by Calculated Risk on 9/11/2023 10:19:00 AM

Monday, September 11, 2023

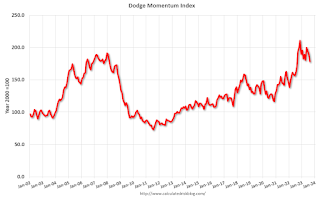

Leading Index for Commercial Real Estate Decreased in August

From Dodge Data Analytics: Dodge Momentum Index Drops 6.5% in August

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 6.5% in August to 178.0 (2000=100) from the revised July reading of 190.3. Over the month, the commercial component of the DMI fell 1.6%, while the institutional component fell 14.8%.

“Overall activity remains above historical norms, but weaker market fundamentals continue to undermine planning growth,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “It’s likely that the full year of tightening lending standards and high interest rates has begun to affect institutional planning, which has otherwise been resistant to these market headwinds. Also, planning in the sector continues to revert from the strong spike in activity back in May. As we move into the final four months of 2023, both commercial and institutional planning will continue to be constrained.”

August saw a deceleration in education, healthcare and amusement planning activity, fueling the sizable decline in the institutional sector. Meanwhile, stronger hotel planning offset weaker office activity, causing a milder regression in the commercial segment over August. Year over year, the DMI remained 4% higher than in August 2022. The commercial and institutional components were up 3% and 7%, respectively.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 178.0 in August, down from 190.3 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown towards the end of 2023 and in 2024.

Commercial construction is a lagging economic indicator.