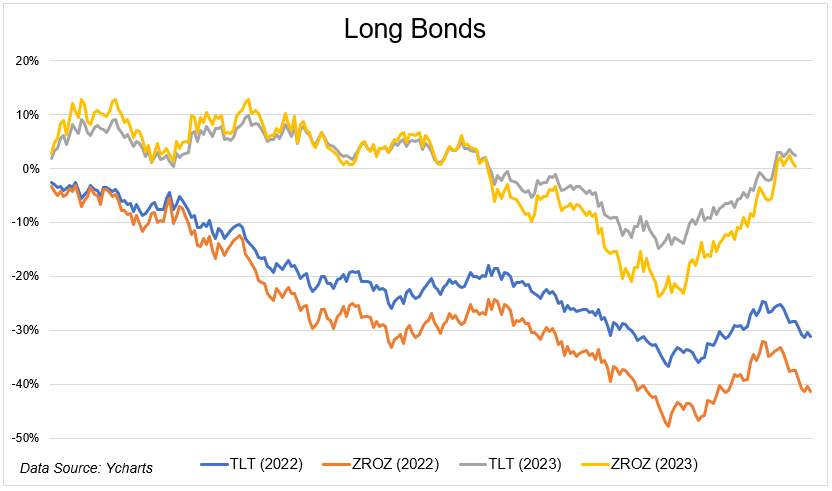

2022 was a difficult year. Risk assets got smoked in 2022 as the fed aggressively came off zero and jacked rates up by 425 basis points. Fixed income had a front-row seat to the horror show. Zero-coupon bonds fell like a meme stock, with a 48% peak-to-trough decline during the calendar year. Even intermediate-term bonds got hammered, falling 10% on the year.

The reason why my call is inconclusive is that bonds got a mixed grade in 2023 depending on how you were positioned. Ultra-short bonds, think cash, returned ~5%% this year. It’s been over 15 years since investors were able to earn this much by doing so little. But if you were so brave to take on interest rate risk, parts of 2023 looked like a repeat of 2022. Long bonds got killed as the higher-for-longer idea permeated Wall Street in the fall of 2023.

But if you went against the grain and faded that call, you made a fortune. Long bonds are up more than 30% since interest rates topped.

The bottom line is that it’s been a mixed year for bond investors depending on how much interest rate and credit risk you took, and when you took it. Speaking of, high-yield bonds are up 13% on the year which is wild considering how afraid we all were of the economic ramifications of an aggressive tightening cycle. ¯\_(ツ)_/¯

- Tech continues its layoffs ✅

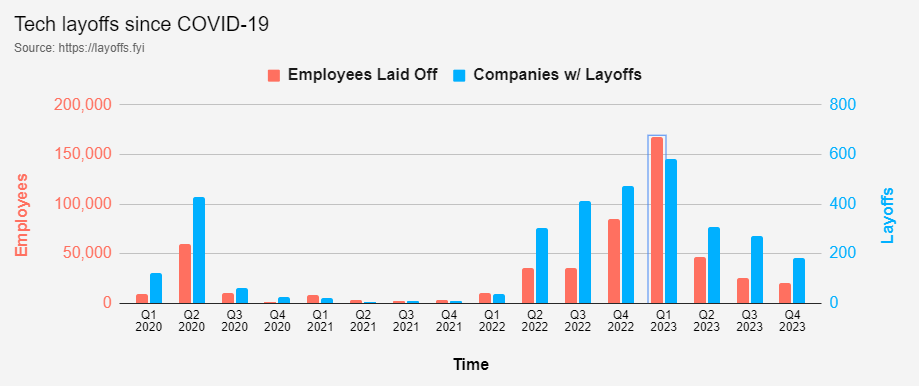

The bad news is I got this right. The good news is this peaked in January and has been coming down ever since. 583 companies laid off 167,409 employees in the first quarter. In the fourth quarter, those numbers fell to 183 companies and 20,376 employees let go.

Virtually every big name in tech laid off employees over the last couple of years: Google, Meta, Microsoft, Amazon, Salesforce, Dell, Micron, Cisco, Twitter, Uber, IBM, Booking.com, Peloton, VMware, Groupon, Indeed, Zillow, Shopify, PayPal, Airbnb, Instacart, Wayfair, Yahoo, Spotify, Carvana, Zoom, Stitch Fix, Snap, and Qualcomm.

The market, cold as it is, rewarded many of these companies as they shifted from growth at all costs to getting lean and focusing on the bottom line.

- Jeff Bezos returns to Amazon X

Out of all the items on my list, this one was the goofiest. Don’t get me wrong, I totally would have started a technology-focused substack if this actually happened, but it was a hail mary.

One of the reasons I like doing these lists is that it’s so easy to forget where we came from as recency bias dominates our cognitive functions. All year we’ve focused on the recent returns of the Magnificent 7 (Amazon is up 83%). How quickly we forget that Amazon fell 50% in 2022 and shed $840 billion in market cap! Amazon, despite its dominance, has barely outperformed the S&P 500 over the past five years. Out of all the large tech stocks, it is by far the worst performer.

From everything we see on the internet, Jeff Bezos looks like he’s living his best life. It doesn’t look like he’ll be pulling a Bob Iger any time soon.

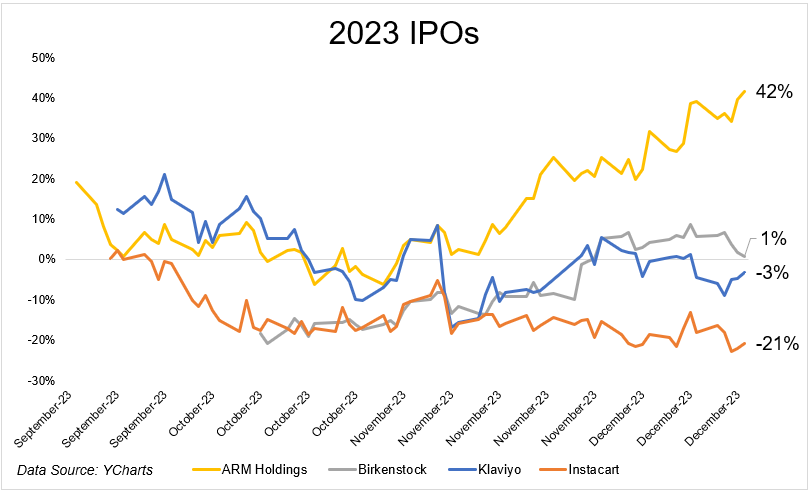

- The IPO market remains frozen ✅

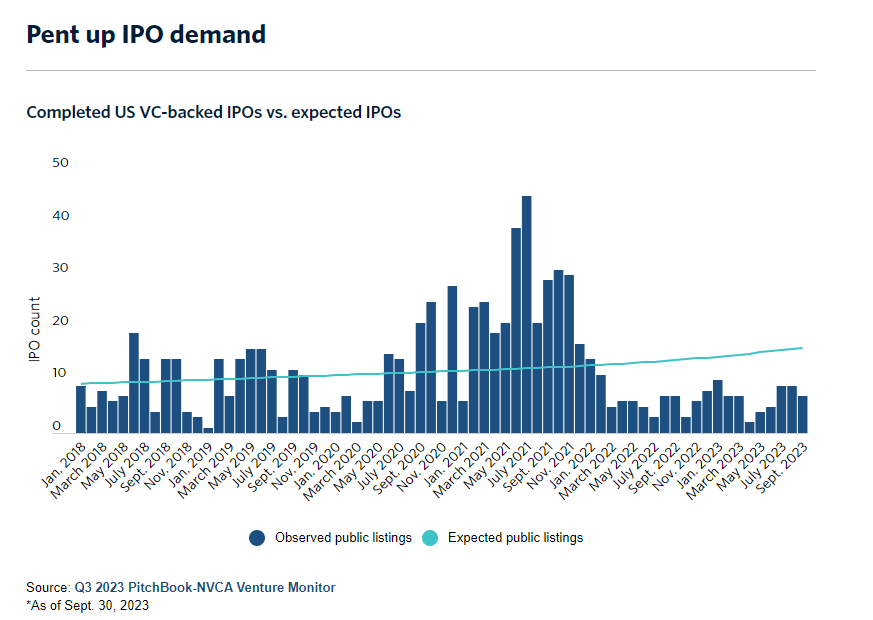

On the spectrum of risk assets, new publicly traded companies are about as risky as it gets. And in a year where risk is shunned, the demand for these risky assets collapses. Such was the story of 2022.

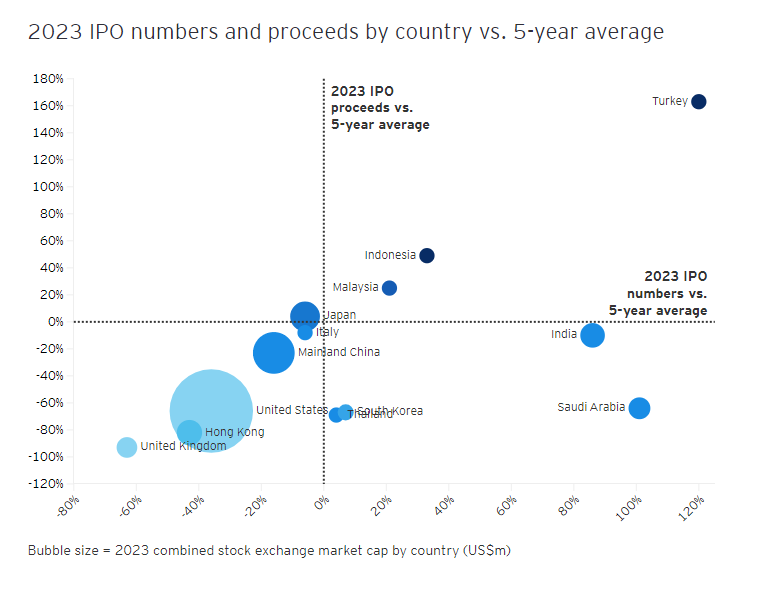

This chart from EY shows the global number of IPOs and their proceeds in 2023 versus the 5-year average. In the United States, IPO activity was down 36% while proceeds collapsed by 66%.

The market did bring a few big names public this year, with mixed results. ARM holdings is up $42 from where the bankers priced the offering, while Instacart is 21% below.

This one was the most consensus prediction on my list. It was not a bold call to think that this year would be a continuation of last year in terms of the demand for new issues.

While the market is still well below where it was a few years ago, there are reasons to be less discouraged. The IPO ETF is up 53% on the year after experiencing a 57% free-fall in 2022.

- Value Outperforms Growth Again X

This was hilariously wrong. I’ll admit, I would have bet a lot of money against the Nasdaq-100 being up 50% in 2023. Not that I needed it, but this particular prediction was a good reminder that guessing the future is a fool’s errand. In 2022, value killed growth. The exact opposite happened in 2023.

The gap between small growth (17%) and small value (12%) actually wasn’t as large as I thought, especially considering financials are such a large slice of the index. Speaking of which, I was surprised to learn that KRE is only down 10% on the year after being down as much as 39% in may.

The performance spread between large growth (41%) and large value (8%) is wider in 2023 than any year during the dotcom bubble and trails only 2020 in its magnitude.

- Gold makes a new all-time high ✅

Close but no cigar on this one. Gold had a solid year, gaining 12%, but its still 2% below its 2020 high.

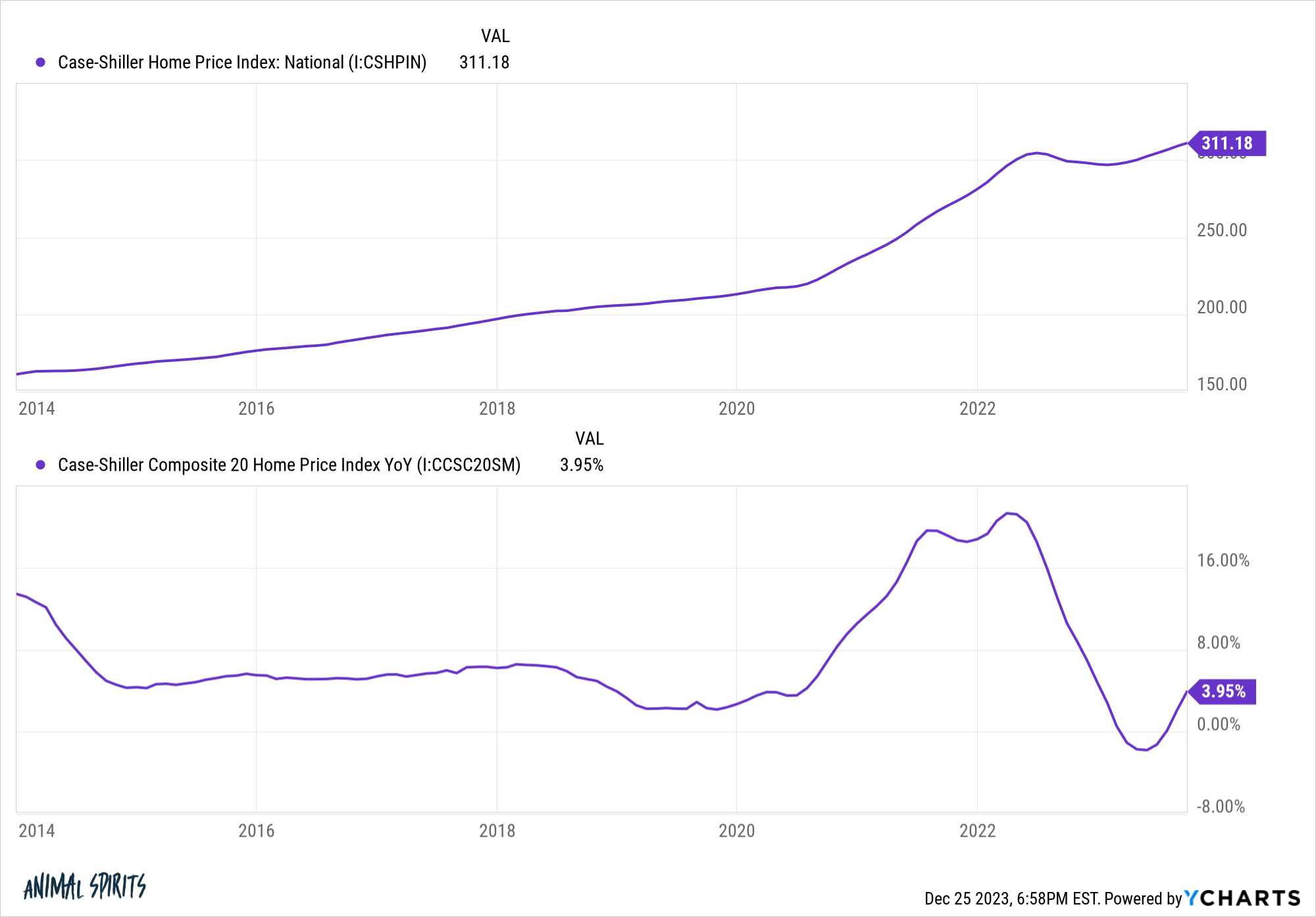

- The Housing Market Doesn’t Crash ✅

This is in the candidate for chart of the year. Housing activity might have crashed as housing affordability hits multi-decade lows, but house prices hit all-time highs. Just an incredible turn of events.

- International Stocks Outperform X

U.S. stocks, once again, were the place to be in 2023. Although international developed stocks didn’t keep up, they’re up 17% (in USD) on the year. The German, French, and U.K. stock markets are each close to all-time highs. Not bad considering how pessimistic investors were on Europe coming into 2023.

- Bitcoin gains 100% ✅

Out of all the predictions I made a year ago, this one seemed the least likely. Here’s what I wrote at the time:

“It’s hard to make the bull case for an asset class that feels like it comes with career risk. With all the negativity surrounding the space right now, I’m amazed that Bitcoin isn’t below 10k right now. And maybe that’s what the bulls can hang their hat/hopes on.”

We were just a month removed from the revelation that FTX was a gigantic fraud, and it genuinely seemed like there was nothing left to be optimistic about. Crypto has emerged as a legitimate asset class, which will be cemented by the ETF. But skeptics still like to point out that it doesn’t do anything. I get what they’re saying, in the sense that most people have never used Bitcoin and have no use for it. While true, I think it dismisses a simple yet powerful fact. What does Bitcoin do? It works. The network doesn’t go down. Transactions go through. It does exactly what it’s supposed to do. It might never replace Venmo, but that doesn’t mean it’s worthless. It’s a deeply liquid market that is currently changing hands at ~$43,000. That’s what it’s worth today.

- Energy stocks continue to outperform X

This wasn’t just wrong, it was very wrong. Energy was the third worst-performing sector behind utilities and consumer staples.

Chalk one up to recency bias on this one. Energy stocks were the top-performing sector in ’21 and ’22. But they were also highly profitable and reasonably valued. I thought this momentum could carry over into 2023. I was wrong.

- Bonus. The market avoids a recession, and stocks gain double digits. ✅

Out of all the predictions I made, this was the one I was most nervous about. Had we gotten a recession and presumably a bear market in 2023, it would have been the one that everyone, and I mean everyone, saw coming. Predicting a strong year when it was “obvious” we would have a bad year took chutzpah. 2023 should serve as a lifelong reminder of why stuff like this, predictions and whatnot, are entirely nonsensical and should be kept far, far away from your portfolio. That said, I am putting the finishing touches on my 2024 list, which will be out later this week 😊

I hope everybody had a wonderful year, and wishing everyone health and happiness in 2024. And if our portfolios go up, that’s just the cherry on top.